Updated August 1, 2023

Variable Costing Formula (Table of Contents)

- Variable Costing Formula

- Examples of Variable Costing Formula (With Excel Template)

- Variable Costing Formula Calculator

Variable Costing Formula

Variable costing is the expense that changes in proportion to production output. We can say that expenses depend on the output with a change in the output of production input expense change.

If variable cost increases, production output also increases; if variable cost decreases, product output decreases. Total variable cost equals the quantity of output into variable cost per output unit.

The main element of the variable costing formula is direct labor cost, direct material, and variable manufacturing overhead. Fixed manufacturing cost is not included because variable costing makes the cost of goods sold solely available.

Examples of Variable Costing Formula (With Excel Template)

Now, let us take an example to understand the Variable Costing formula better.

Variable Costing Formula – Example #1

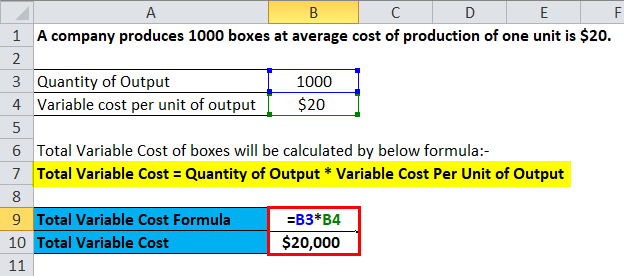

A company produces 1000 boxes at an average cost of production of one unit is $20.

The total variable cost of boxes will be:-

Put the values in the above formula.

- Total Variable Cost = 1000 * 20

- Total Variable Cost = $20,000

So, the total variable cost of 1000 boxes is $20,000.

The business incurs total expenses by adding the variable and fixed costs, where the fixed cost remains constant regardless of the quantity manufactured or produced. In contrast, the variable cost depends on the quantity produced.

Let us see one more example to calculate the total variable cost and its dependency on quantity.

