Updated July 12, 2023

What is Value Added Tax?

Value Added Tax, popularly known as VAT, is an Indirect Tax levied on each stage of production until the end of consumption based on the value added at each stage.

Unlike other Indirect taxes such as Goods and Service Tax, which is an end-user tax, VAT charges on the gross value added at each stage, thereby allowing value addition undertaken at each stage to identify an applicable VAT to charge after adjusting for the VAT paid before that stage. The end customer pays the final VAT charge, and that’s why Value Added Tax is also known as Consumption Tax.

Explanation

A product passes through multiple stages of improvement before it finally becomes ready for the ultimate consumer. At each stage, a certain value is added; it captures the same value-added and applies a tax on the same. At each stage, the seller collects tax and deducts the tax paid by it while buying the product before adding value to it and paying the balance to the government.

Further, due to the value addition criteria, VAT ensures that correct invoicing is undertaken by dealers and manufacturers at each stage for correct Value Added Tax leading to more transparency and a higher tax base for the government.

How Does it Work?

To understand the computation and working of VAT, we need to understand the two components that help determine the VAT: Output Tax and Input Tax. Output Tax charge by the customer, an end-user, or part of the manufacturing chain providing value addition.

Input Tax is the amount paid by the manufacturer for purchasing raw materials. The registered manufacturer can claim the Input Tax credit for the input tax paid. The Net difference between Output Tax and Input Tax results in the VAT charge.

Examples of Value Added Tax (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Example #1

- Stage 1 comprised purchasing raw materials worth $10000, which carries a tax rate of 5%.

- Stage 2 comprises selling the goods made from stage 1 worth $15000, which carries a tax rate of 10%.

The computation of VAT is as follows:

