Updated July 25, 2023

Turnover Ratio Formula (Table of Contents)

What is the Turnover Ratio Formula?

Turnover Ratios are a tool to analyze the performance of the management based on the revenue where it is divided against the different class of assets to ascertain how much of assets were utilized to generate the revenue for a given period.

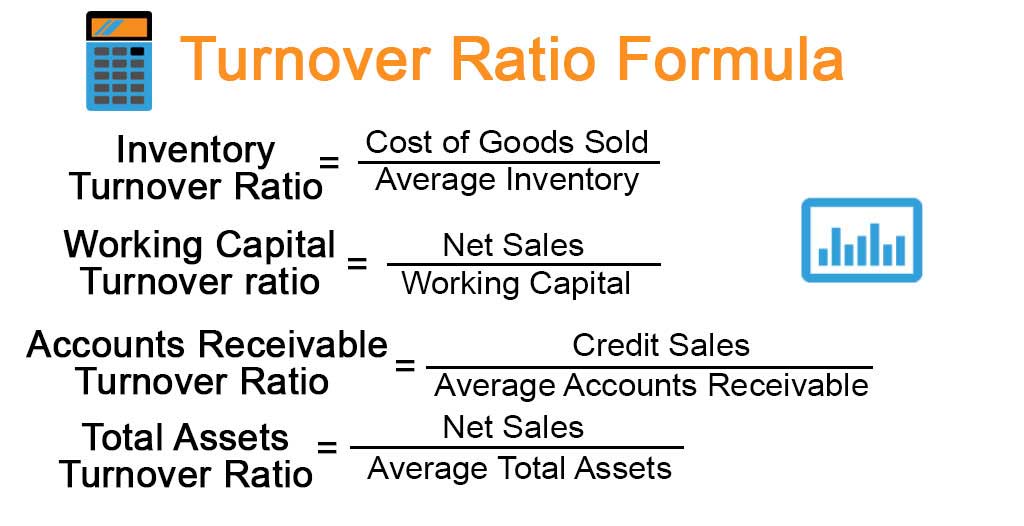

It can depict the efficiency of different assets, and accordingly, the revenue and assets change as per the requirements, for example, Inventory Turnover Ratio, Working Capital Turnover ratio, Accounts Receivable Turnover Ratio, Total Assets Turnover Ratio.

These are all financial ratios that enable insight into different aspects and measure performance on different benchmarks. Some of the key turnover ratios are as follows:

Formulas,

Example of Turnover Ratio Formula (With Excel Template)

Let’s take an example to understand the calculation of the Turnover Ratio in a better manner.

Turnover Ratio Formula – Example #1

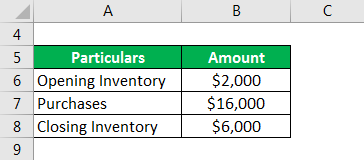

Let us take an example to calculate the Inventory Turnover Ratio. The given values are Opening Inventory = $ 2,000, Purchases $ 16,000, Closing Inventory $ 6,000. What is the Inventory Turnover Ratio?

Solution:

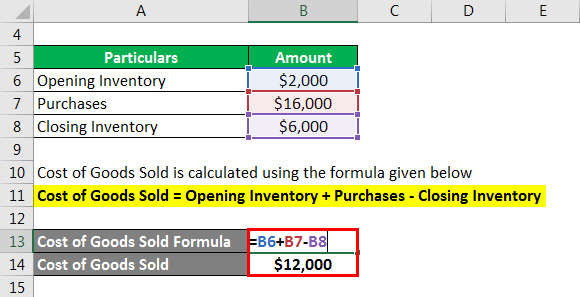

Cost of Goods Sold is calculated using the formula given below

Cost of Goods Sold = Opening Inventory + Purchases – Closing Inventory

- Cost of Goods Sold = 2,000+ 16,000 – 6,000

- Cost of Goods Sold = $ 12,000

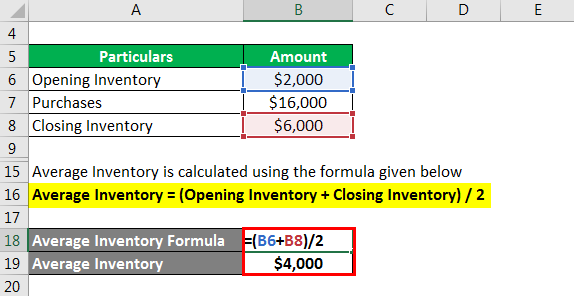

Average Inventory is calculated using the formula given below

Average Inventory = (Opening Inventory + Closing Inventory) / 2

- Average Inventory = (2,000 + 6,000) / 2

- Average Inventory = $ 4,000

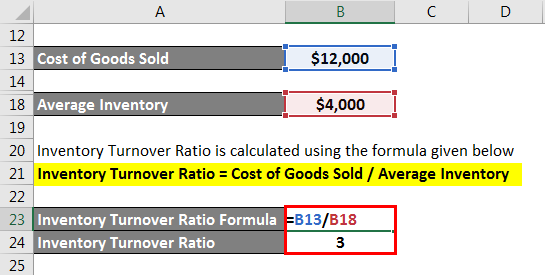

Inventory Turnover Ratio is calculated using the formula given below

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

- Inventory Turnover Ratio = 12,000 / 4,000

- Inventory Turnover Ratio = 3 Times

It shows that the inventory turnover ratio is 3 times, and it should be compared to the previous year’s data as well as other players in the industry to get a better sense.

