What is a Trial Balance?

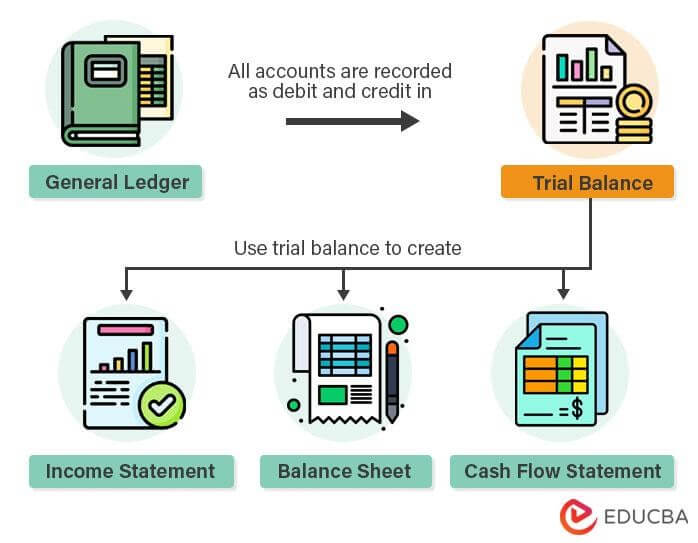

A trial balance is an accounting sheet that arranges records of the company’s every transaction from all general ledgers into two columns: Debit and Credit. It helps find any errors in the financial records by checking if the debit column’s total matches the credit column’s total.

Thus, it checks if the company’s transactions meet the following condition: Total Debits = Total Credits. Companies then use it to create financial statements like balance sheet, income statement, and cash flow statement.

Table of Contents

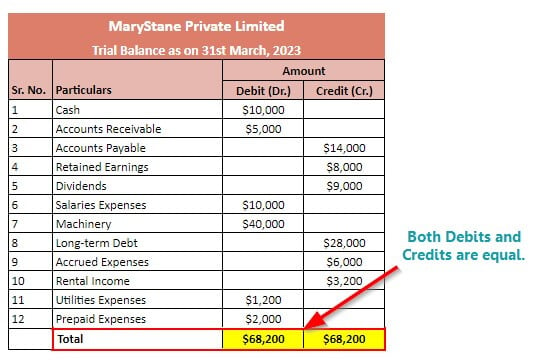

Format of Trial Balance

The trial balance should include the company name, the date when the financial year ends, and three major columns: Ledger account names, debit entries, and credit entries. The debit should be on the left side, while credit should be on the right side.

While adding assets, revenues, expenses, and other records, follow the below rules.

Rule #1: Mention all the assets (Cash transactions, accounts receivable, etc.) on the debit side.

Rule #2: Mention all the liabilities (Debt, accounts payable, etc.) on the credit side.

Rule #3: Mention all the company’s revenue (Earnings, COGS, sales, etc.) on the credit side.

Rule #4: Mention all the company’s expenses (Salary, rent, interest, etc.) on the debit side.

How to Prepare a Trial Balance?

You can either prepare it manually or with the help of accounting tools such as Quickbooks.

Follow the steps below to prepare the trial balance:

- Collect all financial transaction records of the company from all the ledgers.

- Add columns in a new accounting sheet for account names, credit entries, and debit entries.

- Arrange all the transaction amounts in their respective debit and credit columns.

- Calculate the total for both the credit and debit sides.

- Check whether the credit side total matches the debit side or both are equal.

- If the debit and credit totals do not match, re-check the entries and make the necessary changes to make it error-free.

- Finally, when both the debit and credit sides match, use this adjusted trial balance to prepare financial statements.

