Updated July 31, 2023

Difference Between Treasury Bills vs Bonds

Treasury bills vs bonds both are financial instruments used in the market to earn additional income or gain and both are backed by the US government. Treasury Bills are money market instruments. Treasury Bills are short term money market instruments issued by the government to raise short-term funds. Whenever the government needs money for a shorter period Treasury bills are issued by them to raise the funds. whereas Treasury bonds are a capital market instrument. It is an investment mechanism that allows businesses, banks, and governments to full fill large, but short-term capital needs at a low cost. Treasury bonds are long terms bonds issued by the government with a maturity of more than 10 years. A treasury bond is called T-Bonds. A bond pays a specific rate of interest on the principal amount to the holders.

Treasury Bills

Treasury bills categories into 3 bills as per maturity namely, a) 91 Day b) 182 Day c) 364 Day. Treasury bills are sold out at a discounting price, and it did not pay any interest. Treasury Bills is also called as T-Bills. A treasury bill is only typed instrument which is found in both capital and money market. Generally in T-Bills difference between the Issue price and Face value is treated as interest income.

Example:

Suppose there is a bond of price 1000 INR, and the government sells it for 800 INR so at the time of maturity holders of T-Bills will get 1000 INR and this is called selling less than face value and getting actual or face value at the maturity date.

Some of the key features of the Treasury Bill’s areas listed below.

- T-Bills are issued in a physical form that is a Promissory note or with a paperless computerized system.

- In T-Bills Major participants are Individuals, firms, companies, banks, financial institutions, etc.

- T-Bills are sold out at a discounted price and it matured at face value.

- T-Bills are negotiable instruments and highly liquids in nature due to shorter tenure.

Treasury Bond

The bond is sold at their face value and has a fixed interest rate which is paid once every six months. Some of the key bonds are Municipal bonds, Governments bonds, corporate bonds, Zero Coupons bonds, etc. Bonds also called fixed-income instruments.

Example:

Let’s say Smith purchased a government bond from the government for a worth of INR 10,000 and the term of the bond is 10 years, with an interest rate of 4.75%. So every six months Smith will receive an interest payment of 237.50 INR from the government for 10 years and the end of 10-year Smith will be repaid with the initial investment of 10,000 INR.

Some of the key features of Treasury Bills are as listed below.

- T-Bonds are long-term investment bonds issued by the government to finance the ongoing operation of government services.

- T-Bonds paid principal amounts along with interest at the time of the maturity of bonds and Interest payments are distributed twice a year.

- T-Bonds considered as a low-risk investment and therefore pay a lower return to investors.

- T-Bonds provide guaranteed a certain rate of return on investment.