Variable Costing Formula – Example #2

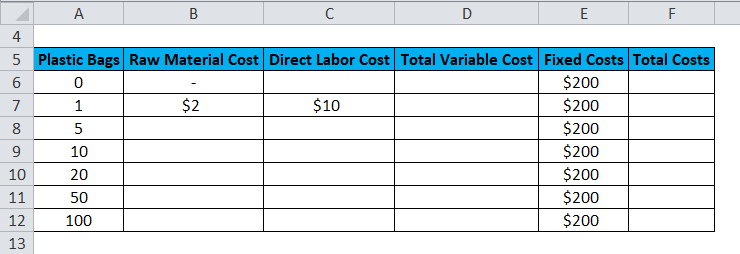

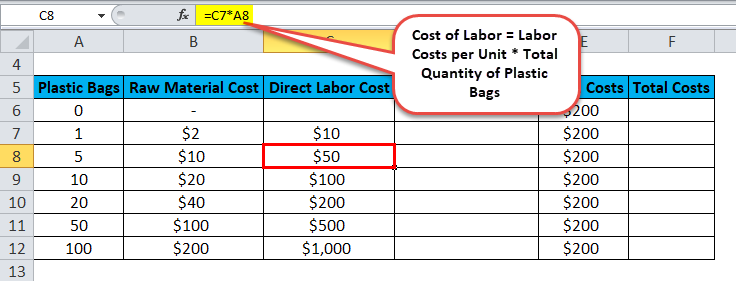

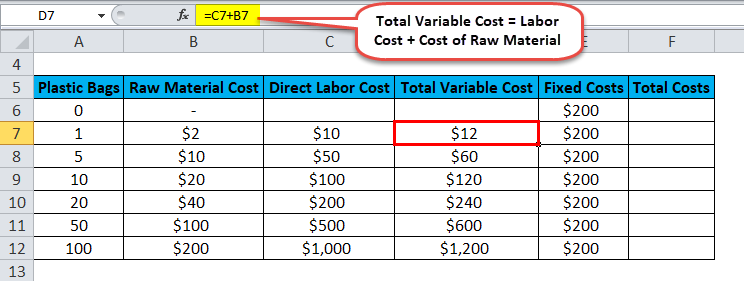

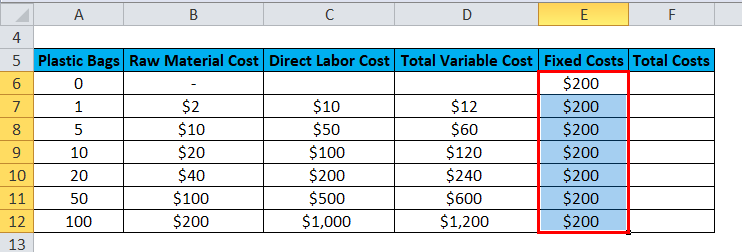

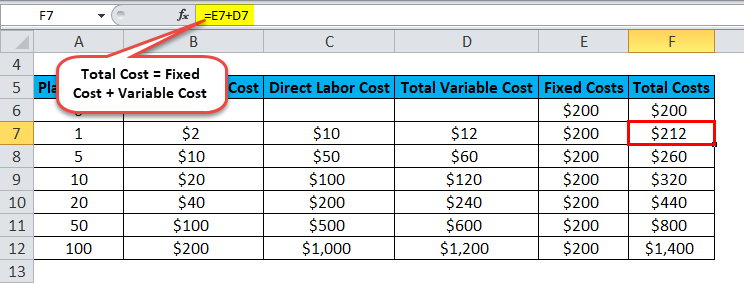

A company manufactures plastic bags, the raw material cost for the production of 1 bag is $2, the labor cost for manufacturing 1 plastic bag is $10, and the company’s fixed cost is $200. Now, we will calculate the variable cost and total cost.

- To calculate the Cost of Raw Materials-

Raw material costs per unit will multiply by the total quantity of plastic bags manufactured.

- To calculate the Cost of labor –

Labor costs per unit will multiply by the total quantity of plastic bags manufactured.

- The sum of labor cost and cost of raw material constitutes the total variable cost.

- Fixed cost is $200, irrespective of quantity.

- The total cost comprises the sum of the fixed cost and the variable cost.

Calculating total variable cost involves multiplying the quantity of output by the variable cost per output unit. The production quantity determines the variable cost, which, in turn, determines the total variable cost of a product. The total variable cost is variable since it depends on the quantity of the product.

Hence,

Total Variable Cost = Quantity of Output * Variable cost per unit of output

Variable Cost Per Unit Formula

Variable cost per unit is the cost of one production unit, but it includes only variable cost, not fixed one. The variable cost per unit is said to depend on the production quantity. It comprises labor cost per unit, direct material per unit, and direct overhead per unit.

- Labor cost is taken as labor cost per unit, depending on the production quantity.

- Direct material is the raw material cost per unit, as it depends on the production quantity. We can say that it is directly proportional to the variable cost.

- The production of one unit requires an additional cost called direct overhead, which varies depending on the production quantity.

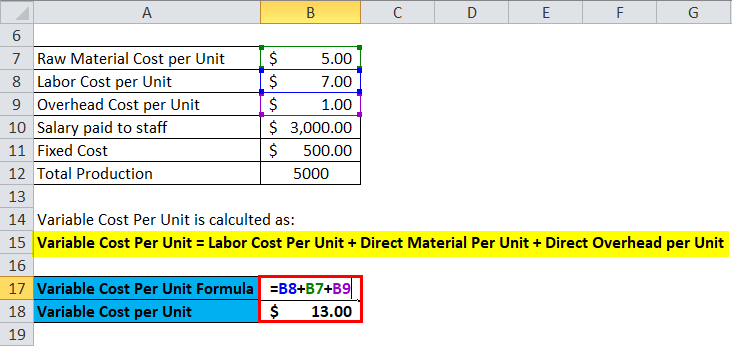

Variable Cost Per Unit Formula Example

Let’s see an example to understand Variable cost per unit better.

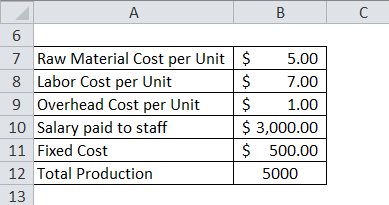

A company named Nile Pvt. Ltd produces handmade soaps. The cost of raw material per unit is $5, the labor cost of production per unit is $7, the fixed cost for a month is $500, the overhead cost per unit is $1, and the salary for office and sales staff is $3,000. The total Production done by the company in one month is 5,000. Now we will calculate the cost of soap per unit.

Calculation for Variable Cost Per Unit is:

Variable Cost Per Unit = Labor Cost Per Unit + Direct Material Per Unit + Direct Overhead per Unit

Put a value in the above formula.

- Variable Cost Per Unit = 7 + 5 + 1

- Variable Cost Per Unit = $13

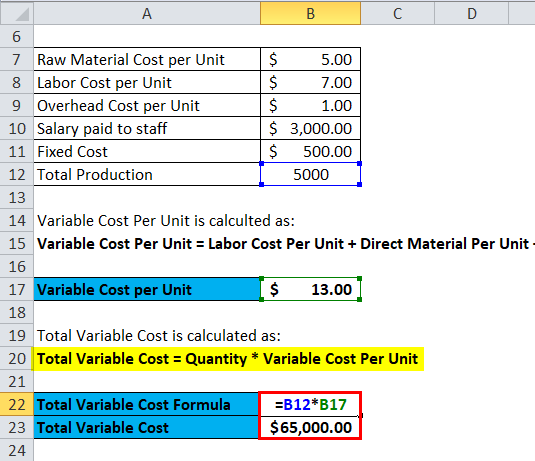

Calculation for Total Variable Cost is:

Total Variable Cost = Quantity * Variable Cost Per Unit

- Total Variable Cost = 5000 * 13

- Total Variable Cost= $65,000

So, the variable cost per unit of soap is $13, and the total variable cost of soap is $65,000.

