What is IFRS? – Meaning & Full Form

Have you ever wondered how businesses work, earn revenue, and keep their assets in check? Well, it all comes down to accounting. Accounting helps companies monitor and record their financial transactions. Companies record these transactions in accounting records, which they finally convert to financial statements. However, comparing financial statements across different countries can be challenging for companies operating globally. IFRS helps to address this challenge.

International Financial Reporting Standards, known as IFRS, provide a common accounting standard for companies to help them create financial statements that are clear, transparent, and easy to compare worldwide.

When businesses operate in different countries, their accounting practices may differ because each country has its own laws and rules. This can be confusing. To address this, the International Accounting Standards Board (IASB) created IFRS on April 1, 2001. More than 120 countries now use it.

The goal is to ensure that financial information about a company is consistent and reliable, regardless of location. This means using the same terminology, definitions, and approaches when identifying and reporting income, expenses, assets, and liabilities.

Table of Contents

What is IFRS – Objectives

The following are some of the objectives of international financial reporting standards.

1. Standardized Reporting

IFRS standards establish universal accounting rules for companies to make consistent and transparent reporting of financial information.

2. Provide Clarity

These standards help everyone (investors and other stakeholders) understand a company’s financial position, performance, and cash flows. This, in turn, allows them to make better economic decisions, such as investing in a company’s stock or deciding whether to lend money to a company.

3. Comparability

It facilitates easy comparison of financial statements across different companies and jurisdictions. This helps investors, lenders, and creditors to identify risks before investing and promoting international trade.

4. Facts Behind Finances

It ensures that financial statements correctly report the details of transactions and events rather than just mentioning them on paper in legal form.

5. Global Adoption

The idea of Global Adoption is to promote the use of IFRS for reporting business activities. This will help make financial reports clear and easy to understand for everyone.

Standards

The following is the list of International Financial Reporting Standards and their purposes.

| Standard | Title | Purpose |

| IFRS 1 | First-time Adoption of International Financial Reporting Standards | It helps companies adopt the IFRS standard for the first time to prepare their complete financial statements during a financial year. |

| IFRS 2 | Share-based Payment | Explains how companies should account for stock options and other share-based payments to employees. |

| IFRS 3 | Business Combinations | Provides rules for how companies should account for combining or merging with other businesses. |

| Note: As of 1st January 2023, IFRS 17 replaced IFRS 4. | ||

| IFRS 5 | Non-current Assets Held for Sale and Discontinued Operations | It helps companies account for assets that they are selling or disposing of as well as any discontinued operations. |

| IFRS 6 | Exploration for and Evaluation of Mineral Resources | It provides guidelines related to the exploration and evaluation of asset activities in the extraction industries of mineral resources. |

| IFRS 7 | Financial Instruments: Disclosures | Provides clarity on disclosing financial information in the hyperinflation year. The company should reveal the significance of financial instruments and the nature and extent of risks arising, both qualitative and quantitative. |

| IFRS 8 | Operating Segments | Focuses on reporting financial information to provide insights into a company’s different business areas, like operating segments, their products and services, geographical regions in which it operates, management reports, and major customers. |

| IFRS 9 | Financial Instruments | Addresses classification, measurement, and evaluation of financial assets and liabilities, impairment of financial instruments, and buying and selling non-financial items to enhance reporting accuracy. |

| IFRS 10 | Consolidated Financial Statements | Outlines the principles for preparing and presenting consolidated financial statements. It defines the principle of presenting assets, liabilities, equity, etc., of both the parent and its subsidiary companies. |

| IFRS 11 | Joint Arrangements | Establishes principles for financial reporting for joint arrangements (joint venture or a joint operation). It includes the rules and regulations of proper accounting and financial reporting of joint ownership properties (collaborative ventures). |

| IFRS 12 | Disclosure of Interests in Other Entities | It outlines details to evaluate a company’s interests in subsidiaries, joint arrangements, associates, and unconsolidated structured entities. They should reveal objectives or interests and the effects of those interests on their financial position, financial performance, and cash flows. |

| IFRS 13 | Fair Value Measurement | Provides rules for how companies should measure and disclose the fair value of various assets and liabilities. |

| IFRS 14 | Regulatory Deferral Accounts | Offers guidance on rate regulation and reporting regulatory deferral accounts, particularly in regulated industries. |

| IFRS 15 | Revenue from Contracts with Customers | Guides on how companies should recognize revenue from contracts with customers. |

| IFRS 16 | Leases | Provides accounting rules for companies regarding new leases and lease transactions and indicates how to present, measure, and disclose leases. |

| IFRS 17 | Insurance Contracts | Sets guidelines for insurance contracts on accounting models. It deals with identifying, measuring, and disclosing a business’s insurance contracts. |

