Professional VAT Filing Services in the UAE: Overview

In the fast-paced business environment of the UAE, staying compliant with tax regulations is essential for success. Managing VAT obligations can be complex, but with expert VAT filing services in the UAE, businesses can ensure accuracy, efficiency, and compliance. In this article, we will look at the key benefits of professional VAT filing services and how they help businesses easily meet UAE tax requirements.

Why Professional VAT Filing Services Matter?

Since the introduction of VAT in the UAE, businesses have had to adapt to new tax regulations, reporting standards, and compliance requirements. Handling VAT calculations, record-keeping, and submission deadlines can become overwhelming without the right support. Professional VAT filing services in the UAE help businesses navigate these challenges seamlessly by ensuring compliance with the latest regulations and preventing costly mistakes.

These services are designed to:

- Ensure accurate VAT calculations and record-keeping.

- Keep businesses updated on regulatory changes.

- Offer expert advice to prevent tax-related issues.

- Allow business owners to focus on core operations instead of tax complexities.

Reliable VAT Filing Services for Your Business

Reliability is crucial when managing VAT obligations. Late or incorrect VAT filings can result in hefty fines and even reputational damage. Trusted VAT filing services in the UAE help businesses handle their tax affairs efficiently and accurately.

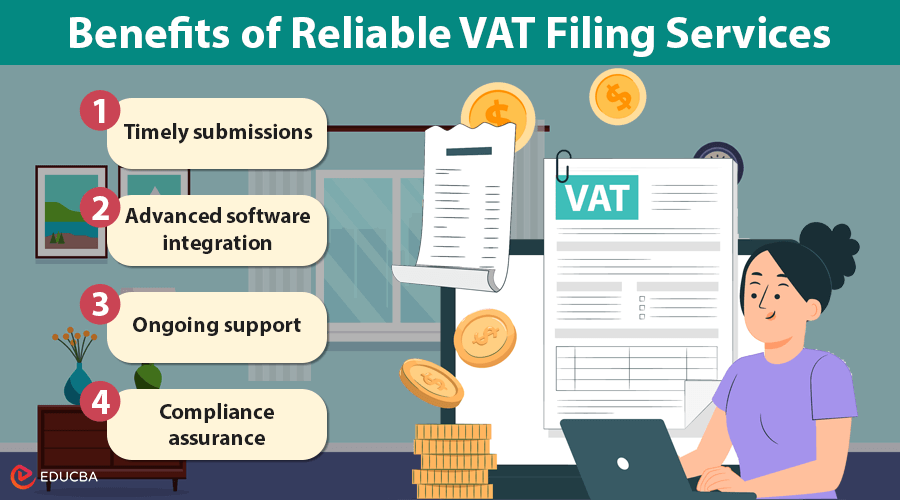

Key benefits of reliable VAT filing services include:

- Timely submissions: Avoid penalties by meeting VAT deadlines.

- Advanced software integration: Automated processes reduce errors and save time.

- Ongoing support: Immediate resolution of any VAT-related discrepancies.

- Compliance assurance: Full adherence to UAE tax regulations.

With professional VAT filing assistance, businesses can rest assured that their tax obligations are managed by experts, minimizing risks and enhancing financial stability.

Simplifying VAT Filing in UAE

VAT filing can be a complicated process, especially for businesses handling large volumes of transactions. Professional VAT filing services in the UAE simplify tax management through automation, expert oversight, and structured financial reporting.

How VAT filing services simplify the process:

- Automated calculations: Reduce manual errors and speed up tax reporting.

- Transaction categorization: Systematic sorting of tax data for accuracy.

- Effortless return submission: Hassle-free tax filing with minimal intervention.

- Cost-saving solutions: Reduce operational expenses with efficient tax management.

VAT filing services use technology and expertise to handle taxes, allowing businesses to focus on growth without stress.

Avoid Penalties with Accurate VAT Filing Services

Accuracy in VAT filing is a good practice and a legal necessity. Late or incorrect filings can result in audits, fines, and compliance issues. Expert VAT filing services in the UAE help businesses maintain precision in tax reporting, reducing the risk of penalties.

Advantages of accurate VAT filing services:

- Error-free documentation: Ensures all data is correctly recorded and reported.

- Compliance checks: Regular audits to detect and fix discrepancies.

- Expert financial oversight: Professional guidance to mitigate risks.

- Regulatory updates: Keep up with tax law changes.

With a system of checks and balances, businesses can confidently meet VAT compliance requirements while avoiding financial and legal complications.

Final Thoughts

Professional VAT filing services in the UAE are necessary in a highly regulated business environment. These services offer businesses a seamless solution to tax management, ensuring compliance, accuracy, and efficiency. From accurate tax calculations to timely filings, VAT experts help businesses avoid penalties and focus on their core operations.

By partnering with experienced VAT service providers, businesses can:

- Reduce tax-related stress and errors.

- Ensure compliance with UAE tax laws.

- Optimize financial management and resource allocation.

- Build a strong foundation for sustainable growth.

Investing in professional VAT filing services is a strategic decision that secures long-term financial health and regulatory peace of mind. Expert VAT filing solutions in the UAE make compliance simple and hassle-free.

Recommended Articles

We hope this guide on VAT Filing Services in the UAE has provided valuable insights. Check out these recommended articles for more expert tax compliance tips and financial management strategies.