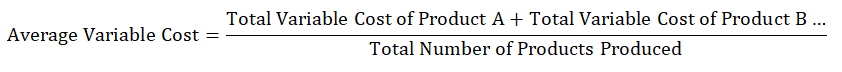

Average Variable Cost & Formula

The sum of all product’s total variable costs divided by the total number of units produced by different products determines the average variable cost.

It helps to determine the average cost of production of a single unit of product in a company irrespective of the type of product.

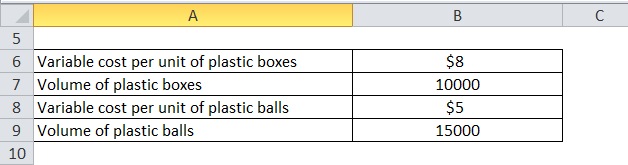

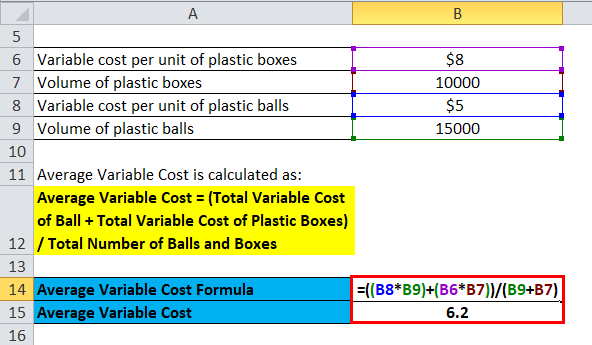

Average Variable Cost Formula Example

A company manufactures plastic boxes and plastic balls. The variable cost per unit of plastic boxes is the company manufactures $8 and 10,000 boxes. The variable cost per unit of plastic balls is $5, and the company manufactures 15,000 boxes.

As we know,

Average Variable Cost = (Total Variable Cost of Ball + Total Variable Cost of Plastic Boxes) / Total Number of Balls and Boxes

Put the value in the above Average Variable Cost formula.

- Average Variable Cost = (8 * 10,000) + (5 * 15,000) / 10,000 + 15,000

- Average Variable Cost = $6.2

So, the average variable cost of plastic balls and boxes is $6.2.

Variable Costing in a Break-even Analysis

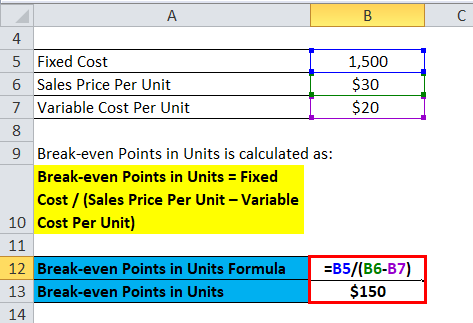

The break-even analysis is a vital application of variable costing. It helps to find the amount of revenue or the units required to cover the product’s total costs. Break-even points in units are fixed costs divided by sales price minus variable cost per unit.

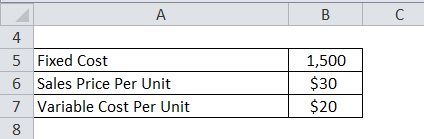

Break-even Analysis Formula Example

A company that produces mugs has a fixed cost of $1,500, a variable cost per unit of $20, and a sales price per unit is $30. Now, we have to calculate the break-even point of the same.

As we know,

Put the value in the formula.

- Break-even Points in Units = 1,500 /(30-20)

- Break-even Points in Units = 150 Units

So, the company needs to sell 150 units of mugs to make a profit.

Significance and Uses of Variable Costing Formula

There are many uses for variable costing formulas they are as follows:-

- Variable Costing Formula helps in profit planning and margin set-up.

- Variable Costing Formula is a major tool for cost control and a flexible budget.

- Variable Costing plays a vital role in decision-making.

- Variable Costing Formula helps to decide the price of a product.

- Variable Costing Formula helps to determine the break-even point.

Variable Costing Formula Calculator

You can use the following Variable Costing Calculator

| Quantity of Output | |

| Variable Cost per Unit of Output | |

| Total Variable Cost Formula | |

| Total Variable Cost Formula = | Quantity of Output x Variable Cost per Unit of Output |

| = | 0 x 0 = 0 |

Recommended Articles

This has been a guide to a Variable Costing formula. Here we discuss How to Calculate Variable Costing along with practical examples. We also provide you Variable Costing Calculator with a downloadable Excel template. You may also look at the following articles to learn more –