Turnover Ratio Formula – Example #2

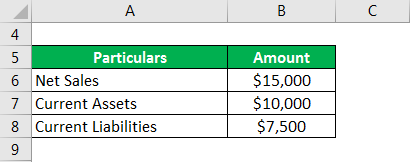

Let us take another example of a company Mobility Inc. Whose revenue from operations or net sales for a period is $ 15,000, and its current assets and current liabilities for the period are $ 10,000 and $ 7,500, respectively. What is the Working Capital Turnover ratio of the company?

Solution:

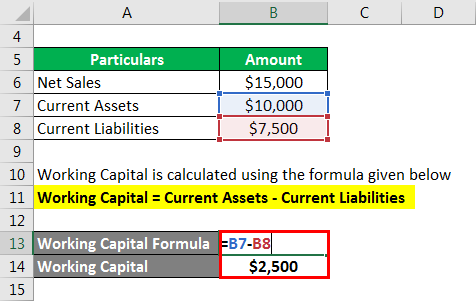

Working Capital is calculated using the formula given below

Working Capital = Current Assets – Current Liabilities

- Working Capital = 10,000 – 7,500

- Working Capital = $2,500

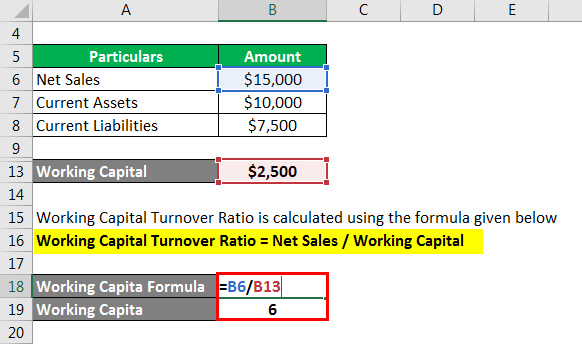

Working Capital Turnover Ratio is calculated using the formula given below.

Working Capital Turnover Ratio = Net Sales / Working Capital

- Working Capital Turnover Ratio = 15,000 / 2,500

- Working Capital Turnover Ratio = 6 Times

Working Capital Turnover Ratio of six times shows that sales in 6 times that of employed assets of working capital should be compared to the previous year’s data as well as other players in the industry to get a better sense.

Turnover Ratio Formula – Example #3

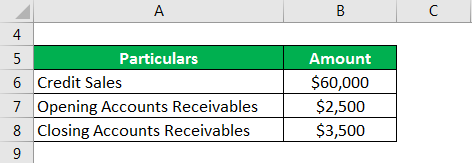

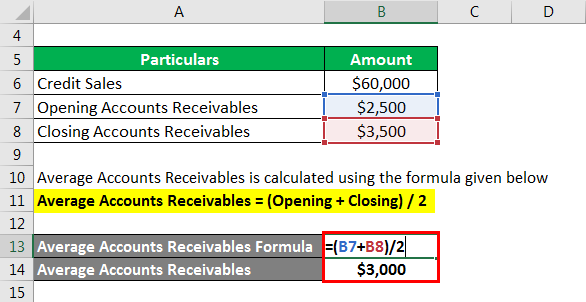

Let us take another example of a company which is having net credit sales worth $ 60,000 during one financial year. At the beginning of the financial year, Accounts Receivables were $ 2,500, and at the end, accounts receivables were $ 3,500. What are the Accounts receivable turnover ratio of the company?

Solution:

Average Accounts Receivables is calculated using the formula given below.

Average Accounts Receivables = Opening + Closing / 2

- Average Accounts Receivables = 2,500 + 3,500 / 2

- Average Accounts Receivables = $3,000

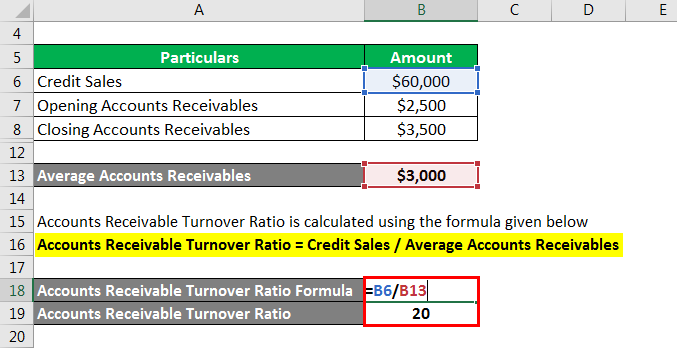

Accounts Receivable Turnover Ratio is calculated using the formula given below.