Trial Balance Example

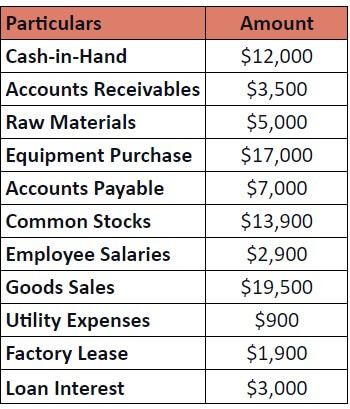

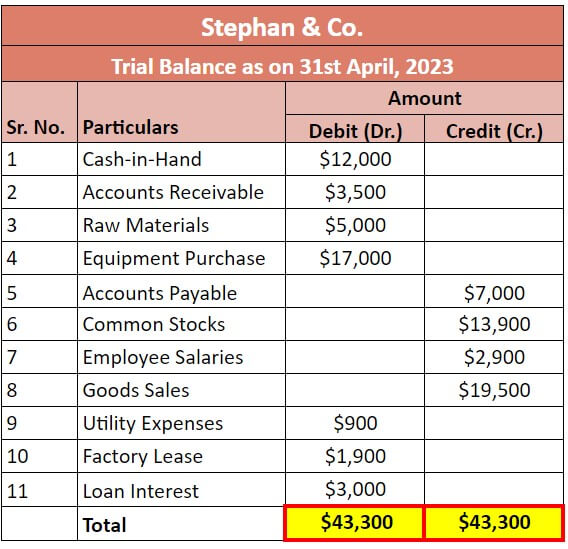

Stephan & Co., a manufacturing company, has the following accounting balances in the ledger accounts.

Below is the final draft of the trial balance after entering the above entries:

Types

Given below are the three types of trial balance:

1. Unadjusted

It is the first trial balance that a business creates, which contains all the direct records of the transactions from the general ledger. Companies use this to check if any corrections in records are required and then make adjustments to this document.

2. Adjusted

It is the trial balance after the company has made all the required corrections to the unadjusted trial balance. It helps us record correct transactions after these adjustments.

3. Post-Closing

After correcting the adjusted trial balance, we create the post-closing trial balance with only permanent accounts (assets, liabilities, equity). When preparing a trial balance at the end of an accounting period, we transfer amounts from temporary to permanent accounts. It is to check if the permanent accounts are balanced.

Errors in Trial Balance

Below are the errors that can affect the trial balance:

1. Error of Omission: This error happens when an accountant completely skips or forgets to add a transaction.

Example: An accountant forgets to record a receipt of an inventory purchase for $1,150.]

2. Error of Commission: This error occurs when the accountant makes an error, like missing a zero or an extra digit, while recording the debit or credit entries.

Example: The accountant mistakenly records incorrect amounts for the accounts payable as $5,000 rather than $50,000.

3. Compensating Errors: It happens when the accountant makes a similar mistake on both the debit and credit sides, which eventually keeps the final sum balanced, but the data is wrong.

Example: The accountant debited $50 to the wrong cost account and credited $50 to the wrong income account.

4. Errors of Principle: This error happens when an accountant doesn’t follow the accounting rules or principles properly.

Example: The accountant mistakenly records the $2,300 repair cost as equipment purchase.

Uses and Limitations

Given below are the objectives and limitations of the trial balance:

| Uses | Limitations |

| It helps find the mathematical errors that occur while recording financial and accounting transactions. | As it is possible that analysts may skip small errors, it doesn’t ensure that all the transaction records are correct. |

| It is the foundation for preparing the three important financial statements: Balance sheet, income statement, and cash flow statement. | It doesn’t mention the order or time of the transactions recorded, so finding related errors can be difficult. |

Frequently Asked Questions (FAQs)

Q1. How is the trial balance different from the general ledger and balance sheet?

Answer: Below is the explanation for each of the accounting sheet explaining how they differ from each other:

- The general ledger is where a company records all its transactions using journal entries. It serves as the initial accounting document.

- Companies create the trial balance using the information from the general ledger. It compares the total debits and credits of each account to ensure they are in balance.

- Lastly, companies prepare the balance sheet using the data from the trial balance. It takes the final balances of assets, liabilities, and equity and organizes them in a report to share with shareholders and stakeholders.

Q2. What is journal entry and trial balance?

Answer: Below is the proper definition of both the accounting documents:

- Journal entry: A journal entry records the initial transactions of a company that mentions the accounts involved, debit and credit entries, their dates, etc.

- Trial balance: It is an accounting document that records all a company’s debit and credit entries, which helps create financial statements.

Q3. What is the first trial balance called?

Answer: Unadjusted trial balance is known as the first trial balance report because it is the first trial balance we create by directly arranging the records from the general ledger.

Recommended Article

We hope you find EDUCBA’s article on trial balance informative. For further information, we suggest the following recommended articles: