Updated July 26, 2023

Velocity of Money Formula (Table of Contents)

What is the Velocity of Money Formula?

The velocity of money can be defined as the speed at which money flows in an economy. In simple terms, we can describe the velocity of money as the speed at which money is being spent in an economy to buy goods and services.

It can either be a dollar, a euro, or any other currency spent to purchase these goods and services. Income earned by an individual enables them to purchase more freely which tends to increase the money velocity.

The velocity of money tells us how people hold cash or spend it. If there is a fear of losing a job, the person will spend slowly. On the other hand, if a person feels he has enough money then he will tend to spend it faster. An economy that shows faster movement in money can be considered a healthy economy. The economy expands if the money transaction made increases in an economy and it shrinks when fewer money transactions are made. However, an increase in velocity also leads to higher inflation and lower inflation ensures a decrease in the velocity of money. The velocity of money is never constant.

How is the Velocity of Money Calculated?

The change in money velocity is mainly due to two reasons:

- Change in the economy’s GDP

- Change in the money supply.

The velocity of money is calculated as below:

Where,

- VM is the velocity of money

- PQ denotes the GDP and

- M is the money of supply.

Thus, the Velocity of money is simply calculated by dividing the money supply with the economy’s GDP.

Certain factors that influence the velocity of money are Value of money, Volume of trade, Frequency of the number of transactions and Credit facilities Business Conditions among others.

Examples of Velocity of Money Formula (With Excel Template)

Let’s take an example to understand the calculation of the Velocity of Money Formula in a better manner.

We have studied the basic theory and definition of the Velocity of Money in the above segment. Let us now understand how the velocity of money works by studying a few examples.

Velocity of Money Formula – Example #1

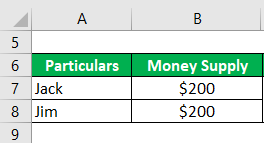

Let us consider a small economy consisting of two individuals named Jack and Jim and assume that all the transactions that take place in this economy are only between them. Jack has $200 with him. Let us calculate the velocity of money based on the transactions made between these two individuals

Solution:

We assume that Jack sells a pen and Jim sells pencils. On Day one, Jack decides to buy pencils from Jim worth $200 this is the first transaction that takes place between them. On Day 2, Jim decides to buy pens from Jack worth $200. This is the second transaction that takes place between them.

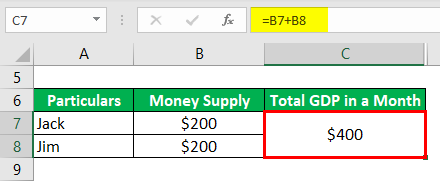

Total GDP in a Month is calculated as

- Total GDP in a Month = $200 + $200

- Total GDP in a Month = $400

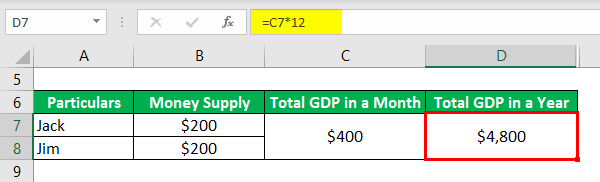

Total GDP in Year is calculated as

- Total GDP in Year = Total GDP in a Month * 12

- Total GDP in Year = $400 * 12

- Total GDP in Year = $4800

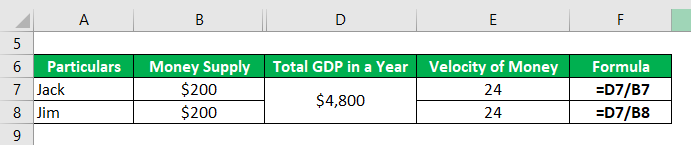

Velocity of Money is calculated using the formula given below

VM = PQ / M

For Jack

- Velocity of Money = $4,800 / $200

- Velocity of Money = 24

For Jim

- Velocity of Money = $4,800 / $200

- Velocity of Money = 24

As seen above, the total GDP of this economy in this month was $400. The same kind of transactions happens throughout the year making the GDP to $4800 and the velocity of money for the year to 24.

