Securitization Meaning

The securitization process is a process where banks mix different assets like loans or mortgages together to create special packages of marketable securities. They sell these packages to investors, which helps banks increase their profits and lower their risks.

Basically, banks and other financial institutions own many high-risk assets like loans and mortgages. To avoid the risks of holding these assets for a long period, banks use securitization to group all the risky assets together and sell them as securities in the market. It is very beneficial to the banks because it removes risky assets from the books of accounts and helps them raise funds for growth.

Let’s understand this further with a very simple example. Imagine you baked some cookies, and you want to sell them. Instead of selling them individually, which would take a lot of effort and time, you put them in boxes to sell them more easily. This way, you can sell many cookies at once and make more money to bake even more cookies.

In the financial world, securitization is a similar idea. As you put cookies in boxes before selling them, securitization combines different assets, like loans or mortgages, and turns them into packages before selling them. It makes it easier for banks or companies to sell many assets at once and make more money.

While packing cookies in boxes and selling them is easy, the process of securitization involves various other factors. Let’s see how it works.

Securitization Process

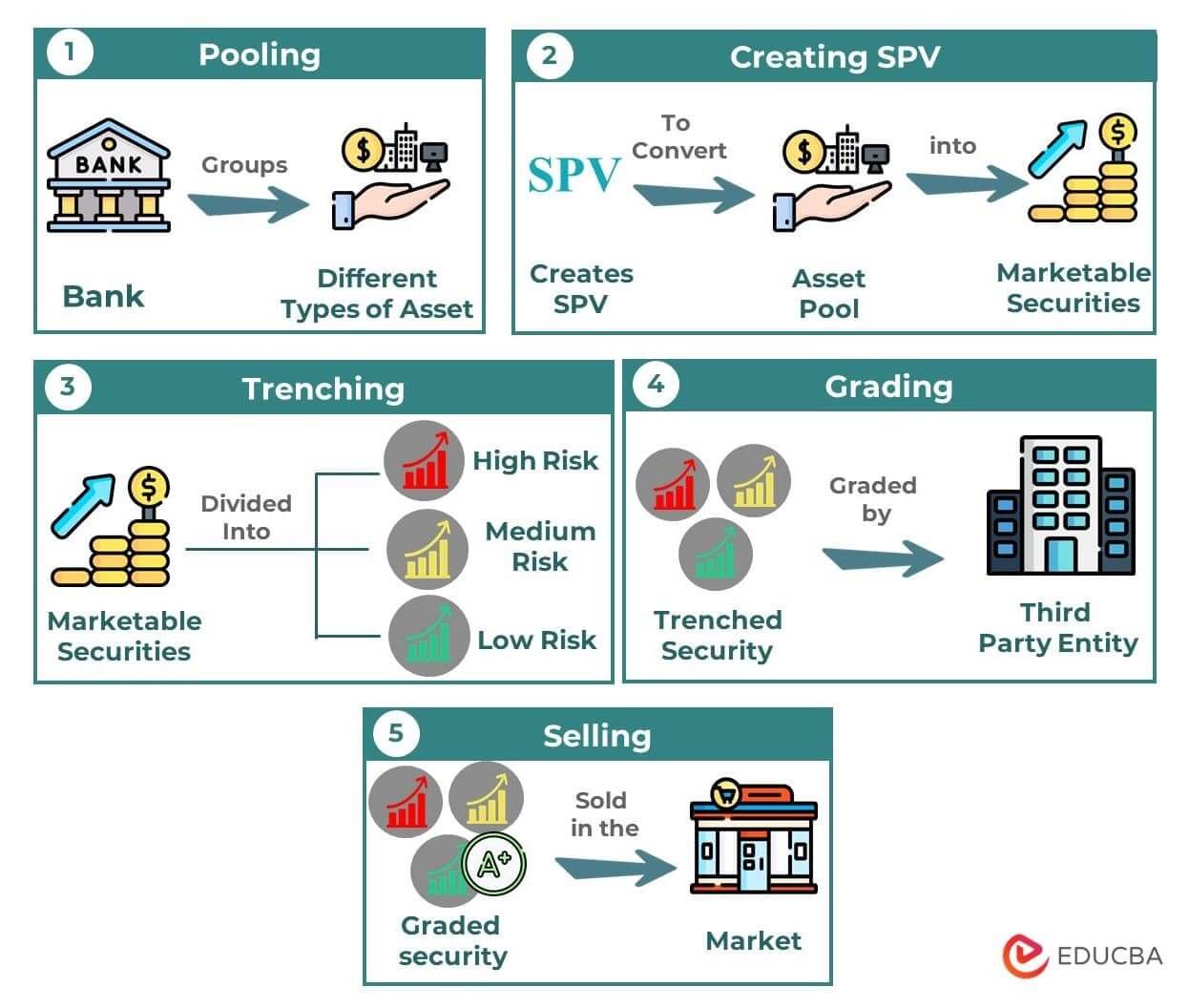

Securitization of assets involves five steps. As it can be confusing for first-time learners to understand securitization, let’s break down each step.

