Unemployment Compensation Meaning

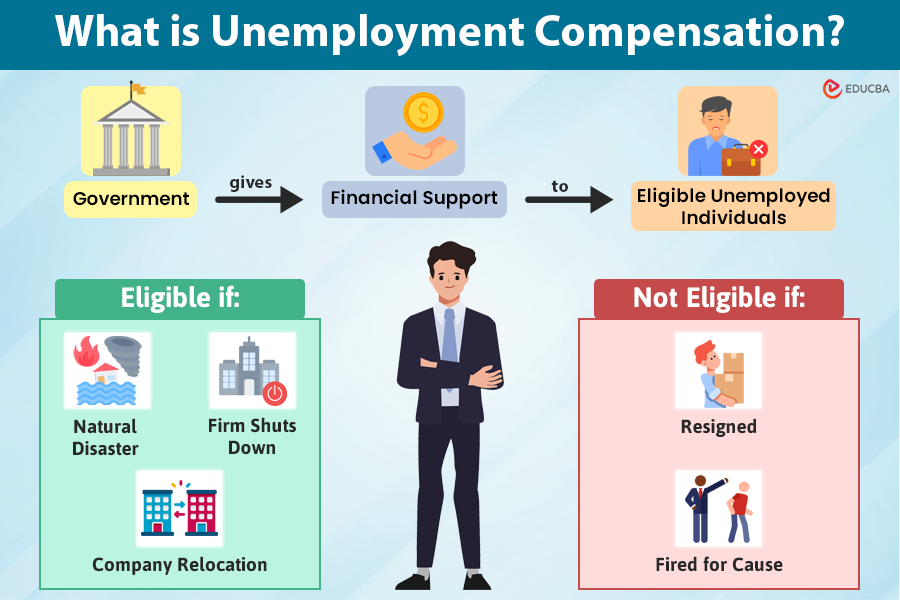

Unemployment compensation or unemployment insurance (UI) is when a government provides financial support to people who are temporarily unemployed but are not personally responsible for their job loss.

They could be unemployed because of reasons beyond their control, such as:

- Firm shuts down

- Company lays off due to budget cuts

- Natural disaster

- Company relocation

- Pandemics

- Position termination

This program aims to support individuals while they search for new employment. For example, if someone loses their job because the company downsizes, they may qualify for unemployment compensation. This support helps them cover basic expenses while they search for a new job, providing a financial safety net during tough times.

Table of Contents

Key Features

- Temporary Financial Assistance: Provides a portion of lost wages to help individuals cover basic living expenses during unemployment.

- Eligibility Criteria: Not all individuals qualify; they must meet specific criteria to receive benefits.

- State Administration: While the program is federally regulated, it is administered by individual states, leading to variations in benefits and eligibility requirements.

How Does Unemployment Compensation Work?

- Eligibility Criteria: To qualify for this, individuals typically must meet eligibility criteria set by their respective government agencies.

- Application Process: To apply for this program, individuals usually must file a claim with their state’s unemployment insurance program. This process often involves providing information about their employment history, unemployment reasons, and personal details.

- Benefit Calculation: An individual’s compensation is usually based on their previous earnings and varies by jurisdiction. Governments typically calculate benefits as a percentage of the individual’s past earnings up to a maximum amount.

- Duration of Benefits: Unemployment benefits are usually provided for a limited period, ranging from 12 to 26 weeks, depending on the jurisdiction and prevailing economic conditions.

- Continued Eligibility: Recipients of unemployment compensation are often required to meet ongoing eligibility requirements. These may include regularly reporting job search activities and attending meetings with career counselors.

Eligibility Criteria for Unemployment Compensation

Eligibility criteria for unemployment compensation can vary widely depending on the laws and regulations of the country or state. However, in general, eligibility is typically based on the following factors:

- Work History: Individuals must have a recent work history and have earned a minimum amount of wages during a specified period before becoming unemployed.

- Reason for Unemployment: Individuals must have lost their jobs through no fault of their own. Reasons such as layoffs, company closures, or termination due to reasons unrelated to misconduct are usually accepted.

- Availability and Job Search: Recipients must be available to work and must actively seek new employment during the period they receive benefits.

Real Examples of Unemployment Compensation Programs

Here are some real-world examples of unemployment compensation programs:

1. United States: Unemployment Insurance (UI)

The United States has a well-known unemployment insurance (UI) program that gives temporary financial aid to qualified employees who have lost their jobs through no fault of their own.

- Eligibility: Workers must meet state rules for how much they earned or how long they worked during a set time period. They must also be able, available, and actively seeking work.

- Benefits: The benefit amount and duration vary by state, but they usually last up to 26 weeks. Extensions are available during times of high unemployment.

- Additional Services: Many states offer job training programs and career counseling through workforce development agencies.

