Overview Derivatives

Definition- “Derivatives are financial instruments whose value is derived from its underlying asset or the value of something else.it is a tool which mitigates the risk of underlying under contractual manner.”

What do you understand by the term derivative? We hear or read in newspapers about derivatives. But most of us still confused about it, what exactly it means? Don’t worry! Welcome to the world of derivatives, Derivatives is nothing but a tool used by the investor for the purpose of “Hedging risk” of investments. Derivatives are very popular because of their flexibility; returns. So let us understand derivatives and what they meant?

What is Derivative?

Generally, we can say that the derivative is a financial instrument or security whose value derived or determined by its underlying asset. Here underlying assets could be anything for example equity, bond, commodity, currency. Derivatives are traded between two parties called counterparties. Primarily derivative is a tool that mitigates the risk of underlying between two counterparties. Let’s take a simple example for better understanding.

e.g. ABC Pvt Ltd is a packaged food manufacturing company (First Counter Party), and for production using raw material as wheat. Mr. David is a wheat producer. (Second counterparty). ABC Company’s manager Mr. John speculate the price of wheat, he thought that the price of wheat would be increased in near future, he have bullish approach (positive approach) towards the price of wheat, On other hands, David believes that the price of wheat will go down in near future; he has bearish approach (negative approach) towards prices of wheat. One day, John meets David and make a contract with him, this contract includes some terms and condition that company ABC will buy wheat (specifying quantity) in near future (specific date) at today’s pre-agreed price from David who is a producer of wheat. Both are agreeing with terms and conditions and make a contract. What do you understand by this example?

John who is manager of Food manufacturing company secured prices of wheat at today’s pre-agreed price, so he mitigates the risk of underlying asset i.e. Wheat, so if in near future prices of wheat goes up then also he can purchase wheat at pre-agreed price(past price which both are agree to buy and sell). Where David is a farmer or wheat producer, he believes that the price of wheat will go down in the near future, but now he has been secured the price of wheat. If prices of wheat go down then also, he could sell wheat to john at its pre-agreed price. So we can say that a derivative is a financial instrument whose value derived from its underlying asset in a contractual manner. Generally, it’s in the form of a contract between two counterparties where they agree to buy and sell an underlying asset at pre-agreed price and date to mitigate risk. Derivatives are generally used as an instrument to hedge risk.

Understand how derivative trading works. Learn various derivative instruments and its trading. Evaluate financial futures transactions and investment in instruments.

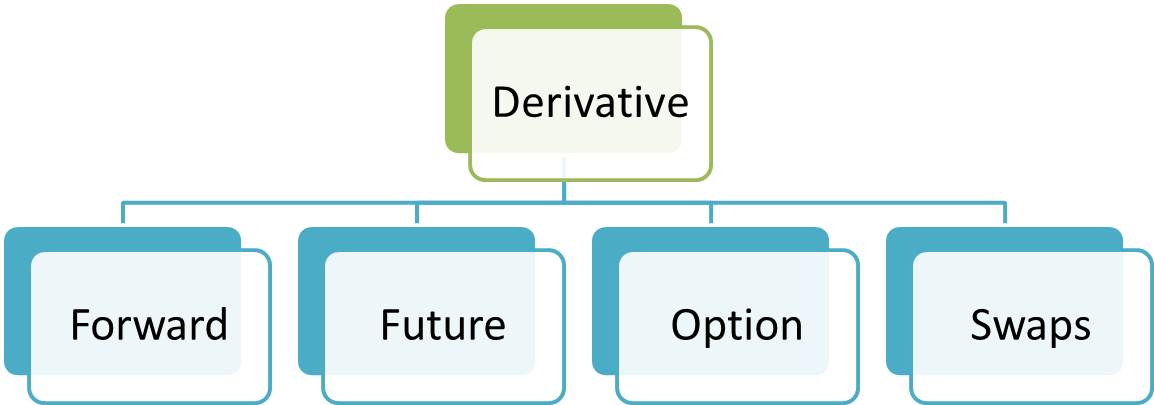

Derivative and It’s Types-

Following are the types of Derivatives

- Forward

- Future

- Option

- Swaps

Forward Contract-It is a customized contract between counterparties where they agree to buy or sell the underlying asset in the near future (specific date) at today’s pre-agreed price(specific Price). It is a customized contract where they can change the terms and conditions of the contract. The forward contract is traded in the OTC market. i.e. Over the Counter market. In this contract, the counterparty default risk is very high.

Future-It is a standardized contract between counterparties where they agree to buy or sell the underlying asset in the near future (specific date) at today’s pre-agreed price (specific Price). Futures are traded in the stock exchange and are subject to a daily settlement procedure. In future contracts counterparty default risk is low and delivery of underlying is in cash only.

Option-Option means giving right but not the obligation to buy or sell the underlying asset, at a specific price in the future (specific date). Generally, options have two folds

- Calls option

- Put option

In Layman words,

Call means -To buy

Put means -To sell

Call Option-Call option means giving right but not the obligation, to buy the underlying asset, at a specific price in the future (specific date).

Put option-Call option means giving right but not the obligation, to sell the underlying asset, at a specific price in the future (specific date).

Following are styles of options

- American option

- European option

- Bermudan option

An American option-American option is an option which may be exercised at any time before the expiration date.

A European option-European option is an option which may be exercised at the time of expiration only.

Bermudan option-A Bermudan option is an option which may be exercised at predetermined intervals. It is a combination of both. I.e. an American option and a European option.

Swaps-Swap means the exchange of cash flow between two counterparties. There are various types of swaps, let’s look at some of these

- IRS (Interest rate swaps)

- Currency swaps

- CDS (Credit default swaps)

IRS (Interest rate swaps)- Interest rate swaps (IRS) are used to hedge against changes in interest rates. It is an agreement between counterparties where future interest payments are exchanged for another based on a specified principal amount.

Currency swaps- It involves the exchange currency for the same in another currency. A foreign exchange agreement between two parties to exchange a given amount of one currency for another and, after a specified period of time, to give back the original amounts swapped

CDS (Credit default swaps)- Credit default swap (CDS) contracts under which two counterparties (protection buyer and protection seller) where protection seller agrees to compensate protection buyer in case of any credit event happens with reference to an entity.