Velocity of Money Formula – Example #2

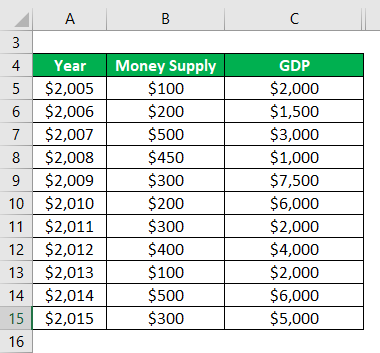

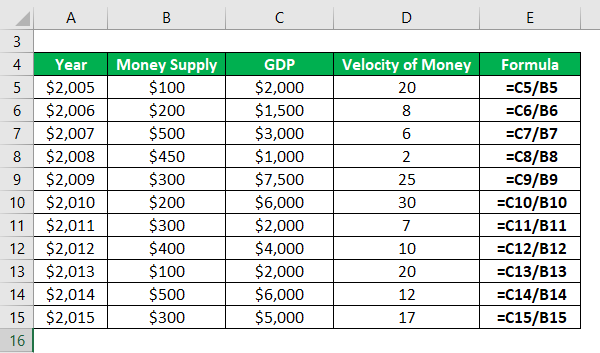

Below is the data of Country X from the year 2005 to 2015 along with the money supply and GDP. Calculate the Velocity of Money by the given information.

Solution:

Velocity of Money is calculated using the formula given below

VM = PQ / M

For 2005

- Velocity of Money = 2000 / 100

- Velocity of Money = 20

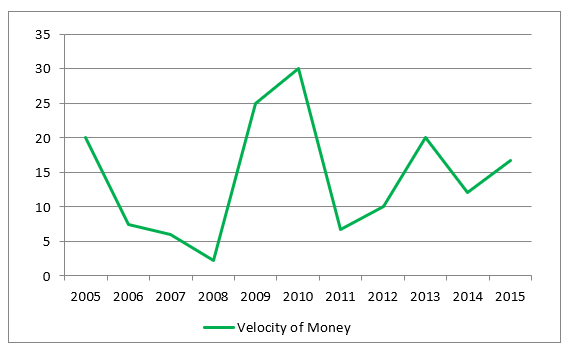

Similarly, the velocity of money can be calculated for the remaining years. Graphical representation of the above is shown below –

We see that the velocity of money increased after 2008 and decreased drastically in 2011. The velocity of money has increased in the year 2009 and 2010 indicating a higher number of money transactions between individuals during this period. It also states that during the period where the velocity of money increased the inflation was high and the transactions were frequent between the individuals. When the money is spent rapidly, velocity rises. Likewise, people also hold money as savings for the future which is called idle money. If the money kept is idle or if people hold on cash and do not spend the velocity of money decreases.

Please note that a decrease in the velocity of money is not a sign of concern. The higher growth of money supply is in compared to the growth in the economy is an indicator of growing inflation.

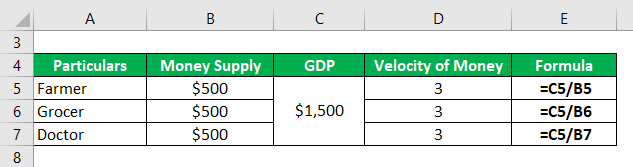

Velocity of Money Formula – Example #3

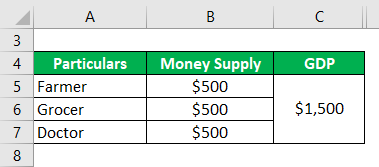

Consider a farmer, doctor, and grocer in an economy and all three make some transactions among themselves worth $500.Calculate the Velocity of Money by the given information.

Solution:

Velocity of Money is calculated using the formula given below

VM = PQ / M

For Farmer

- Velocity of Money = $1,500 / $500

- Velocity of Money = 3

Similarly, the velocity of money can be calculated for the Grocer and Doctor.

We have calculated a simple velocity of money between a farmer, doctor, and grocer which determines the flow and movement of money between individuals. We observed that $1500 changed hands throughout the year even though there was only $500 at the initial stage. This was because each dollar was spent on new goods and services.

Relevance and Uses

The velocity of money helps economists to determine the rate of inflation by studying and analyzing the increase or decrease in velocity of money. Generally, the velocity of money aims to reduce taxes. This means higher the velocity of money lower is the tax rates.

Money velocity can be determined by both the demand for money and the supply quantity of money. In a developing economy, the transactions are more rapid and this demands the need for more money to fulfill these transactions. In this case, the growth of supply in money is desirable to match the income growth.

Velocity of Money Formula Calculator

You can use the following Velocity of Money Formula Calculator

| PQ | |

| M | |

| VM | |

| VM | = |

|

|

Recommended Articles

This is a guide to the Velocity of Money Formula. Here we discuss how to calculate the Velocity of the Money Formula along with practical examples. We also provide a Velocity of Money calculator with a downloadable Excel template. You may also look at the following articles to learn more –