Introduction to Acquisition

There are various forms of the business combination, Acquisition being one of these, wherein, under US GAAP, in an acquisition, before the acquisition, there is an acquiring company, and a target company, and post-acquisition, both the companies still exist but only the acquiring company reports the consolidated balance financial statement including the results of the target company.

Explanation

The acquisition is done to get a share of profits or synergies of the target company’s business without affecting its brand name or autonomy. The target company exists as it used to be before the acquisition, but the ownership changes hands. It might also be true that there would be some level of intervention of the acquiring company in the workings of the target company, however, not so much as we call it a merger in which the target company ceases to exist.

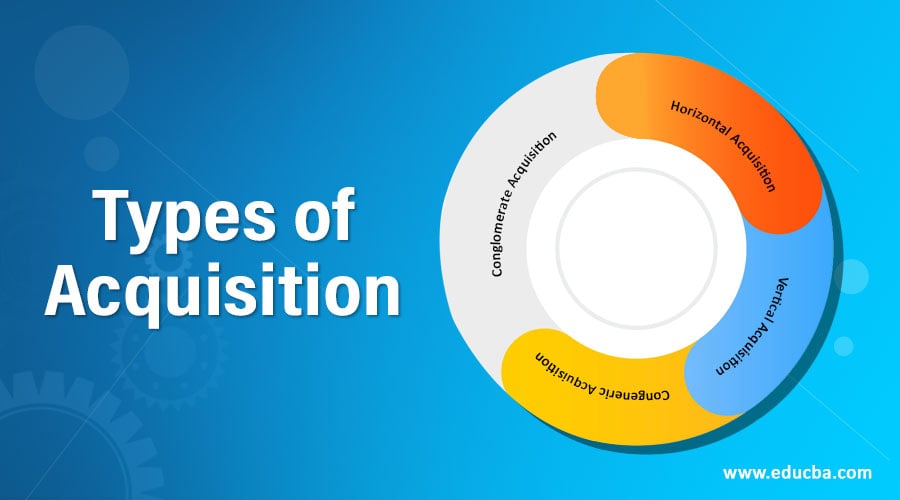

The acquisition is a method of Inter-corporate investments, and unlike US GAAP, IFRS doesn’t distinguish between various forms of business combinations. Types of acquisition are classified based on the nature of businesses the two companies and are termed accordingly. There can be other classifications as well and will be described in detail in the following section.

Top 4 Types of Acquisition

Classification based on businesses of companies involved:

1. Horizontal Acquisition

This is when a company acquires another company in the same business, or industry or sector, that is, a competitor. A real-life example of the same would be Facebook acquiring Whatsapp. Whatsapp still exists with its brand name, however, it is now owned by Facebook. In the purpose classification of acquisitions, we can further elaborate on this transaction. Facebook & Whatsapp are both in the same industry, that is social media, however, the acquisition has led to both benefitting from each other’s expertise.

2. Vertical Acquisition

This is when a company acquires either a supplier of inputs or a distributor of its products or the company to which it sells its products. For example, a garment company acquiring the source of cotton such as a farm. This is mostly done to have higher control over the supply chain and therefore impacting the receipt of raw material and delivery of products and in turn, impacting the turn-around time of the sourcing of input and delivery of the product to the end-user.

3. Conglomerate Acquisition

This is when a company acquires a company in a completely different kind of business, industry, or sector. This is mostly done for diversification. An example of this would be a food industry company acquiring a company in the clothing industry. Reliance Industries recently took over Hamley’s, a toy products company. Reliance is a giant conglomerate, which wanted to diversify into the toy industry and therefore undertook the acquisition by getting the 100% ownership transferred to itself.

4. Congeneric Acquisition

This is when companies sharing a similarity come together. This can be anything, either similar production technology or similar distribution channel and so on but the production activity of the two companies is not related. This terminology exists because it is assumed that there can’t be any other kind of similarity except that being considered while defining the types of acquisitions explained till now, however that is not the case practically. There is always some kind of overlap and therefore if an acquisition is not purely any other type, it is classified as the congeneric one.

Purpose of Acquisition

According to Mckinsey, it is also helpful to analyze the acquisition based on the purpose of the same. Therefore the consulting firm has defined following broad heads of such purposes under which acquisitions are categorized. Classification based on the purpose of acquisition:

1. Improvement in Target’s Performance

This is the type of acquisition in which the acquiring company is highly involved in the day to day activities of the target company. It is not an acquisition to use the synergies of the target company but to improve its performance. This is generally done by private equity players who expect high profits from the targets and therefore, invest heavily in the same. So this is a high-risk high reward approach. It involves austerity measures such as of cost reduction and increasing margins.

2. Remove Duplication

When a company is acquired, it will have certain aspects that the acquirer already has and therefore such duplications cause a drain on profits. Acquirer aims to get rid of such duplication and enhance the profits of the target company and consolidated profits of both the companies. Such duplication might be of having a separate transport fleet. If the acquirer has sufficient for both the companies then the target company’s fleet can be done away with.

3. Acquire Expertise and Technology

It is at times more cost-effective to get hold of new technology and expertise of the target company instead of developing it in house, therefore certain big conglomerates keep a separate budget for such acquisition regularly. These acquire smaller players now and then when they see a new piece of technology being developed by them. One reason is to boost production of such technology at a large scale, another is to prevent the creation of a competitor and yet another reason is to have the new technology in its portfolio.

4. Economies of Scale

This is one of the most important reasons for the acquisition, however, it is not always the case. In a certain acquisition, such economies are negligible. This is when the companies are already very large in themselves that they both have achieved the maximum level of economies possible. However, when a big company acquires several smaller companies, it enables them with such economies for example by reducing their input cost as the large company receives bulk discounts. So it might be beneficial in such cases and effective in increasing the profits of smaller players.

5. Finding Promising Companies in the Seed Stage

Unlike the first purpose of improving the performance of the target company, this purpose comes into play when the acquisition takes place at a very early stage of the target’s life cycle. This is done when the target possesses a disruptive technology or product that can make all existing products obsolete. Therefore, the companies that can assess such possibilities acquire such companies and groom them to their full potential.

Conclusion – Types of Acquisition

Therefore, there can be various types of acquisition and different types of classifications. These classifications are ever-evolving and therefore we can’t say which method of classification is the right one. However, one of the most prominent methods of classification is the one base on the nature of companies involved, and not knowing that definition conveys a lack of knowledge. Purpose-based classification cannot always be possible because at times the companies do not make it public the real reason for such an acquisition and the information in the public domain might not be sufficient.

References: https://www.mckinsey.com

Recommended Articles

This is a guide to Types of Acquisition. Here we discuss an introduction to types of acquisition along with the top 4 types and purpose in detail. You can also go through our other related articles to learn more –