Requirement of IFRS

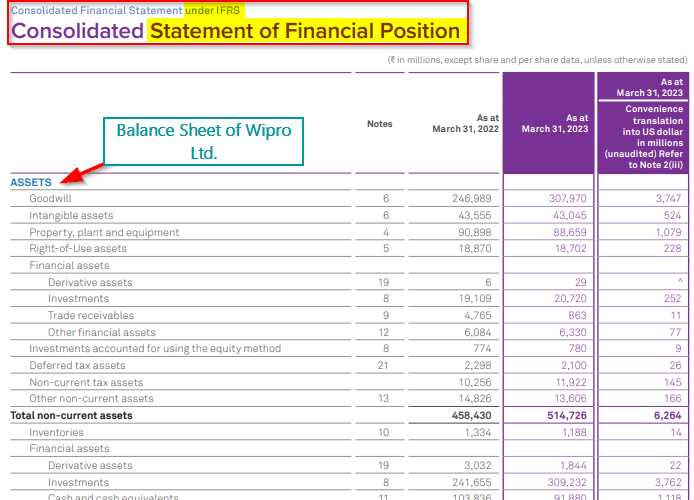

According to International Financial Reporting Standards, there are different types of financial statements that companies need to prepare.

The Statement of Financial Position, also known as the balance sheet, is one of these statements. It shows what a company owns (assets), what it owes (liabilities), and ownership (equity).

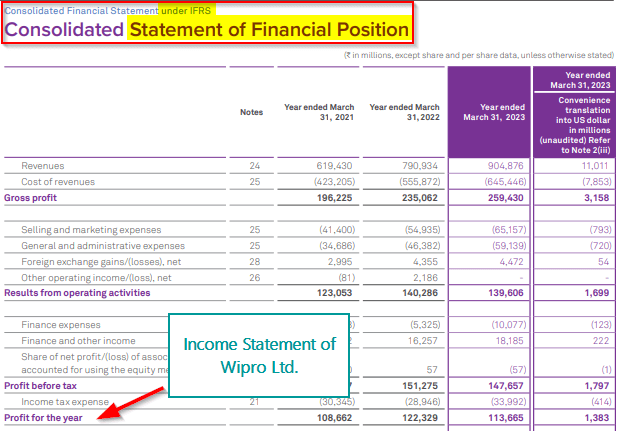

Another statement required by this standard is the Statement of Comprehensive Income, which shows all the money a company has earned (revenues), all the money it has spent (expenses), and any other financial gains or losses over a specific period (for example, one year).

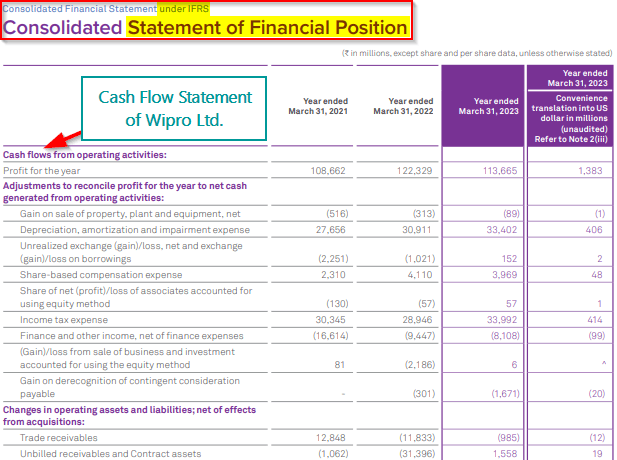

The Statement of Cash Flows is another statement that outlines how a company’s cash and cash equivalents change over time. It categorizes cash flows into operating (day-to-day activities), investing (buying or selling assets), and financing (borrowing or repaying money) activities.

