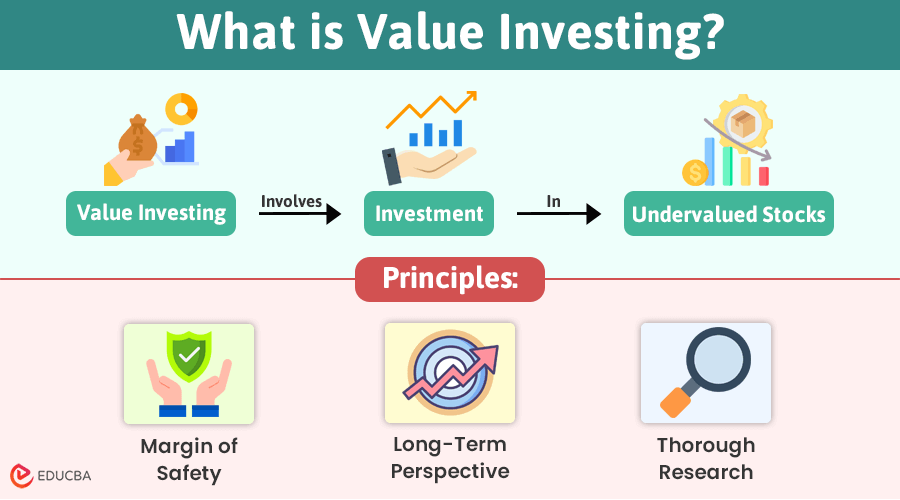

What is Value Investing?

Value investing is an investment strategy in which you invest in stocks that the market undervalues. This means the stock’s price is lower than its true worth based on earnings, dividends, and overall company performance. The idea is to buy these stocks at a bargain price and hold onto them until their market price reflects their true value, making a profit when you sell.

Suppose the company stock’s current price is $10 per share, but based on its earnings and potential, it should be worth $15 per share. A value investor would buy the stock at $10 because they believe it is undervalued. They hold onto it, and once the market realizes its true value and the stock price rises to $15, they can sell it for a profit.

Key Principles of Value Investing

Here are the key principles of value investing:

1. Margin of Safety

Value investors buy stocks at a price below their intrinsic value. This margin of safety protects them from valuation errors and market downturns.

For instance, if a stock’s true value is $100 but is available for $70, the investor has a 30% margin of safety. This cushion helps reduce the risk of loss if the stock’s price falls.

2. Long-Term Perspective

Value investing focuses on the long haul. It is not about making quick profits but keeping your investments for years or even decades to see their true value grow.

Investors believe undervalued stocks will eventually reflect their true worth as the market corrects itself over time. Reinvesting earnings to maximize compounding growth is a key aspect of this long-term approach.

3. Thorough Research

Successful value investing requires careful analysis and research. Instead of following market trends or hype, investors should deeply understand a company’s financials, business models, and competitive landscape.

This involves reading financial statements, evaluating business plans, and comparing the company to similar ones to make informed investment decisions and avoid speculative losses.

How to Identify Undervalued Stocks?

To find undervalued stocks, focus on companies with strong fundamentals like a healthy balance sheet, steady profit growth, and a strong market position. Use the P/E (price-to-earnings) and P/B (price-to-book) ratios to assess if a stock might be undervalued.

A low P/E ratio suggests the stock is cheaper than its earnings, which could mean it is undervalued. Similarly, a low P/B ratio shows the stock trades below its book value, which could present a buying opportunity.

Also, check the company’s debt-to-equity ratio. A low ratio means the company relies less on debt, making it more stable. Lastly, free cash flow reflects the company’s financial health. Learning about these factors through a value investing course can help you make informed decisions.

Common Mistakes to Avoid in Value Investing

Value investing can be highly profitable, but beginners often fall into traps that can cost them money. Here are some common mistakes to avoid:

1. Over-reliance on Financial Indicators

Many investors focus too much on financial metrics like the Price-to-Earnings (P/E) ratio and ignore other important aspects.

- Pitfall: A low P/E ratio might seem like a good deal, but it can indicate underlying problems like a declining industry or poor management.

- Lesson: Always consider the company’s business plan, management team, and the broader market conditions alongside financial figures.

2. Lack of Patience

Value investing is a long-term strategy that needs patience.

- Pitfall: New investors may panic and sell if the stock drops in value soon after purchase.

- Lesson: Think long-term. It might take time for the market to recognize a stock’s value. Selling too early could result in missing out on significant gains.

3. Falling into Value Traps

Not every cheap stock is a good value. Sometimes, a stock is “cheap” for a reason.

- Pitfall: A company may appear undervalued based on numbers, but issues like bad management or corporate decline might prevent it from recovering.

- Lesson: Watch out for value traps—stocks that look attractive based on financials but are unlikely to rebound due to deeper problems.

Final Thoughts

Value investing is a proven strategy for building long-term wealth. You can create a strong investment foundation by focusing on undervalued stocks, following key principles, and managing your emotions. Success requires time, knowledge, and a long-term mindset, but those who stay committed can see significant rewards. Whether new to investing or looking to refine your approach, value investing is a smart way to achieve your financial goals. Follow this strategy to start and build a successful portfolio confidently.

Recommended Articles

We hope this guide to value investing helps you understand the fundamentals and avoid common pitfalls. Check out these additional articles for insights on enhancing investment strategies and financial planning.