Updated October 5, 2023

Definition of Unlevered Beta

Unlevered Beta, which is sometimes also known as asset beta, is the measure of the sensitivity of the stock to its relevant market or index consisting of its peers after removing the effect of debt or leverage from its total risk, thereby narrowing down the risk sources to only equity or the assets of the company.

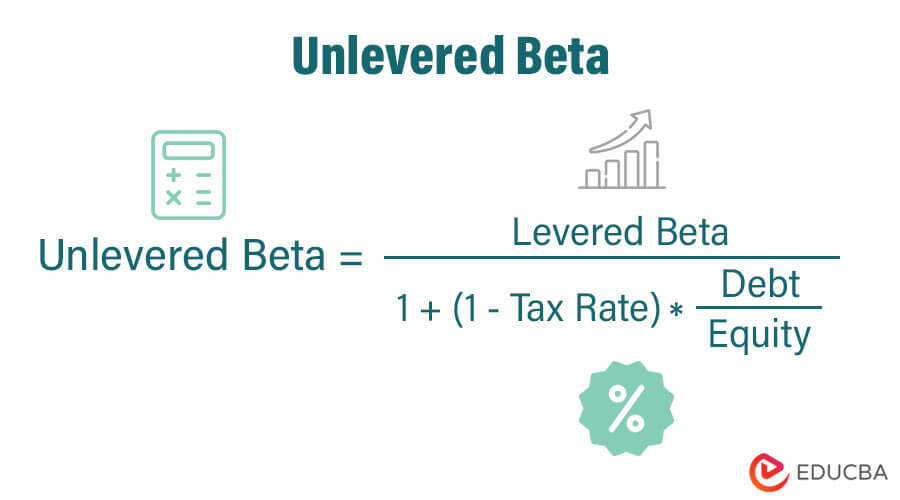

Formula

Following is the formula for calculating the Unlevered Beta:

Levered beta is also known as Equity Beta, but it is important not to confuse it with unlevered beta, which is sourced through equity financing only.

Explanation

- Beta measures the degree of sensitivity of the stock’s returns to the returns of the market. Thus, one calculates it by regressing the stock’s return to the market returns over a given period. We can say that it is the slope of the stock returns with respect to the market returns.

- When we include the company’s debt while calculating the beta, it is the Levered Beta. If we do not include the debt, then the beta arrived at is called asset beta or unlevered beta.

- This calculation occurs because the investors want to know how risky it is to invest in the given stock due to market movements. But when we include leverage, we also include the risk that leverage imposes by reducing the net income available to shareholders and also bringing in some benefits, such as tax shield. None of these has anything to do with market movements, and the purpose of the analysis is to segregate the impact of market movements.

Examples of Unlevered Beta (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

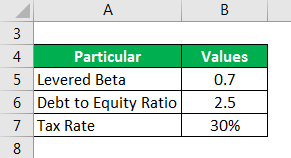

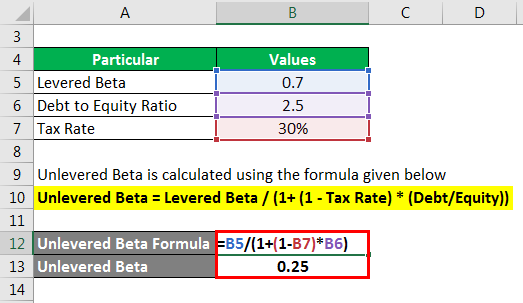

Suppose we have the following data for the stock of a company in the banking sector. Thus, the relevant market for this stock is a banking index:

Solution:

One calculates the Unlevered Beta using the formula given below:

Unlevered Beta = Levered Beta / (1+ (1 – Tax Rate) * (Debt/Equity))

Here,

- Unlevered Beta = 0.7 /(1+ (1- 30%) * 2.5)

- Unlevered Beta = 0.25

The unlevered beta can, at max, be equal to the Levered beta or lower. That is the case when the Debt is equal to zero, i.e., the company is completely equity financed.

- However, suppose the Debt is negative, which is the case when the business becomes ‘Cash cows’. Then, the unlevered beta can become higher than the levered beta

- If the beta is negative, it is a good stock for portfolio diversification because its returns move counter-cyclically. When the returns of the market rise, its returns fall, but when the market performs poorly, it has positive returns.

- The value of beta = 1 implies that the stock is equally risky to the market, while that of lower than 1 means that the stock is less risky in comparison to the market, as is the case in the above example. At a time when the beta is higher than 1, the stock is riskier than the market. Therefore, the investors would demand a higher rate of return for investing in such a stock when compared to investing in a stock with a beta lower than 1, as given in the above example.

Importance of Unlevered Beta

- Facilitates Comparison: It assumes that the companies have no debt and then measures the risk of the stock to the market or an index. Therefore, one can compare companies with varying capital structures using this metric. This is not the case if we compute the unlevered beta.

- Measure of Systematic Risk: It is a systematic risk for only the company’s assets, which is the risk faced by all the companies together instead of a single company arising out of the company-specific factors. Systematic risk measures the risk of the industry, sector, or economy as a whole.

- Used for Measuring the Risk of Private Companies: In the case of valuing a private company, we use the levered beta of a company that is similar to it and is publicly trading. We then remove the leverage effect from it by applying the above equation and then use the private company’s debt-to-equity ratio, if any, to calculate the beta for the private company. One also refers to this method as the pure-play method.

Unlevered Beta vs Levered Beta

- Inclusions: Levered beta includes the debt component of the company, while the unlevered beta removes the same. Therefore, the levered beta includes the benefits and limitations related to debt financing. Whereas the unlevered beta only considers the equity portion of the financing.

- Comparison: Levered beta can’t be used to compare companies with different debt-to-equity ratios. On the other hand, the unlevered beta helps in comparing such companies. This helps in analyzing companies in the industry without bothering about the capital structure of the company

- Value: Levered beta mostly has a higher value, as it includes the impact of leverage. Therefore, it conveys that the stock is exposed to two kinds of risk: one is due to the market movements or the cycles in the economy, while the other is because of the presence of debt in the capital structure, as it reduces the amount of net profit available for the equity shareholders. Unlevered beta, on the other hand, has a lower value as it only considers the risk arising from the market movement and ignores the risk pertaining to the leverage in the company. Only when the company has much cash, i.e., debt is negative, the value of unlevered beta will be higher than levered beta.

Conclusion

Therefore, we can understand that the Unlevered beta removes the impact of debt financing present in the capital structure of the company from the Levered beta of the company. Thus, it helps in the comparison of stocks having different debt to equity ratios. Further, it narrows down the systematic risk to that arising only due to company assets or from the equity source of financing.

Recommended Articles

This is our guide to Unlevered Beta. Here are some further articles to learn more: