Private Equity Meaning

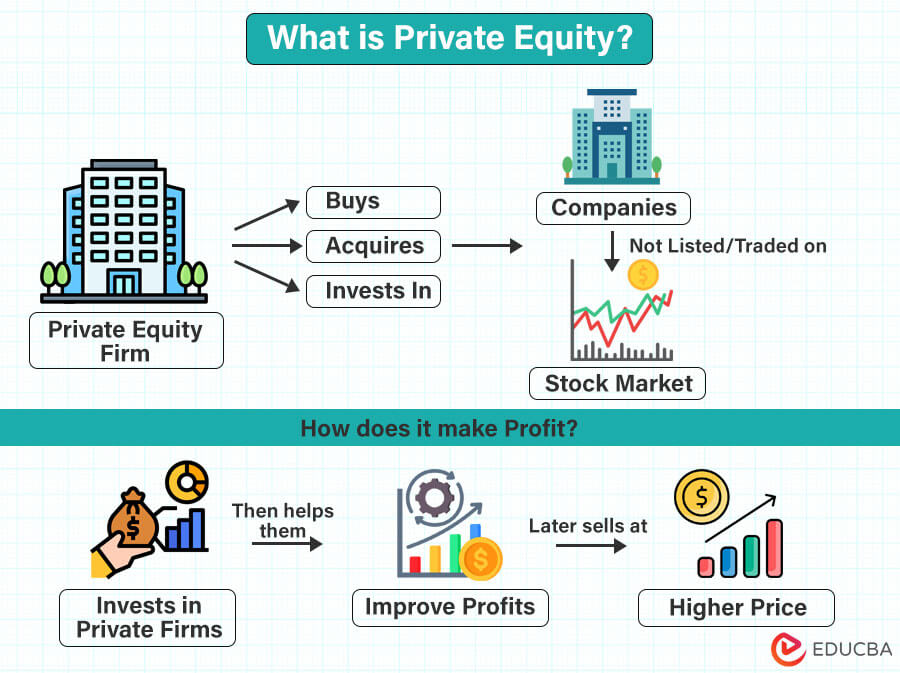

Private equity is an investment strategy where a firm buys, acquires, or directly invests in companies or securities that are private, i.e., not listed or traded on the public stock market.

The company that makes investments in private companies is called a private equity firm. Essentially, private equity purchases a portion of privately owned companies based on their value and eventually sells them for a higher price than their initial investment. Additionally, the firm offers financial and strategic support to help the company grow. Though these investments are risky and may take a long time to make a profit, they can provide greater rewards than other investments.

Table of Contents

How Does Private Equity Work?

This is the simplest way private equity works.

- Raising Funds: Private equity firms usually raise capital for investments from limited partners, including banks, wealthy individuals, institutions, insurance companies, etc.

- Choosing Target Companies: After successfully raising desired funds, the firm searches for companies that show growth potential and offer a favorable return on investment.

- Investing: After selecting a company, the firm negotiates the investment terms and exit strategy and acquires ownership of the company.

- Improving Performance: The firm then helps the company increase its value by implementing new strategies, expanding markets, cutting costs, etc.

- Exit Strategy: After some time, the firm sells its part of the company either through IPO (Initial Public Offering) or to another company.

- Sharing Profits: The firm then shares the profits among all the investors while holding a significant percentage of the total earnings for themselves.

Types of Private Equity (with Examples)

There are three major types of private equity: Equity strategy, credit strategy, and asset strategy, which have subdivisions, such as venture capital, LBO, REPE, etc.

#1 Equity Strategy

-

Venture Capital (VC)

Venture capital is an equity investment that invests in small, early-stage start-ups and new businesses that have promising growth potential. In exchange for their investment, investors get a minority share in the company.

Example: In 2005, when Facebook was a small social networking site, Accel Partners invested $12.7 million, helping them grow into a big, successful company.

-

Growth Equity

In growth equity, equity firms invest capital in growing companies that are already established or mature. The companies use the money to expand, enter new markets, buy new companies, restructure their operations, etc.

Example: In 2013, Uber received $258 million from TPG Capital and Google to expand internationally. Google provided access to Google Maps, and TPG Capital supported their global expansion.