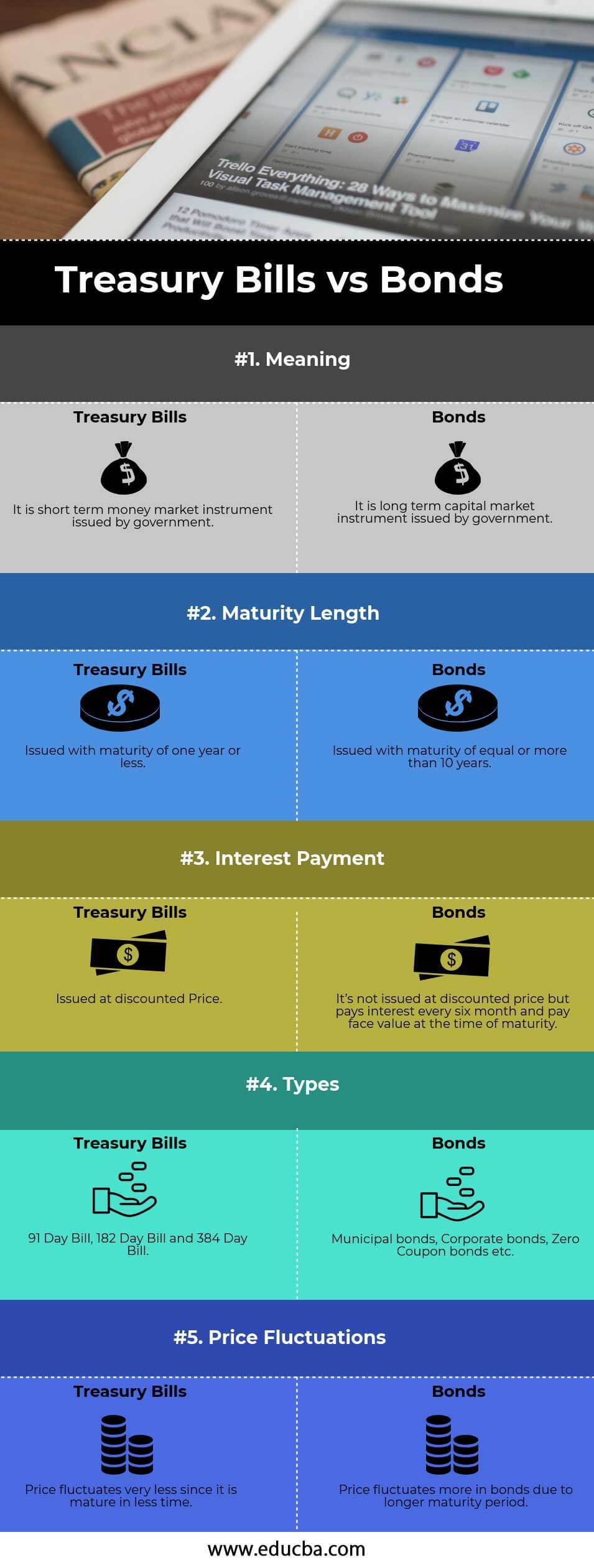

Head To Head Comparison Between Treasury Bills vs Bonds (Infographics)

Below is the top 5 difference between Treasury Bills vs Bonds

Key Differences Between Treasury Bills vs Bonds

Let us Discussed some of the major differences between Treasury Bills vs Bonds:

- Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments.

- Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond.

- Treasury bills mature in a year or less whereas Treasury bonds have a maturity greater than 10 years.

- Return on investment is low in Treasury bills instruments due to shorter maturity period ahead return on investment is higher in Treasury Bonds due to longer maturity period.

- A risk associated with T-Bills is low as compared to T-Bonds due to a shorter maturity period.

Treasury Bills vs Bonds Comparison Table

Let’s look at the top 5 Comparison between Treasury Bills vs Bonds

| The Basis of Comparison |

Treasury Bills |

Treasury Bonds |

|

Meaning |

It is a short-term money market instrument issued by the government. | It is a long-term capital market instrument issued by the government. |

| Maturity Length | Issued with a maturity of one year or less. | Issued with the maturity of equal or more than 10 years. |

|

Interest Payment |

Issued at discounted Price. | It’s not issued at a discounted price but pays interest every six month and pay face value at the time of maturity. |

| Types | 91 Day Bill, 182 Day Bill and 384 Day Bill. | Municipal bonds, Corporate bonds, Zero Coupon bonds etc. |

| Price Fluctuations | Price fluctuates very less since it is mature in less time. | Price fluctuates more in bonds due to the longer maturity period. |

Conclusion

From the above description, it is clear that Treasury bills are short-term money market instruments with a maturity period of a year or less and Treasury Bonds are long-term capital market instruments with a maturity period of more than 10 years or more and 30 years at the most. Both treasury bills vs bonds are less risky as compared to other investments since they are secure by the government. T-Bills issued at a discounted price, and it’s mature with face value whereas T-Bonds pay interest every six months and mature with a face value of bonds. Both the instruments are issued by the government to raise money for government operations.

Investors may consider investing in Treasury Bonds if they want a good low-risk way to earn some interest. Some investors think that Treasury Bonds are not good things to invest in because the interest rate is over 10 years and it is a very long time. T-Bills are highly liquid instruments and are very low-risk instruments. Both treasury bills vs bonds can be sold before maturity through the secondary market.

Recommended Articles

This has been a guide to the top difference between Treasury Bills vs Bonds. Here we also discuss the Treasury Bills vs Bonds key differences with infographics and comparison table. You may also have a look at the following articles to learn more.