Updated December 20, 2023

What is a Trust Receipt?

Trust receipts are bank-issued official promissory notes to businesses for buying goods till they sell them to prospective clients. Any party that wants to buy goods on credit can use a trust receipt. This includes importers, exporters, manufacturers, distributors, wholesalers, and retailers.

In this process, banks play a crucial role. A company that wishes to buy goods but doesn’t have sufficient funds can approach a bank and request a trust receipt loan. After analyzing the creditworthiness of the company, the bank may approve the loan and issue a trust receipt to the company. It serves as a document of title and security for the bank. It enables the company to take possession of the goods and use them as required. However, the bank retains ownership of the goods until the loan is fully repaid. The company can use the goods to generate revenue and repay the loan in installments.

For instance, a company needs a new delivery van. They borrow money from a bank using a trust receipt. They purchase the van and use it for their deliveries. As they earn money, they use the funds to pay back the bank. Once the loan is fully repaid, the company owns the van.

Table of Contents

- What is it?

- How it works?

- Example

- Requirements

- Format

- Advantages & Disadvantages

- Letter of Credit Vs. Trust Receipt

Key Highlights

- It is a statement that a bank has released goods to a buyer while owning those assets.

- Companies that distribute equipment, sell cars, or manufacture expensive items commonly use this statement.

- The buyer can keep and use the goods as well as sell them, but the bank still retains ownership.

- This structure is similar to financing with a letter of credit.

How Does it Work?