| Cost of raw material in Stage 1 | $10,000 |

| Tax rate | 5% |

| Input tax Credit paid | $500 |

| Finished Goods sold in Stage 2 | $15,000 |

| Tax Rate | 10% |

| Output Tax Received | $1,500 |

| Net VAT payable | $1,000 |

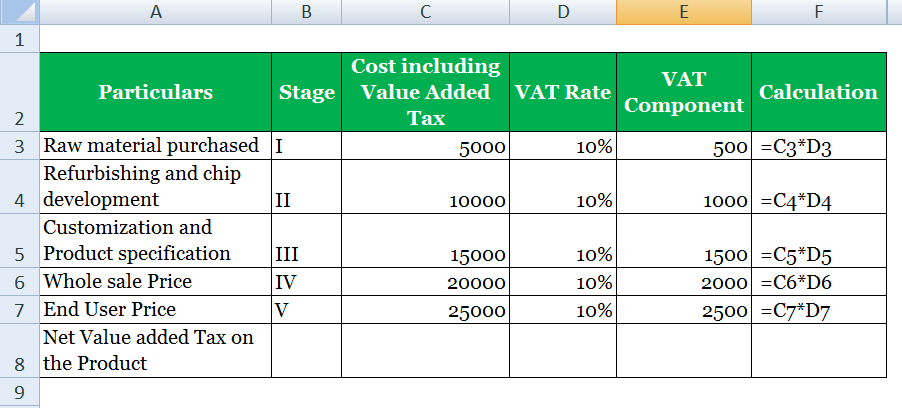

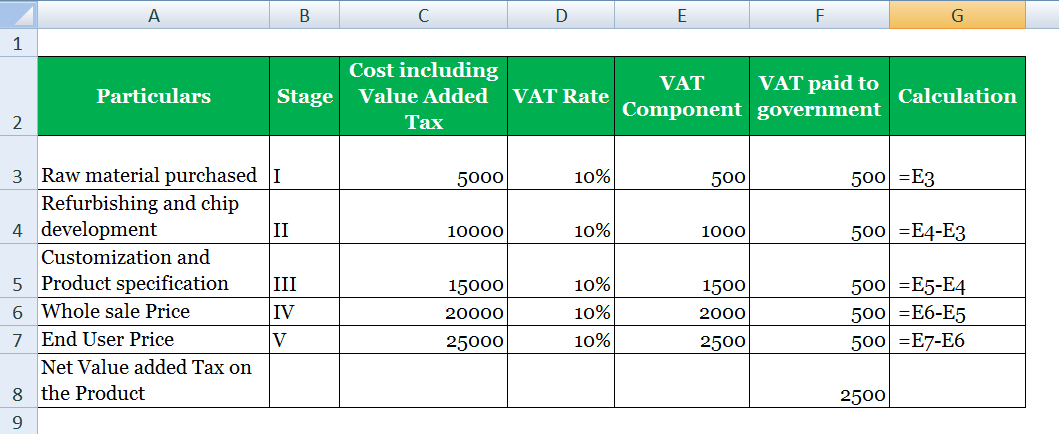

Let’s understand Value Added Tax with the help of a multi-stage product manufacturing of a Television Set, which attracts Valued Added Tax of 10%.

The VAT Component calculates as

VAT paid to the government calculates as,

Net Value-added Tax on the Product

| Particulars | Stage | Cost including Value Added Tax | VAT Rate | VAT Component | VAT paid to the government |

| Raw material purchased | I | 5000 | 10% | 500 | 500 |

| Refurbishing and chip development | II | 10000 | 10% | 1000 | 500 |

| Customization and Product specification | III | 15000 | 10% | 1500 | 500 |

| Wholesale Price | IV | 20000 | 10% | 2000 | 500 |

| End-User Price | V | 25000 | 10% | 2500 | 500 |

| Net Value-added Tax on the Product | 2500 |

Thus we can observe that the end product costing $25000 attracts a VAT of 10%, which is equivalent to $2500 paid by manufacturers at different stages depending on value addition and charged from the end customer.

Advantages of Value-Added Tax

- First, it allows levying taxes at each level, which helps better tax management and avoids income tax leakage for the government.

- It avoids the problem of double taxation as one can avail of input tax credit paid from VAT received.

- This helps the government better plan its expenditure by identifying which products contribute more, and accordingly, VAT rates can structure to optimize product demand and tax revenue collection.

- It removes the problem of under-invoicing as it is a tax on value addition.

- It results in equal tax for all irrespective of Income level and promotes higher-income earning among people.

- This increases revenue for the government as VAT is not dependent on the sale of products, and revenue earns at each stage of value addition.

Criticism

- It is difficult to claim value-added on certain services, resulting in over-taxation as it is difficult to define value-added, unlike goods.

- Different states levy different VAT rates, which results in more confusion and complexity in an otherwise simplistic tax structure.

- It charges the same tax rate irrespective of the user’s income level and, as such, criticizes it for being an anti-poor tax.

- It is complex in cases where products are manufactured at multiple stages and in different jurisdictions with varying VAT rates.

- The complex VAT rates for a single product at various manufacturing stages are observed, leading to increased compliance costs.

- It leads to a problem of deadweight loss in cases where tax revenue demand lost is more than the tax gained by levying the tax. Moreover, since VAT increases the price of the product without giving any Input tax credit to the end user, it leads to a reduction in demand.

Conclusion

It is a multi-stage value-added tax that is finally paid by the end user and is truly simplistic at its core. Normally VAT rates are classified under Standard rates, zero rates, and reduced rates; however, there can also be more rates in some developing countries like India. Every jurisdiction has certain criteria and registration procedures through which one needs to register for VAT. Once registered, the business can avail of input tax credit for the taxes paid against the output tax received by them from onward selling of product post value addition. It is a popular form of tax adopted by more than a hundred countries across the globe and has resulted in better tax management by the government.

Recommended Articles

This is a guide to Value Added Tax. Here we also discuss the definition and how VAT is calculated. Along with advantages and criticism. You may also have a look at the following articles to learn more –