Updated July 24, 2023

Definition of Transaction Exposure

In international trade, there is a risk that the currency exchange rate will always be fluctuating, and there might arise a risk of loss to any of the parties involved before the trade or contract is settled, and such uncertainty is termed transaction exposure (also known as transaction risk).

What is Transaction Exposure?

Whenever there is a cross-currency dealing or a transaction, there will be conversion rates that will be applicable when the contract is entered into and when the contract is settled. With such transactions arise the transaction risk or exposure wherein the fluctuation in such rates will cause either of the parties to suffer the risk of paying more or receiving less as rising or fall in the currency rates, as the case may be, over the term of the contract, will alter the value of the contract.

Types of Transaction Exposure

Below are the types of transactions in which exposure arises:

- Buying and selling goods or services on a credit basis when prices are quoted in foreign currency.

- Borrowing and lending money when repayment shall be made in foreign currency.

- Being a party to the contract where there is a forward contract in foreign exchange and such contracts remain unperformed or underperformed.

- Buying assets or bring upon liabilities that are denominated on foreign currency.

- Any other transaction which has future performance and payment in foreign currency.

Example of Transaction Exposure

Let us understand the concept of transaction exposure with the help of an example:

Example #1

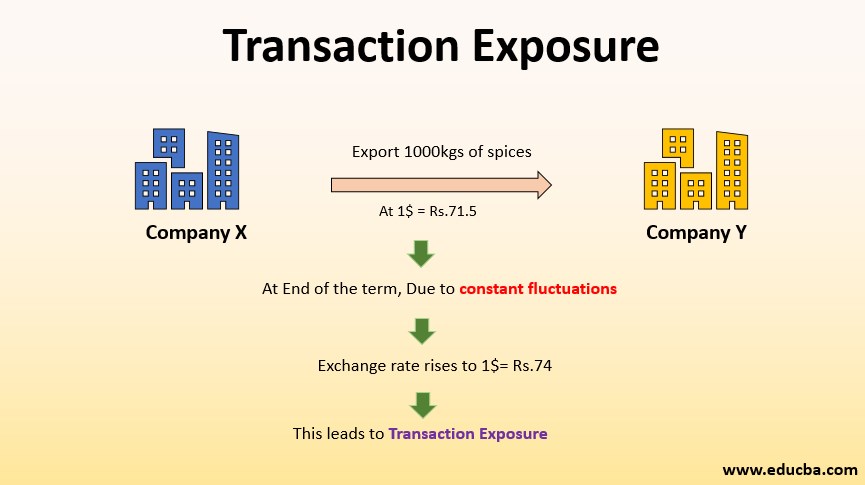

A domestic company (India), say X enters into a transaction with a foreign company (US), say Y.

Solution:

As per the terms of the contract, Company X has to export 1000kgs of spices to company Y in 3 months, and company Y will pay $1000 for the same. At the time of entering the contract, the exchange rate is 1$ = Rs.71.5. The domestic company is the one that would have dollar receipts, would be the one having the transaction exposure. The value of the contract would be exposed to the risk of exchange fluctuations.

If the exchange rate remains the same, the value of inflows to company X on account of exports of spices would be $1000 X Rs.71.5 = Rs.71500.

But the exchange rate is subject to constant fluctuations. At the end of the term, when the contract has to be honored, let us consider two situations:

a) Rs. 74

b) Rs. 70

- In case (a), when the dollar value rises to Rs.74, i.e. in case of rupee value depreciation, the exporter, Company X, would be at a gain because now its value is the contract becomes Rs. 74000.

- In case (b), when the dollar value falls to Rs.71, i.e. in case of rupee value appreciation, the exporter, Company X, would be at a loss because now the value of the contract becomes Rs. 70000.

Comparison Table Between Transaction Exposure vs Translation Exposure

Below are the differences mentioned:

| Transaction Exposure | Translation Exposure |

| The risk that the value of the currency may fluctuate before the settlement of the contract. | Due to the change in the exchange rate between home currency and foreign currency, there may arise a change in the asset’s value. Such a risk is translation exposure. |

| This impacts the cash flows of the entity and hence is a cash flow risk. | This impacts the valuation of assets, liabilities in the balance sheet and hence is a balance sheet risk. |

| Transaction exposure is a cash flow accounting treatment and hence results in realized losses or gains. | Translation exposure is book accounting treatment and hence results in notional gains or losses. |

| For this kind of exposure to arise, the company need not have a parent company or a subsidiary, or an associate company. | This exposure usually arises while the consolidation of financial statements with subsidiaries or associates. |

| In case of loss, there would arise tax benefits in this type of exposure. | No tax benefit is available as this a notional loss. |

Risks of Transaction Exposure

- In the example stated above of Companies X and Y, company X is the one facing the risk of transaction exposure because the conversion of the $1000 in two cases gives two different receipts value.

- But for Company Y, there would be no such exposure because always, it would have to pay $1000 only. There would be no change in that value.

- From this, we can understand that there is exposure only to the party who has receipts or payables that are convertible to their currency. Parties to which the contract value is fixed, i.e., in their home currency, need not face the transaction exposure risk.

- High exposure can lead to huge losses to the party.

- There are ways and means to curb and control this foreign transaction exposure like hedging, entering into the same transaction volume wherein cash flows offset in part or in whole the cash flows bearing transaction exposure.

Conclusion

In short, we can say that transaction exposure is an economic exposure that stems from the probability that gains or losses may be incurred on account of transactions already entered into and denominated in foreign currency, which leads to realizable gains or losses. This may lead to fluctuations in the cash flows of the entity.

Recommended Articles

This is a guide to Transaction Exposure. Here we discuss definition, explanation, with examples and knowing the risk of it. You can also go through our other related articles to learn more –