Updated July 10, 2023

What is Trading on Equity?

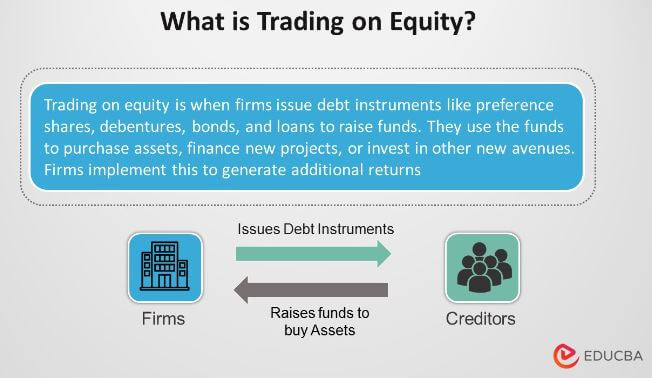

Trading on equity refers to a process in which firms issue new debt instruments such as preference shares, debentures, bonds, and loans to raise funds. The issuer uses the funds to purchase assets, finance new projects, or invest in other new avenues.

Firms implement this with the hope of generating some additional returns. Since the firm uses debt capital to generate returns for its shareholders, the strategy is popularly known as trading on equity.

Key Takeaways

Some of the key takeaways of the article are:

- Trading on equity is when a firm raises funds by issuing new debt instruments. They then use them to purchase assets or invest in new projects to generate additional returns.

- It can be classified into two types – trading on thick equity and thin equity.

- A company can increase its earning potential with the help of borrowed money. They have to consider that it generates adequate additional profits to cover the cost of debt capital.

How Does it Work?

When a firm raises money, its primary objective is to secure funds to create wealth for its shareholders. The firm invests the money raised by issuing debt capital in new avenues, assets, or upgrading manufacturing processes. A firm does this in the hope of making additional returns that are higher than the cost of the debt capital. While it is the primary objective, the company has other strategic goals.

- Ensure a higher contribution of debt funding in the company’s overall capital structure.

- Maintain control over the decisions within the company by not raising funds through the issuance of equity to new shareholders, as it tends to dilute the company’s ownership.

- Enhance the company’s market value by choosing to use debt capital for funding in place of equity infusion.

Types of Trading on Equity

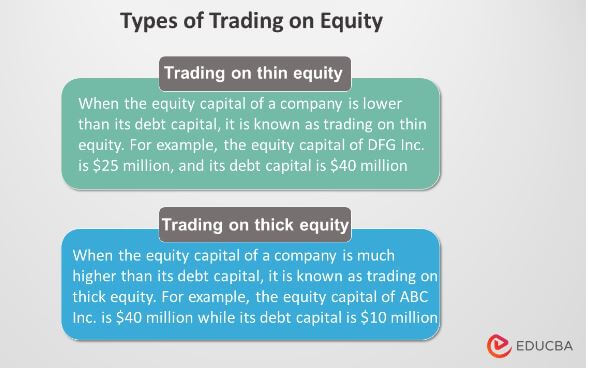

It can be classified into two types depending on the mix of equity capital and debt capital in the overall capital structure of a company. The following two types are trading on thick and thin equity.

1. Trading on Thick Equity

When the equity capital of a company is much higher than its debt capital, it is known as trading on thick equity. For example, if the capital of ABC Inc. is $40 million while its debt capital is $10 million. Thus, ABC Inc. is trading on thick equity.

2. Trading on Thin Equity

When the equity capital of a company is lower than its debt capital, it is known to be trading on thin equity. For example, let us assume that the capital of DFG Inc. is $25 million and its debt capital is $40 million. It is a case of trading on thin equity.

Effects of Trading on Equity

It is an important corporate decision that primarily results in fluctuation in earnings before interest and taxes (EBIT). It eventually impacts the company’s earnings per share (EPS). The higher the share of debt in the capital structure, the more significant the impact. However, it increases the risk for the ordinary shareholders because, in case of business failure, there will be an amplified impact on the EPS earned by the shareholders.

Managers usually measure the effects by using the gearing ratio (= debt/equity) and degree of financial leverage (= % change in EPS / % change in EBIT). The gearing ratio helps managers assess the degree of capitalization that depends on equity funding. On the other hand, the degree of financial leverage helps estimate how the EPS will behave concerning any change in the company’s profitability.

Examples of Trading on Equity

The following formula can be used to calculate:

Let us examine using examples.