-

Leveraged Buyouts (LBO)

In a leveraged buyout, an equity firm uses the investor’s fund and debt (borrowed money) to purchase a major stake in a company. The equity firm then uses the target company’s operational income to pay the loan interest. In short, equity firms invest in companies to make them more profitable, so they can generate more revenue to repay the loans.

Example: A leading example is when private equity companies KKR, Bain & Company, and Merrill Lynch purchased Hospital Corporation in 2006.

#2 Credit Strategy

-

Distressed Debt

Distressed debt involves investing in companies facing financial difficulties. It is also known as turnaround investing, distressed investing, distressed debt investment, and vulture capital. The equity firm helps improve a company’s financial situation by managing its debt, making efficient business strategies, selling assets, and various other ways.

Example: During the financial crisis of 2008, Lone Star Funds got a distressed debt private equity deal from the Federal Deposit Insurance Corporation (FDIC) to recover the debts and generate profitable returns.

-

Mezzanine Debt

Mezzanine debt is when the firm takes a loan without providing any collateral. So, if the borrower is unable to repay the loan and the loan defaults, the lender has the option to convert the debt into equity. That is, the lender can become a part owner of the borrower’s firm. Companies take mezzanine capital (loans) from investors during the financial crisis.

Example: In 2005, Apple Inc. took over Beats, a well-known audio equipment company. Apple took mezzanine debt from a private equity firm, Carlyle Group, to facilitate the transaction.

#3 Asset Strategy

-

Real Estate Private Equity

The Real Estate Private Equity (REPE) firm raises capital from limited partners for investing in real estate assets, such as residential or commercial buildings. The main motive is to develop, acquire ownership of buildings and sell it at a higher price to make a profit. Real estate private equity firms are well-versed in property management, construction, and development.

Example: In 2007, Blackstone Group invested $26 million in Hilton Hotels to increase its global recognition and profitability. Today, there are more than 584 Hilton hotels across six continents.

Private Equity Process

Here is the detailed process of how private equity deals take place.

#1: Sourcing: First and foremost, the private equity firm looks for potential investment opportunities and gathers fundamental information about them. They look for private companies based on their potential for growth, location, financial position, etc.

#2: Creating a Teaser: The equity firm then creates a document called a teaser that contains all the information about the target company without disclosing sensitive details.

#3: NDA Signing: After finalizing a target firm for investment, both the equity and the target firm sign a Non-Disclosure Agreement (NDA) to protect confidential information during due diligence.

#4: Initial Due Diligence: Here, the firm conducts a thorough analysis of the target company’s financials, operations, and other key aspects.