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivables

- Accounts Receivable Turnover Ratio = 60,000/ 3,000

- Accounts Receivable Turnover Ratio = 20 times

It shows that sales and, specifically, credit sales are 20 times the accounts receivable outstanding, which is a good turnover to have, but it should be compared to previous year’s data as well as other players in the industry to have a complete analysis.

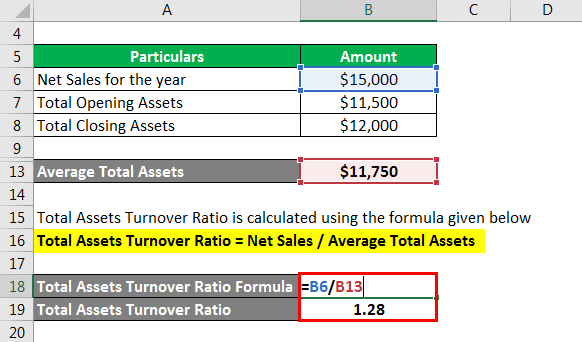

Turnover Ratio Formula – Example #4

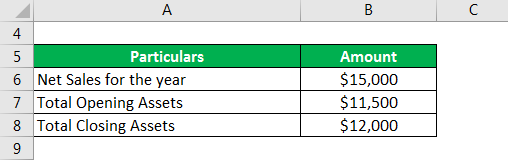

Let us take an example to calculate the Total Assets Turnover Ratio. The given values are Net Sales for the year = $ 15,000, Total assets at the beginning of the year = $ 11,500 and Total assets at the end of the year = $ 12,000. What is the Total Assets Turnover Ratio?

Solution:

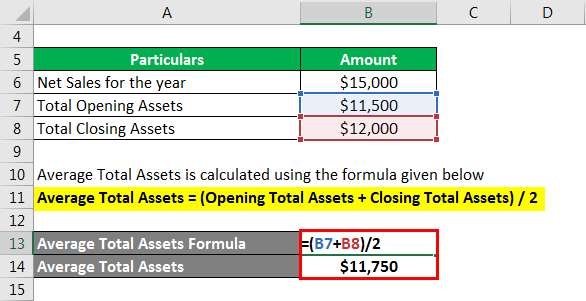

Average Total Assets is calculated using the formula given below.

Average Total Assets = (Opening Total Assets + Closing Total Assets) / 2

- Average Total Assets = 11,500 + 12,000 / 2

- Average Total Assets = $ 11,750

Total Assets Turnover Ratio is calculated using the formula given below

Total Assets Turnover Ratio = Net Sales / Average Total Assets

- Total Assets Turnover Ratio = 15,000 / 11,750

- Total Assets Turnover Ratio = 1.28 Times

Total assets turnover ratio of 1.28 times shows that net sales are above average total assets, which are always favorable to have, though it should be compared to previous year’s data as well as other players in the industry to have a complete analysis.

Explanation

The formula for Turnover Ratio can be calculated by using the following points:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Cost of Goods Sold is the total cost of the goods sold during the period under consideration. Average Inventory is the amount of inventory maintained during the year; on average; it is arrived at by dividing opening inventory plus closing inventory by two.

Net sales are the sales amount less any sales return or any discount offered (it may be a cash discount or bulk purchase discount). Subtracting Current Assets calculate working Capital with Current Liabilities; it shows the amount which is invested in the entity throughout the year in liquid assets.

Accounts Receivable Turnover Ratio = Credit Sales / Average Accounts Receivable

Credit Sales are the sales made on credit, i.e. without receiving the full amount for it immediately. Average Accounts Receivable is the average outstanding amount that is still not realized from the receivables; it is calculated by taking into account both opening and closing figures and dividing it by two. (Weighted average can also be considered)

Total Assets Turnover Ratio = Net Sales / Average Total Assets

Average Total Assets is the average of total assets held by the company throughout the period under consideration is calculated by taking into account both opening and closing figures and dividing it by two.

Relevance and Use of Turnover Ratio Formula

- Inventory Turnover Ratio is used to calculate how much of the inventory is converted into cash, and the higher the ratio, the better it is; however, slow and non-moving items in the inventory should be considered as well before making any conclusions.

- Working Capital Turnover ratio is used to showcase the ability to utilize the working capital. It is a great measure of comparison between the industry firms, past as well as the present.

- Accounts Receivable Turnover Ratio indicates the ability to covert or collect its account receivables as it uses only credit sales in its formula instead of total sales. Its comparison with past data can help give insight into the quality of accounts receivable is held on the books.

- Total Assets Turnover Ratio is the financial ratio that indicates all the assets combined to gather the sales for that specified period.

Recommended Articles

This is a guide to Turnover Ratio Formula. Here we discuss how to calculate the Turnover Ratio Formula along with practical examples. We also provide a Turnover Ratio calculator with a downloadable Excel template. You may also look at the following articles to learn more –