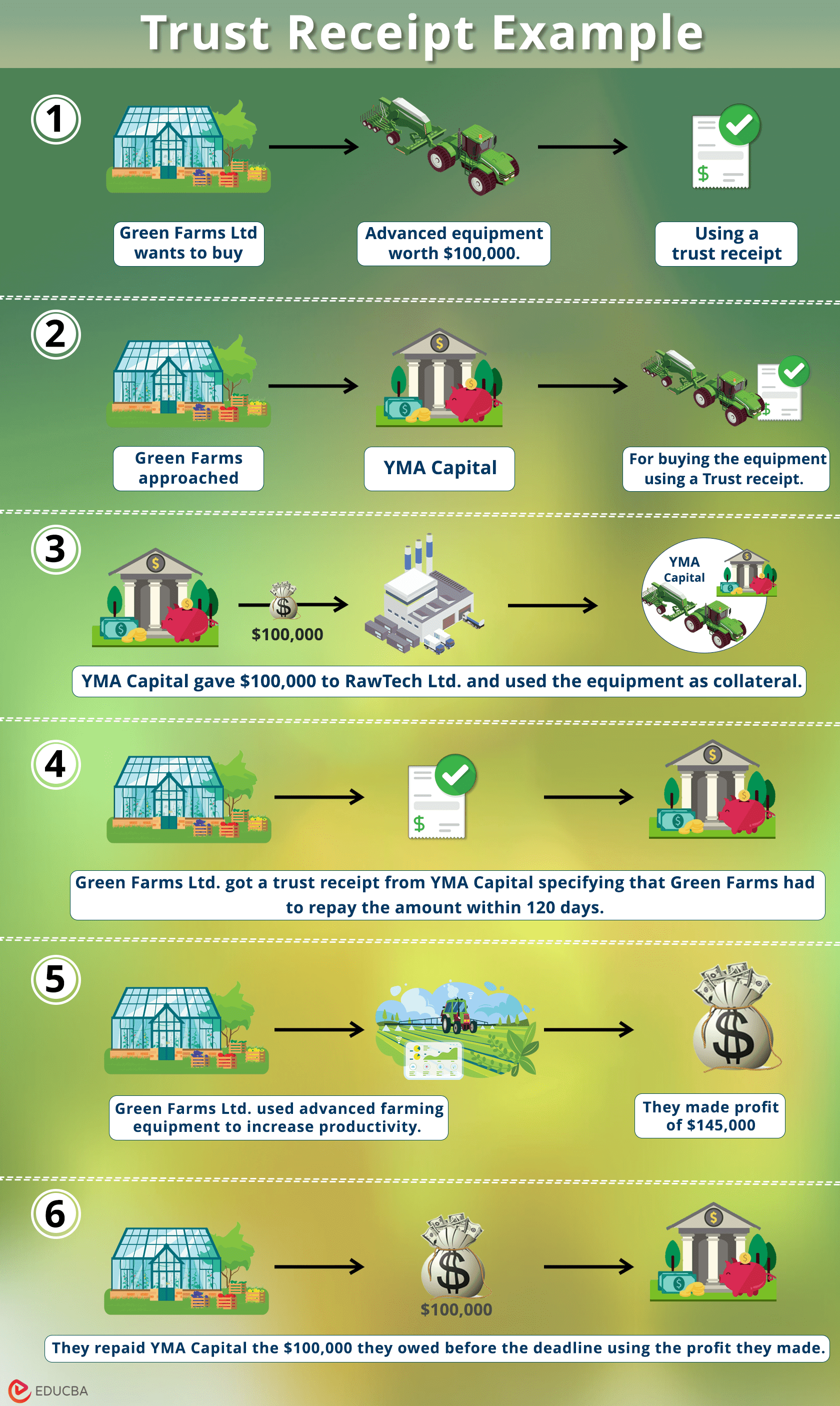

Let’s understand the step-by-step process of how a trust receipt works with the help of an example.

Step 1: The company recognizes the need for purchase

Let’s say a construction company needs bulldozers for a project but lacks funds.

Step 2: The company submits a trust receipt application to the bank

The company applies for this loan at a bank to fund the bulldozer acquisition.

Step 3: The bank approves and disburses funds to the company

The bank reviews and approves the loan application and disburses the necessary funds for the acquisition.

Step 4: The company buys assets using the bank loan

Using the loan, the company purchases the bulldozers from a supplier and immediately puts them to use on the project.

Step 5: The company uses bulldozers as collateral

The newly acquired bulldozers serve as collateral for the loan. The bank holds the equipment’s title until the loan is fully repaid.

Step 6: The company generates revenue

The company completes various projects with bulldozers, generating revenue through its construction services.

Step 7: The company repays the loan

The company repays the loan to the bank as it receives payments for completed projects.

Step 8: The bank transfers ownership to the company

Once the loan is fully repaid, the bank transfers the title of the bulldozers to the company, signifying complete ownership of the equipment.

Example

Suppose GreenFarms Ltd. is an agricultural business that wants to improve its farming techniques. They decided to buy advanced equipment from RawTech, a foreign supplier, which cost $100,000. So, GreenFarms chose to finance the purchase using a trust receipt.

- GreenFarms approached YMA Capital, a bank, to get funding for buying the equipment using a trust receipt.

- YMA Capital agreed to help them and communicated with RawTech Ltd. to make the payment on behalf of GreenFarms Ltd.

- YMA Capital gave $100,000 to RawTech Ltd. and used the equipment as collateral to secure the funds they advanced to GreenFarms Ltd.

- GreenFarms Ltd. got a trust receipt from YMA Capital, which allowed them to possess the farming equipment.

- However, YMA Capital retained ownership until GreenFarms fully settled the debt of $100,000.

- The document specified that GreenFarms had to repay the amount within 120 days.

- GreenFarms Ltd. used advanced farming equipment to increase productivity and harvest more crops.

- They sold their produce and generated a revenue of $145,000 within 120 days.

- They repaid YMA Capital the $100,000 they owed before the deadline using the profit they made.

This ensured a successful expansion without any financial strain on GreenFarms Ltd.

Requirements

Below are some requirements that must be met for a trust receipt to be valid.

- The document must include all the necessary details about the transaction. This includes the names of both parties involved and their signatures.

- In some countries, a witness signature or notary seal may also be required.

- The buyer must provide payment for the goods and accept them from the seller in person or by an authorized representative, such as a freight forwarder.

- The seller must deliver the goods to the agreed location or an acceptable alternative location.

- The buyer must inform the seller of any defects in the quality of the goods within a reasonable time after delivery before using them.