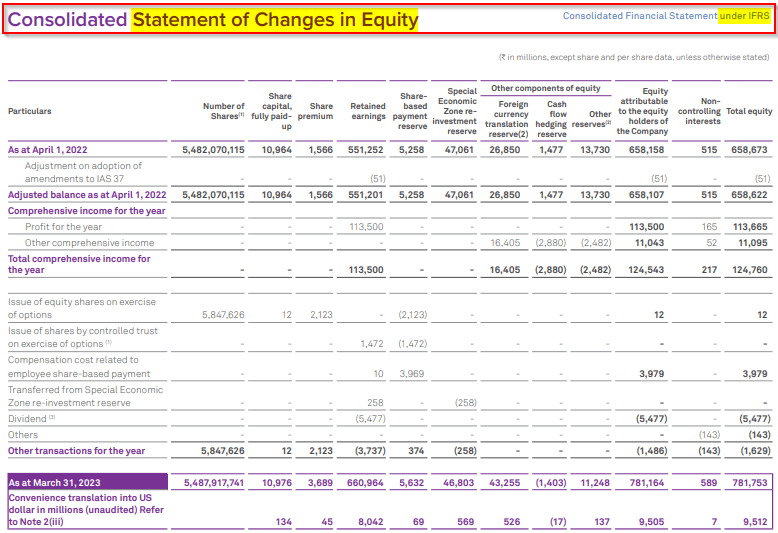

The Statement of Changes in Equity shows how a company’s ownership changes over time. It includes details about any transactions the company has had with its shareholders, any changes in the amount of shares it has issued, any reserves it has set aside for future use, and retained earnings.

Finally, companies need to include explanatory Notes at the end of the financial statements. These notes offer additional information and explanations about accounting policies. For example, if a company has property, plant, and equipment, the balance sheet will show the total value of these assets. However, the explanatory notes will provide more detailed information about each asset, such as its gross block, net block, depreciation method, and useful life.

Principles

1. Consistent Accounting Standards

This principle means that the International Financial Reporting Standards ensure that financial data is consistent and comparable across companies that follow it. It also guides how to choose the appropriate accounting methods for different types of transactions. For instance, IFRS 8 guides on how to report information about operating segments, while IFRS 10 guides on how to prepare consolidated financial statements.

2. Financial Transparency

Financial transparency is a key principle of IFRS. It means that companies should be honest about their financial status. They should provide accurate financial information through the Statement of Financial Position (balance sheet). They should also use performance indicators to show their financial performance. This helps consumers and investors understand if a company can sustain and progress.

3. Financial Movement Disclosure

This standard requires companies to disclose their financial performance through financial statements. For instance, Cash flow statements show details of operational expenses, equities, and other business transactions.