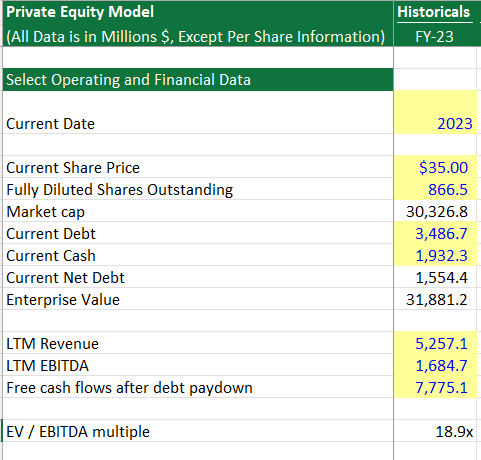

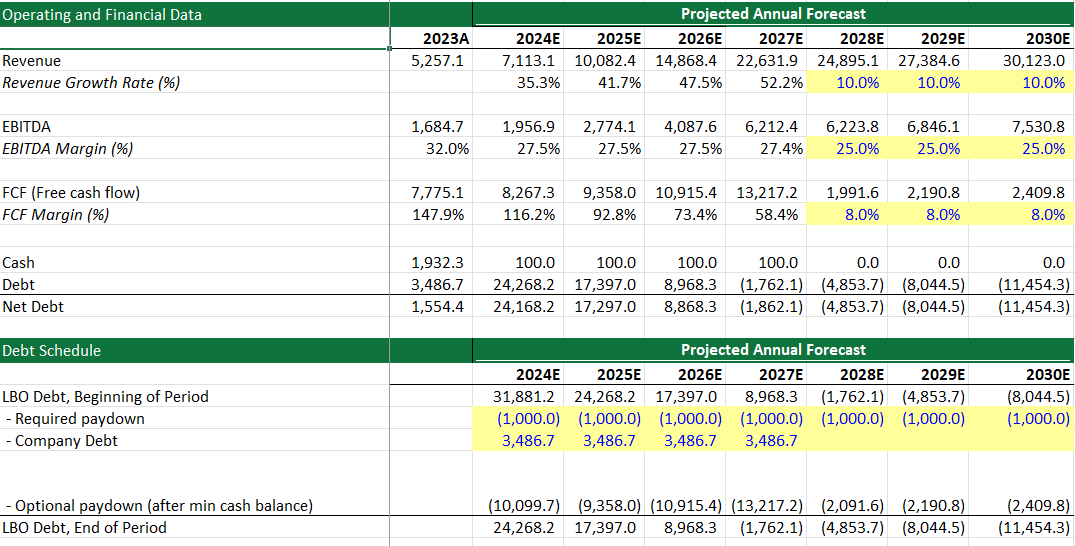

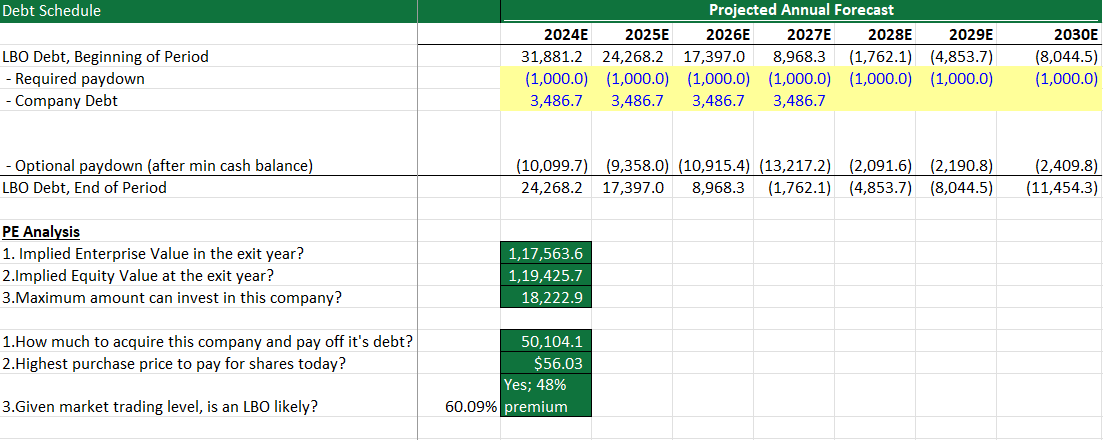

#5: Valuation & Financial Analysis: After conducting initial due diligence, the firm evaluates the value of the target company by creating a PE model. They also use projected financial data and schedules to find enterprise and equity value after exit, etc.

Given below are a few screenshots from our comprehensive course on private equity. Moreover, if you want to learn to build these financial models, you can also check our course on financial modeling.

- EV/EBITDA Multiple Calculations

- Financial Projections

- Debt Schedule & Analysis

#6: Deal Structuring: After performing the valuation, the firm decides the terms of the deal, including equity ownership, controlling rights, and other important aspects.

#7: Financing: After creating a deal structure, the equity firm starts obtaining the needed funds for the investment. The money can come from the private equity firm’s fund as well as external debt or equity sources.

#8: Proposal: The investing firm finally creates a formal proposal, including valuation, deal structure, and financing, and sends it to the target company.

#9: First Bidding Round: If many parties are interested in the target firm, there is a first bidding round, where all parties submit their initial offers.

#10: Final Due Diligence: Once the target company accepts an offer, the firm conducts more thorough due diligence to validate the information obtained earlier.

#11: Final Bidding Round: If there are still multiple offers, a final bidding round may occur where interested parties submit their best and final offers.

#12: Negotiations: The equity firm and the target company now discuss terms and conditions to ensure a mutually beneficial deal.