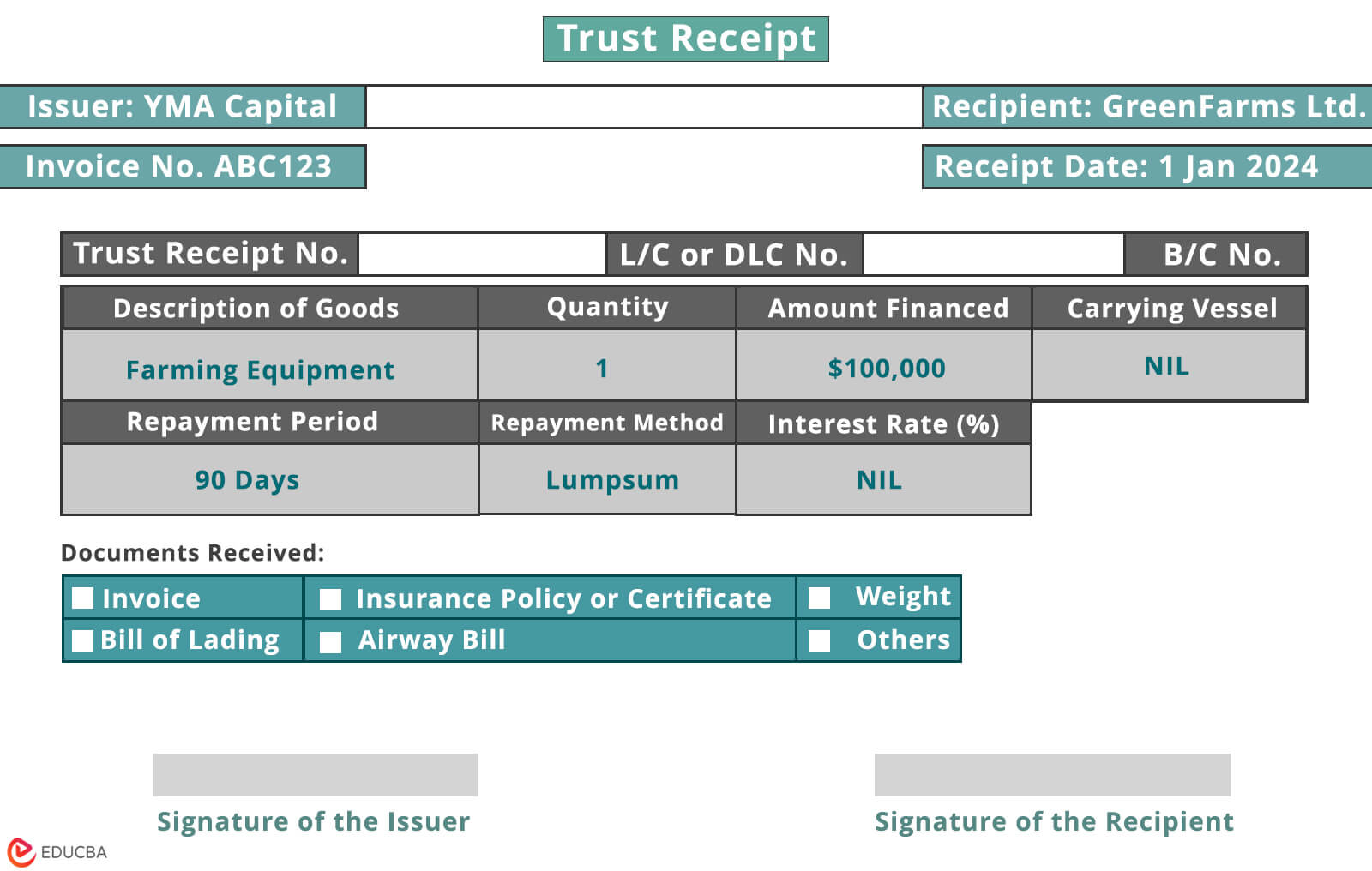

Format

The basic format is as follows. We have used the previous example to show this format.

Parties Involved:

- Issuer: [Name of the Bank]

- Recipient: [Name of the Business]

Transaction Details:

- Amount financed [e.g., $10,000]

- Due date

- Description of Goods

- Quantity

- Invoice No.

