Introduction to VAT Registration in UAE

The UAE government introduced a 5% VAT on 1st January 2018. After this, businesses in the UAE must register and file VAT with the authorities. If your business has made over AED 375,000 from taxable supplies in the last 12 months, you need to register for VAT. However, some businesses are exempt if they only deal with VAT-exempt goods or services. Additionally, if your business meets the threshold but won’t make more taxable supplies, you can apply for an exemption from VAT registration in UAE.

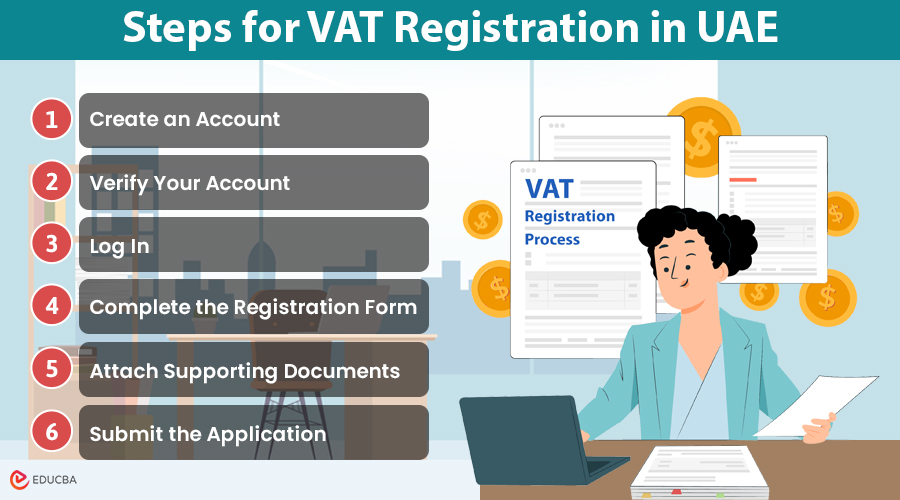

Steps for VAT Registration in UAE

To register for VAT in the UAE, follow these simple steps:

1. Create an Account

-

- Open the Federal Tax Authority (FTA) website and go to the VAT registration portal.

- Create a user account.

2. Verify Your Account

-

- Through email confirmation, activate your account.

3. Log In

-

- Use your username and password to log into the VAT registration portal.

4. Complete the Registration Form

-

- Fill out the VAT registration form with the required information.

5. Attach Supporting Documents

-

- Upload the necessary documents to prove the details you provided.

6. Submit the Application

-

- Submit your application. The FTA will review it and email you your Tax Registration Number (TRN).

Types of VAT Registration in UAE

VAT registration in UAE depends on your business’s annual revenue and taxable expenses. There are two main types:

1. Mandatory VAT Registration

If your business earns more than AED 375,000 annually, you must register for VAT and get a Tax Registration Number (TRN).

2. Voluntary VAT Registration

If your business earns between AED 187,500 and AED 375,000, you can voluntarily register for VAT and get a TRN.

Required Documents for VAT Registration

To register for VAT, you will need the following documents:

- Trade License: Copy of your business’s trade license.

- Emirates ID: Copy of the Emirates ID for the business owner or partners.

- Memorandum of Association (MOA): Copy of the MOA or similar document.

- Power of Attorney: If applicable, a copy of the power of attorney.

- Bank Account Details: Proof of your business’s bank account (bank statements or letters).

- Details of Business Activities: Full information on your business’s activities.

- Import/Export Details: Information about any import/export activities, if relevant.

- Passport Copy: Copy of the passport for the business owner or partners.

- Certificate of Incorporation: For companies, a certificate of incorporation or similar document.

- Contact Information: Contact details of the authorized person, including address and phone number.

- Financial Records: Proof of your business’s annual turnover or audited financial statements.

- Customs Authority Registration: If needed, proof of registration with the customs authority.

VAT Registration Exemptions

Some areas are exempt from VAT registration under UAE Federal Decree-Law No. (8) of 2017:

| Exemption Area | Description |

| Plain Land | Sales of undeveloped land (new plots) are not subject to VAT. |

| Financial Services | Financial services without explicit fees or commissions are VAT-exempt. |

| Housing Properties | The lease or sale of residential properties, except those zero-rated, are exempt from VAT. |

| Local Passenger Transport | Transport services within the UAE (e.g., buses, taxis, metros) are VAT-exempt. |

Final Thoughts

Understanding VAT registration in the UAE is essential for businesses and individuals receiving income. VAT registration is often mandatory, so it’s important to follow the steps carefully. If you need help with the process, VAT consultants like VAT Registration UAE can guide you through the steps and ensure your business stays compliant while growing in the UAE market.

Recommended Articles

We hope you found this article on ‘VAT Registration in UAE ’ insightful. For more information on VAT and other taxes, refer to the posts below.