What are the Different Types of Real Estate Rehab Loans?

While TV shows often portray real estate rehab as an exciting and glamorous pursuit, it’s more than just fresh paint and sparkling new fixtures. You also need market knowledge, strategic research and planning, and smart financial decisions. So, let us unlock the types of real estate rehab loans.

The Basics of Real Estate Rehab

Real estate rehab, often referred to as house flipping, involves purchasing distressed properties, completing renovations, and then selling the renovated properties at a higher price. While this investment strategy can result in substantial profitability if executed correctly, successful rehabbing requires investors to start with a solid financial foundation.

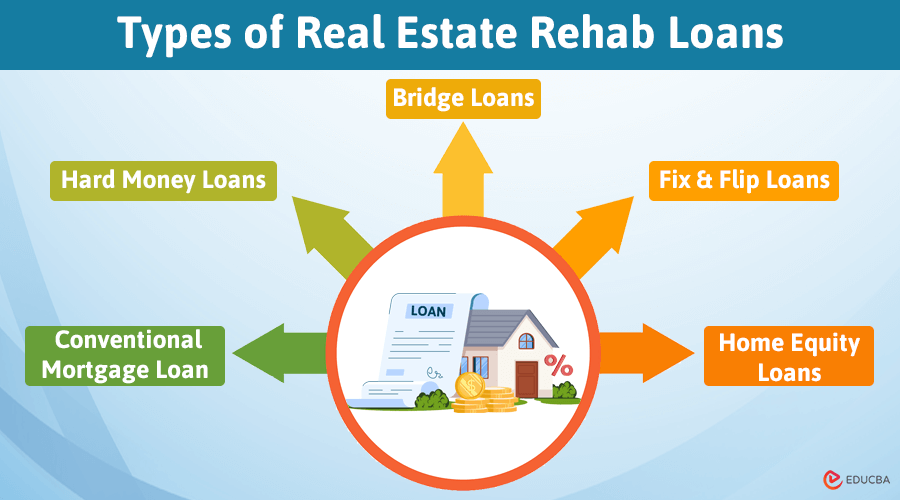

Top Financing Options for Rehab Projects

Choosing the right type of financing can make a significant difference. So, it’s essential to understand the types of real estate rehab loans that are available to you as an investor.

#1. Conventional Mortgage Loan

It is a conventional loan when you get a loan through private lenders such as credit unions rather than the government.

Pros

- Lower interest rates

- Longer repayment terms.

Cons

- Lengthy approval process

- Strict credit and income requirements

- Require a substantial down payment.

#2. Hard Money Loans

You can secure hard money loans by keeping the property itself as collateral rather than using your creditworthiness.

Pros

- Faster approval process

- Less stringent credit requirements

- Based on property value, not credit or income.

Cons

- Higher interest rates and fees

- Shorter repayment terms.

#3. Bridge Loans

You can use bridge loans when you need financing only for a short term until you can secure permanent financing.

Pros

- Quick approval and funding process

- Flexible repayment schedules

- Allow for the purchase of a property before selling another.

Cons

- Higher initial costs and interest rates

- Shorter repayment period

- Potentially require payments on two loans at the same time.

#4. Fix and Flip Loans

Fix and flip funding is another short-term loan option that is for investors who want to purchase a property, renovate it, then sell it for a profit.

Pros

- Faster approval and funding

- Flexible loan terms

- Designed specifically for house flipping.

Cons

- Higher fees, costs, and interest rates

- Potential to lose money or your property if something goes wrong.

#5. Home Equity Loans

A home equity loan is when the investor can get a lump sum amount at a fixed interest rate that they have to repay monthly.

Pros

- Competitive interest rates

- Potential tax benefits.

Cons

- Risk foreclosure on your home if unable to repay.

Strategies to Enhance Financing Success

Choosing the right type of financing as an aspiring investor can be challenging. Partnering with a trusted lender like Crossroads Investment Lending can help. They can explain the different options and help you determine which financing is best for your needs. Other strategies for financing success include:

- Building a strong credit profile

- Developing a solid business plan

- Understanding your local real estate market

- Preparing for contingencies.

Final Thoughts

Mastering real estate rehab financing is a key component of becoming a successful investor. By understanding the varying financing options and strategies, you can secure the funds needed for profitable rehab projects.

Recommended Articles

If you found this article listing the types of real estate rehab loans, check out these similar articles.