#13: Signing the Deal: Once the target firm accepts the final offer, both the private equity firm and the target firm sign the legal agreement.

#14: Post-Deal: After closing the deal, the equity firm helps the target firm generate value by implementing strategies to achieve targets.

#15: Exit: Finally, when the private equity firm thinks that the investment has reached its desired level of profits, they use exit strategies, such as:

- Initial Public Offering (IPO): Taking the portfolio company public through an IPO.

- Strategic Sale: Selling the portfolio company to another company (trade sale).

- Secondary Sale: Selling the investment to another private equity firm.

- Recapitalization: Restructuring the company’s capital to generate returns for investors while retaining ownership.

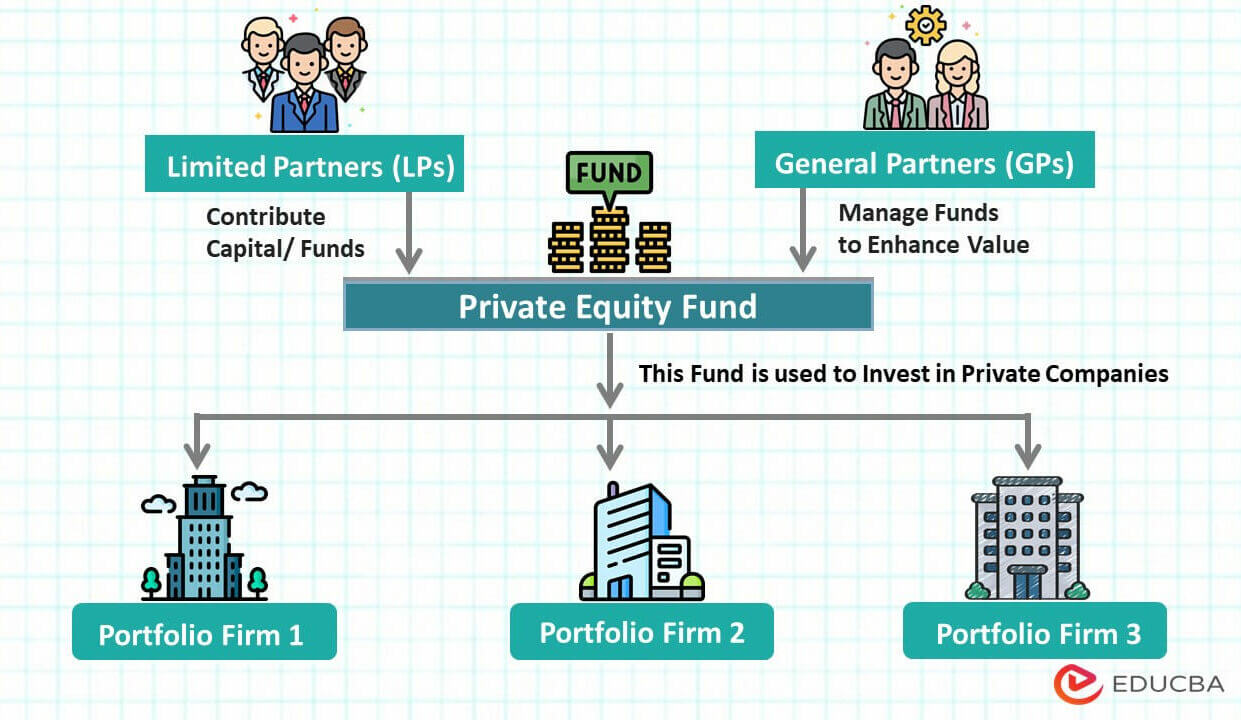

Fund Structure

The private equity fund structure tells us about the organization of the funds as well as how it works. It includes information about the types of investors, their contributions, investment lifecycle, management strategies, exit processes, and profit distribution methodologies. We have explained each aspect below in detail.

Participants: Private equity funds consist of primarily two participants: general partners (GPs) and limited partners (LPs).

Contributions:

- The general partners manage the fund, choose where to invest, handle management, sales, and profit distribution

- Limited partners are the investors who agree to invest a certain amount over time (usually a few years) and provide capital to the fund

- Moreover, the GPs can only use the capital if needed for an investment.

