Introduction to Ways to Enhance Payment Transparency

The way we pay and get paid has evolved significantly, moving far beyond handwritten ledgers and paper trails. Modern technologies make transactions faster and far more transparent. From real-time tracking of international transfers to seamless automation of invoices, these advancements bring clarity and minimize errors. Whether you are managing business finances or personal expenses, these tools offer unparalleled visibility into every cent exchanged. Let us explore five powerful ways to enhance payment transparency using cutting-edge technologies.

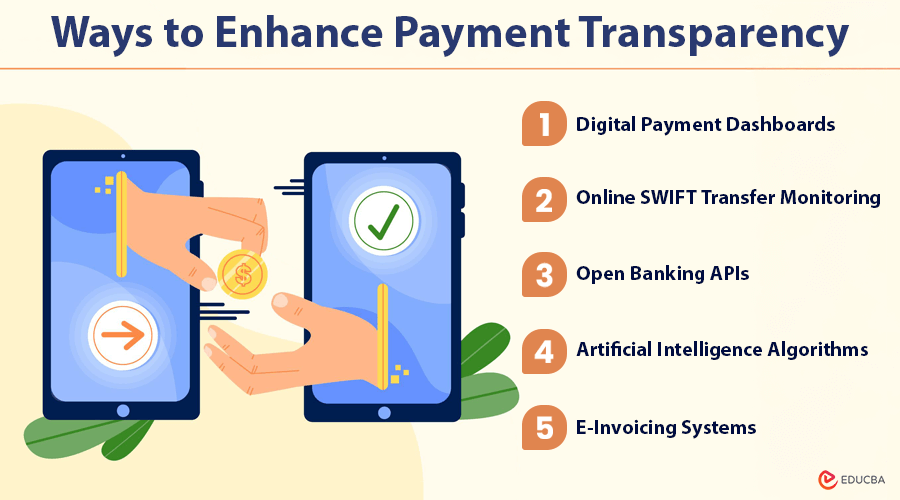

Ways to Enhance Payment Transparency with Modern Technologies

Here are some ways to enhance payment transparency:

#1. Digital Payment Dashboards

Managing payments across multiple accounts and platforms can quickly become overwhelming. Digital payment dashboards address this challenge by providing a centralized, real-time view of all your financial transactions.

Benefits:

- Track outgoing payments, pending invoices, and cash flow at a glance.

- Spot discrepancies faster and streamline accounting processes.

- Incorporate charts and graphs to enhance decision-making.

For businesses, this means reduced reliance on spreadsheets and improved financial oversight. For individuals, it simplifies tracking spending habits and achieving budgeting goals. Additionally, automated alerts for upcoming payments or irregularities ensure nothing slips through the cracks.

#2. Online SWIFT Transfer Monitoring

International payments often lack transparency, but online SWIFT transfer monitoring solves this issue by enabling real-time tracking of funds as they move between banks globally.

Benefits:

- Continuous updates on payment progress eliminate uncertainty.

- Enhanced accountability reduces disputes or miscommunication with recipients.

- Supports regulatory compliance by tracking transactions against standards.

This technology ensures funds are received as intended for businesses handling cross-border payments and builds trust through greater visibility and efficiency.

#3. Open Banking APIs

Open Banking APIs revolutionize financial data management by securely sharing payment information between banks and authorized third-party apps. This allows you to access and analyze your financial data in one centralized location.

Benefits:

- Track payments, view balances, and analyze spending seamlessly.

- Automate tasks like payment reconciliation and cash flow forecasting.

- Compare costs across services and manage savings more efficiently.

This transparency fosters competition among service providers, ultimately leading to better tools and personalized banking solutions tailored to your needs.

#4. Artificial Intelligence (AI) Algorithms

AI algorithms are transforming payment monitoring and optimization. By analyzing large amounts of transactional data in seconds, AI identifies patterns and flags unusual activity much faster than humans can.

Benefits:

- Detect issues like duplicate charges or potential fraud early.

- Provide predictive insights for smarter financial planning.

- Automate expense tracking and budget recommendations.

For businesses, AI enhances accuracy and reduces financial losses by identifying anomalies in vendor payments or customer transactions. For consumers, it simplifies managing expenses and ensures a secure payment lifecycle.

#5. E-Invoicing Systems

E-invoicing systems automate and digitize the invoicing process, replacing traditional paper invoices. This results in faster delivery, fewer errors, and greater transparency for all parties involved.

Benefits:

- Track invoices at every stage—from creation to payment.

- Sync seamlessly with accounting software to prevent mismatches.

- Automate payment reminders to minimize delays.

E-invoicing improves cash flow management and simplifies audits or regulatory compliance for businesses. This system streamlines financial workflows for small businesses and large corporations.

Final Thoughts

Adopting modern financial technologies is key to achieving better control and confidence in payment management. Whether you are a business owner looking to streamline operations or an individual aiming for clarity in personal expenses, these tools offer practical ways to enhance payment transparency.

Explore the solutions that align with your needs and take the first step toward smarter, more transparent financial management. The future of payments is here, and it is time to leverage technology to stay informed, secure, and ahead of the curve.

Recommended Articles

We hope this guide on ways to enhance payment transparency has been helpful. For more insights on financial management, check out these recommended articles.