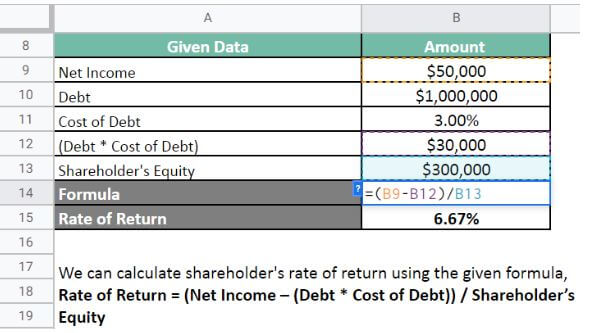

Example 1

XYZ Inc. raised Debt of $1,000,000 on Equity capital of $300,000. This is an example of trading on thin equity. With a Net Income of $50,000 and the Cost of Debt as 3%, calculate the shareholder’s rate of return.

The rate of return for the shareholders will be 6.67%.

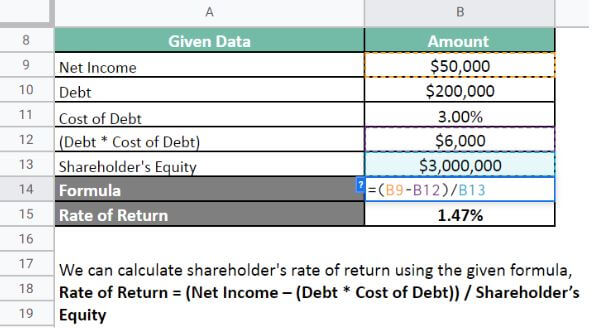

Example 2

XYZ Inc. raised a Debt of $200,000 on Equity capital of $3,000,000. This is an example of trading on thick equity. With a Net Income of $50,000 and the Cost of Debt as 3%, calculate the shareholder’s rate of return.

The rate of return for the shareholders will be 1.47%.

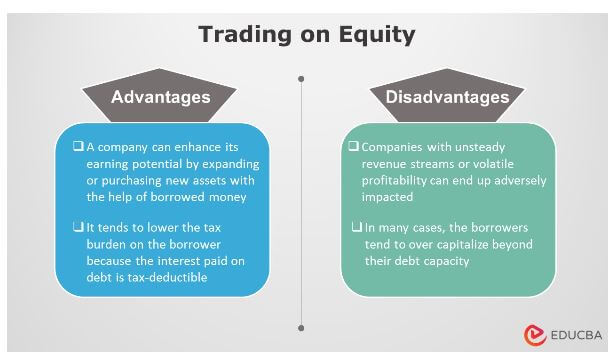

Benefits & Disadvantages

Some of the significant benefits are as follows:

- A company can enhance its earning potential by expanding or purchasing new assets with the help of borrowed money.

- It tends to lower the tax burden on the borrower because the interest paid on debt is tax-deductible.

Some of the major disadvantages are as follows:

- Companies with unsteady revenue streams or volatile profitability can end up adversely impacted.

- In many cases, the borrowers tend to over-capitalize beyond their debt capacity.

Conclusion

It provides companies with the external funding required to invest in growth opportunities. They do so to generate additional returns for their shareholders. Trading on thick or thin equity is the two types. The base of classification is the mix of equity and debt funding.

It significantly impacts the profitability of the subject company. The impact is vast, with higher shares of debt. Although it can materially enhance a company’s profitability, a mismanaged attempt can leave it in severe financial distress. So, while evaluating a company, thoroughly examine whether or not it is employing the strategy appropriately.

Frequently Asked Questions(FAQs)

Q1. What is trading on equity? What are the types?

Answer: It refers to the process of companies raising external funds to invest in growth opportunities. They issue debt instruments that can generate additional returns for their shareholders. Depending on the combination of debt and equity, the process can be divided into two types thick equity and thin equity.

Q2. Who usually utilizes trading on equity?

Answer: Professional managers who don’t own a business but want to increase their stock options’ value use this aggressive technique. On the other hand, a family-run business prefers long-term financing solutions over such risky options.

Q3. Is it a safe option?

Answer: Yes, it is a safe option. However, the borrower must employ a sustainable strategy to generate significant returns. The returns should be higher than the cost of its debt funding.

Q4. What is the major risk in the case of trading on equity?

Answer: The major risk that a firm face is inadequate returns. If the process generates insufficient returns, it cannot cover the cost of debt capital.

Q5. What are the limitations?

Answer: One limitation is the possibility of financial distress. Companies with unstable revenue streams or dodgy profit margins can impact their overall financial performance.

Recommended Articles

To learn more about trading on equity, please visit the following links.