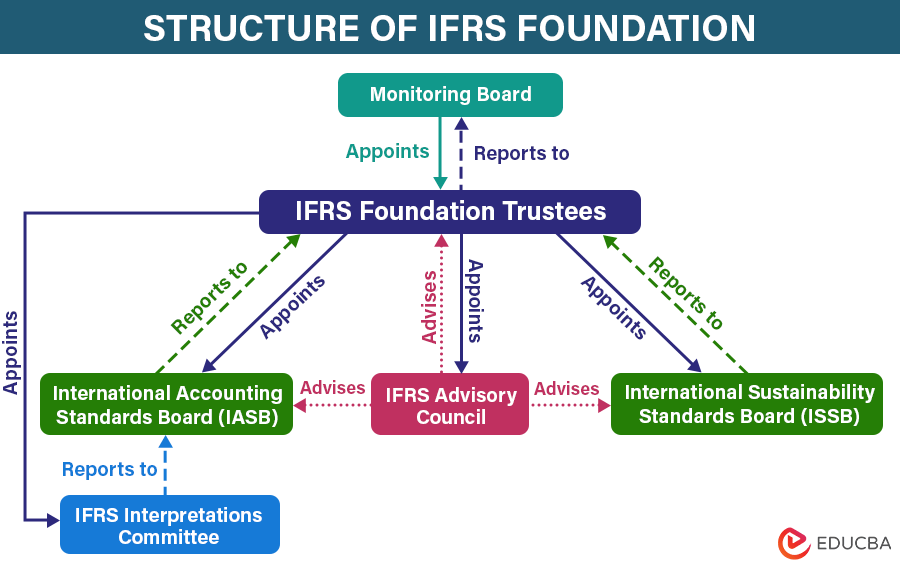

Structure of IFRS Foundation

The IFRS Foundation creates and maintains financial reporting rules. It is a well-structured governance system. It comprises several bodies working together, as seen in the image below.

Let’s take a look at each of these bodies in detail.

#1: Monitoring Body

- The Monitoring Body is an important part of the foundation. It ensures that all companies using these rules follow them in the same way.

- It is the link between the trustees (IASC Foundation trustees) and public authorities.

- It approves trustee appointments and checks that financial reports are structured and written correctly.

- Takashi Nagaoka, Deputy Commissioner for International Affairs of JFSA, is the Chairperson of the Monitoring Body.

#2: IFRS Foundation Trustee

- The IFRS Foundation Trustee comprises 22 members and is led by Erkki Liikanen.

- They report to the Monitoring Board and ensure that the IFRS Foundation, IASB, and ISSB follow the rules.

- They also promote the use and application of these standards globally and have fundraising responsibilities.

#3: International Accounting Standards Board (IASB)

- The IASB is a group of 14 independent members who create and publish accounting regulations for businesses.

- The IFRS Foundation Trustees appoint the members of the IASB.

- Additionally, the IASB approves interpretations that the IFRS Interpretations Committee develops.

#4: International Sustainability Standards Board (ISSB)

- The International Sustainability Standards Board (ISSB) is a board developed by an IFRS Foundation trustee.

- It comprises 14 members and focuses on developing global sustainability reporting standards.

- It aims to establish guidelines for companies to report their financial data to support investors’ decision-making and improve comparability to attract international capital.

#5: IFRS Interpretations Committee

- The IFRS Interpretations Committee comprises 14 members appointed by the IFRS Foundation Trustees.

- It works as an interpretative body of the IASB and helps them maintain the IFRS Accounting Standards.

- This committee also provides and resolves accounting issues of the current IFRS Standards and gives technical guidance to IASB on these issues.

#6: IFRS Advisory Council

- The IFRS Advisory Council comprises 51 organizations, including 56 members from across the world.

- It is a formal advisory body that provides strategic advice to the IFRS Foundation, IASB, and ISSB.

- It advises on deciding various agendas and setting standard projects.

There are also other advisory groups and consultative bodies.

Final Thoughts

International Financial Reporting Standards aims to promote transparency and accuracy in financial reporting across companies and industries globally. It helps businesses compete worldwide, and investors make informed decisions by promoting clarity and consistency.

Frequently Asked Questions (FAQs)

Q1. What are the five elements of IFRS?

Answer: The following are the five elements of the International Financial Reporting Standards:

- Asset refers to any resource a company owns that will bring future benefits.

- Liability refers to debts or obligations a company owes that will require an outflow of money or any other resource.

- Equity represents what remains after subtracting liabilities from the company’s assets, i.e., ownership.

- Income is the income a company earns after subtracting its expenses from revenue.

- Expenses refer to the cash outflow from the business’s funds to run its day-to-day activities.

Q2. To whom IFRS is applicable?

Answer: Public companies, entities, or businesses listed on stock exchanges or part of the public interest or sector can implement International Financial Reporting Standards. The entities include banks, mutual funds, insurance companies, financial institutions, subsidiaries of the parent company, and more.

Q3. What are the challenges in IFRS?

Answer: The following are some challenges when implementing the international financial reporting standard system.

- It can cause complexity in interpreting standards when dealing with evolving business models or adopting unique transaction structures.

- Maintaining consistent standards across various jurisdictions and industries becomes challenging due to different local practices.

- Staying updated with the revisions of these standards requires continuous organizational training and adaptation to ensure compliance.

Recommended Articles

We hope this article on “What is IFRS” was helpful to you. To learn more, refer to the following related articles.