Lifecycle:

- Over the years, the GPs invest the capital in various portfolio companies. They evaluate and execute investments in various companies according to the fund’s strategy

- After investing, they work actively with management teams to enhance operational performance, implement growth strategies, and improve the companies’ overall value.

Exit & Profits:

- The GP chooses to exit the investment when they think that the investment has reached its maximum potential

- After converting the investment into cash, all earned profits go to the LPs. However, LPs and GPs can share the returns based on previously agreed-upon terms

- As the LPs receive all the profits, GPs usually earn by charging a management fee (typically 1-2% of committed capital).

Deal Structure

A private equity deal includes details about the financial and ownership arrangement. It tells you about the purchase price, the portion of company ownership offered, and the control the investor gets. These deal structures can vary based on the goals of the equity firm, the target company, and the market conditions.

Here are some common private equity deal structures:

Control Buyout

It is when the equity firm receives a majority or controlling stake in the target company. Mostly, the equity firms delist the company from the public stock market after acquiring it. It allows the firm to control the target company’s strategic decisions, management, and operations.

Minority Investment

It is when the equity firm gets only minimum ownership in the target company, and the existing shareholders retain a significant portion of ownership. Thus, the equity firm’s involvement is limited. This structure is often useful when the company’s management wants funds and guidance without losing complete control.

Co-Investment

It is when the equity firms invite their limited partners to invest directly in the target firm. This way, the investors can participate in specific investment opportunities directly.

Secondary Buyouts

It is when an equity firm buys a company from another private equity firm. Usually, it happens because the first firm thinks they have made the company as valuable as possible and wants to get their profits.

Top Private Equity Firms

The following is a list of the top private equity firms:

- Blackstone Group Inc.

- KKR & Co.

- The Carlyle Group

- Bain Capital

- TPG Capital

- General Atlantic

- Vista Equity Partners

- Thoma Bravo

- EQT

- HarbourVest Partners

How to Invest in Private Equity?

While investors like institutional investors and high-net-worth individuals can directly invest in private equity, non-accredited investors or less wealthy individuals can use indirect investing methods such as:

1. Funds of Funds

When companies invest in funds of funds, they are actually investing in a collection of investment funds instead of directly in a group of private companies. It is also known as a multi-manager investment. Some examples are mutual and hedge funds.

2. Exchange-Traded Funds (ETFs)

ETFs hold different types of assets, like stocks, bonds, etc., together as a single security. The investors gain profit by receiving interest on the fund investment.

3. Crowdfunding

Crowdfunding is a process of generating funds/ money from investors. Investors receive a proportionate share in the business in exchange for the contributions.

4. Special Purpose Acquisition Companies (SPACs)

SPACs are shell companies formed by investors that raise money through an initial public offering (IPO) process to acquire another company. The money raised is placed in trust, and investors distribute the interest received.

Frequently Asked Questions (FAQs)

Q1. How to start a private equity firm?

Answer: Below are the steps for starting a private equity firm:

- Do market research and define your investment strategy.

- Create a solid business plan that outlines business goals and operational details.

- Set up the necessary infrastructure and create a suitable legal structure.

- Pitch your investment ideas to potential investors and try to raise capital.

- Follow all the rules and regulations and seek legal advice when needed.

Q2. Who invests in private equity?

Answer: Investors in private equity are mostly institutional investors, such as insurance companies, university endowments, trusts, pension funds, and high-income and net-worth individuals. All the investors should meet the Securities and Exchange Commission’s ( SEC) accredited investor criteria.

Q3. What is the difference between private and public equity?

Answer: The five major differences between private and public equity are,

| Private Equity | Public Equity |

| It involves investing in privately owned companies. | It involves investing in publicly owned companies. |

| Private equity is accessible to high-net-worth individuals. | Public Equity is available to everyone. |

| Converting these investments to cash can be a long princess and challenging. | We can easily convert these investments into cash. |

| These have lesser regulations. | It has higher trade regulations due to higher trade volume. |

Recommended Articles

We have created a great article to help you understand what is private equity. If you want to dive deeper into equity investing, here are a few articles you should read.