2. Canada: Employment Insurance (EI)

Canada’s Employment Insurance (EI) program provides temporary income support to unemployed individuals while they seek work or upgrade their skills.

- Eligibility: Claimants must have been employed in insurable employment and worked a minimum number of insurable hours. They must also be available and actively seeking employment.

- Benefits: EI benefits are generally available for up to 45 weeks, depending on regional unemployment rates and the individual’s work history.

- Additional Services: The program includes access to training and skills development programs to help improve employability.

3. United Kingdom: Jobseeker’s Allowance (JSA)

The UK offers the Jobseeker’s Allowance (JSA) to support unemployed individuals actively seeking work.

- Eligibility: There are two main types of JSA—contribution-based (for those who have paid sufficient National Insurance contributions) and income-based (for those with low income and savings).

- Benefits: The amount varies based on age and circumstances, and claimants must regularly show proof of job-seeking activities.

- Additional Services: The Jobcentre Plus network provides job search support, training opportunities, and career advice.

4. Germany: Arbeitslosengeld I (Unemployment Benefit I)

Germany’s unemployment benefits system is known as Arbeitslosengeld I.

- Eligibility: Workers must have paid into the unemployment insurance system for at least 12 months within the last two years and be registered as unemployed and actively seeking work.

- Benefits: The benefit amount is typically 60% of the claimant’s previous net earnings (67% if they have children) and can be received for up to 12 months (extended for older workers).

- Additional Services: The Federal Employment Agency offers vocational training, job placement services, and career counseling.

5. Australia: JobSeeker Payment

Australia’s JobSeeker Payment provides financial assistance to individuals looking for work or participating in approved activities to improve their job prospects.

- Eligibility: Individuals must be unemployed, meet income and asset tests, and be willing to meet mutual obligation requirements, such as attending appointments and participating in job search activities.

- Benefits: Payment amounts vary based on individual circumstances, including age and family situation.

- Additional Services: Employment services providers offer job search support, training opportunities, and work experience programs.

Advantages

- Financial Support: Unemployment compensation offers immediate financial relief to individuals who have lost their jobs, helping them cover basic living expenses such as rent, food, and utilities.

- Economic Stability: Unemployment benefits help maintain consumer spending by providing financial assistance to unemployed individuals, which is vital for economic stability and growth.

- Reduced Poverty and Homelessness: Unemployment compensation can prevent individuals and families from falling into poverty or becoming homeless during unemployment.

- Encourages Job Search: Financial support allows individuals to focus on finding suitable employment without the immediate pressure of financial hardship, potentially leading to better job matches.

- Workforce Development: Some unemployment programs offer job training and career counseling services to help individuals enhance their skills and increase their chances of finding a job.

- Psychological Benefits: Knowing that there is a safety net can reduce stress and anxiety for individuals who have lost their jobs, contributing to better mental health and well-being.

Disadvantages

- Cost to Government: Unemployment compensation programs require significant funding, which can strain government budgets, especially during economic downturns with high unemployment rates.

- Potential for Abuse: Some individuals might exploit the system by not actively seeking employment or misrepresenting their employment status to continue receiving benefits.

- Disincentive to Work: In some cases, generous unemployment benefits may reduce the incentive for individuals to find new employment, potentially prolonging unemployment periods quickly.

- Administrative Complexity: Managing unemployment compensation programs can be complex and bureaucratic, leading to delays in benefit distribution and challenges in accurately determining eligibility.

- Dependency Risk: Long-term reliance on unemployment benefits can create a dependency syndrome where individuals may struggle to re-enter the workforce even after the benefits end.

Final Thoughts

Unemployment compensation is a crucial safety net for unemployed individuals. It provides temporary financial support, allowing individuals to meet their basic needs and help them sustain themselves while actively searching for new employment opportunities. While the system has advantages, such as economic stabilization and job transition support, it also faces challenges like limited duration and potential for misuse.

Frequently Asked Questions (FAQs)

Q1. Can I work part-time and still receive unemployment compensation?

Answer: In many cases, yes. However, your earnings from part-time work may reduce the amount of unemployment benefits you receive. The specifics depend on your state or country’s rules.

Q2. Are unemployment compensation benefits taxable?

Answer: Unemployment benefits are typically subject to taxes. Recipients may choose to have taxes withheld from their payments or pay taxes on the benefits when they file their tax returns.

Q3. What should I do if my unemployment compensation claim gets denied?

Answer: If your claim gets denied, you typically can appeal the decision. The appeals process varies by location but usually involves providing additional information or attending a hearing.

Q4. Can I receive unemployment compensation if I receive any other income forms?

Answer: Severance pay and other forms of income may affect your eligibility or the amount of unemployment compensation you receive. Generally, you must report any income you earn while receiving benefits, and the unemployment office may deduct it from your weekly payments.

Recommended Articles

If you found this article on “Unemployment Compensation” helpful, check out these recommended reads to explore further options.