- Carrying vessel

- Port of shipment

- Port of discharge

Documents Received:

- Invoice

- Insurance Policy or Certificate

- Weight

- Bill of Lading

- Airway Bill

- Others

Terms of Agreement:

- Repayment Period [e.g., 6 months]

- Repayment Method [e.g., monthly installments]

- Interest Rate [percentage]

Conditions and Responsibilities:

- Proper Utilization [purpose of the loan]

- Compliance [any specific conditions or obligations]

Signatures:

- Signature of the Issuer: ____________________

- Signature of the Recipient: ____________________

Advantages

Trust receipts offer several advantages to businesses, such as:

- It is a great way for companies to purchase goods from suppliers without paying upfront.

- It can help build trust between the buyer and seller, especially if they haven’t worked together before.

- It can also help a small business expand its inventory without making an initial investment.

- And it can help a company allocate funds for operational needs like hiring new staff or investing in new equipment.

Disadvantages

There are some downsides to using trust receipts, such as:

- They lack legal backing, which can make it challenging to resolve any disputes.

- Suppose a customer claims a product received through a trust receipt has a defect. In that case, it can cause problems for the seller to maintain a positive relationship with the customer.

- Additionally, businesses that use this mode of financing must follow several restrictions imposed by the bank, such as maintaining accurate credit records and undergoing regular audits.

- And companies must pay back the money within a set time frame, which can put them at risk if the goods purchased don’t sell or get damaged.

Difference Between a Letter of Credit and a Trust Receipt

Letters of credit and trust receipts have different purposes and functions. To simplify the comparison between them, we have created a table below.

| Aspect | Letter of Credit | Trust Receipt |

| Issuing Party | The bank helps the buyer make a guarantee. | The bank gives a loan to the buyer. |

| Buyer | Uses a letter of credit to assure payment. | Takes a trust receipt loan to buy goods. |

| Seller | Gets assured payment through the bank. | Sells goods to the buyer. |

| Bank | Ensures payment to the seller. | Gives a loan and keeps ownership until repaid. |

| Purpose | Guarantees seller gets paid. | Lets the buyer have goods with a loan. |

| Function | Bank ensures payment. | Buyers can use goods, and the bank owns them until the loan is repaid. |

Final Thoughts

The future of trust receipts looks promising. We will see more businesses adopting this form of financing in the coming years. Furthermore, these receipts may become more standardized and regulated, making them a more reliable form of business financing. However, it’s crucial to carefully consider the pros and cons before opting for them, as they may not be suitable for every business.

Frequently Asked Questions (FAQ)

Q1. Is trust receipt negotiable?

Answer: Trust receipts can be negotiable, meaning they can be transferred to another party. This usually happens if the buyer has to move the goods (or assets) to a different location or use them as collateral for a loan. However, when transferring these receipts, it is important to follow legal and contractual requirements. For instance, the buyer must get the seller’s permission before transferring the receipt to someone else.

Q2. What is the purpose of trust receipt?

Answer: Trust receipts serve several important purposes as follows:

- They work as evidence that a company has paid for the goods it bought.

- They make transactions more clear and help businesses establish credit for future deals.

- They also give flexibility in managing cash and serve as a dependable form of credit.

- Moreover, they support transparency in business operations.

Q3. Who issues a trust receipt?

Answer: Banks or other financial institutions issue trust receipts to importers, manufacturers, dealers, and distributors of goods who need money to buy the goods.

Q4. How is a trust receipt violated?

Answer: If a borrower breaks the rules of the agreement, they violate it. Breaking the rules could mean selling the goods without permission, using the proceeds for other purposes, or not keeping the goods in the required condition.

Q5. What is trust receipt financing?

Answer: It is an arrangement whereby the bank takes a step to settle the bills for an importer to purchase the goods. The bank remains the legal owner, assumes credit responsibility, and releases the goods to the importer on trust. The importer sells the goods and pays the bank with the proceeds.

Recommended Articles

We have covered a comprehensive guide on trust receipts, which includes its definition, structure, and various examples. If you want more insights, we recommend checking out the following articles.