Step 1: Pooling of Assets

To start the securitization process, banks group together different types of assets based on their risk-reward ratio and monetary value.

Step 2: Creation of SPV

After pooling all the assets together, banks create a special purpose vehicle (SPV) to keep themselves safe when selling assets. An SPV is like a separate entity that holds and manages assets independently, which allows the bank to lower its risk of losing money. The SPV also helps with legal troubles and claims. Moreover, selling the assets becomes easier as they become more attractive to buyers.

Step 3: Tranching of Securities

After converting the assets into securities, banks divide the securities into three parts based on risk levels: senior(Low risk), Mezzanine (Medium risk), and Equity(High risk).

Step 4: Grading by a 3rd Party

After tranching, banks send the packaged securities to a third-party firm that grades them from the scale of A, AA, and AAA to CCC. They are graded based on factors like credibility, historical performance, and internal and external aspects of the bank. Here, A means the best and the most secure, and CCC is the riskiest.

Step 5: Sale and Managing of the Security

Once the third party grades the security, the SPV sells it in the market to interested investors.

When investors purchase the securities, they receive returns on the investment from the bank. The bank gives the investors a portion of the monthly payments that the mortgage owners make.

Securitization Types

Below are four types of securitization depending on the underlying asset used in them.

1. Mortgage-Backed Securities (MBS): People who borrow from banks repay them monthly until they pay off their debts. Usually, these mortgages are very risky for the banks. So, some banks make a group of securities for these mortgages and sell them to investors. In this way, the banks and investors share the risk. In return, the investors get a percentage of the monthly payment.

For example, Bank ABC groups five mortgages into marketable securities and sell them to 9 investors. When the five mortgage holders make the monthly payment, it divides them into ten parts (9 investors + 1 Bank).

2. Commercial Mortgage-Backed Securities (CMBS): Like home loans, banks also give loans for commercial properties. These loans are more risky than residential mortgages. So banks securitize these mortgages and convert them into marketable securities called commercial mortgage-backed securities.

3. Asset-Backed Securities (ABS): Asset-backed securities are very similar to mortgage-backed securities. While the MBS package only has mortgages (home loans), the ABS package also has other kinds of loans. Different kinds of loans that the bank can include in the ABS package are car loans and personal loans.

4. Collateralized Debt Obligations (CDO): CDO is a bundle of debt that firms sell to investors. It’s like if your friends owe you money, you can group together all that money and sell it as a package. The package has divisions (tranches) based on their risk levels. Investors can choose which parts they want based on how much risk they’re willing to take. Some investors prefer riskier tranches with higher returns, while others want safer ones with lower risk. CDOs are a way for investors to earn money from the interest that the debtors pay on the debts.

5. Future Flow Securitization: Businesses can use their future income sources (cash they certainly have incoming in the future) to raise funds. It is like a startup where the investors invest in companies trusting in their future income cash flow. However, there are risks like the customer not paying credits on time.

Securitization Examples

Example 1: Mortgage-backed Securities

Consider a bank named “Kshlerin Inc” based in the city of New York. The bank issues 100 home loans every month. The bank plans to securitize these loans to reduce the risk factor. Thus, the bank uses the securitization process to group all the loans and converts them into securities. After this, they sell the marketable securities to the investors and reduce their risks.

Example 2: Asset-backed Securities

Jerde-Dare Bank provides various kinds of loans, such as car, education, home, and personal loans, to the people of Washington, D.C. Compared to mortgages, these loans are riskier. Thus, to reduce the risks from their books, the bank securitizes these loans. They pool these loans together, convert them into marketable securities, and sell them in the market to generate capital.

Example 3: Future Flow Securitization

Mills Oil Refineries Ltd. sells refined oil to petrol pump companies. They recently came across a new oil reserve, but they need funds to buy the machinery for drilling. To generate quick money, they decide to securitize their future cash flow, i.e., future income sources. As per the company, they will sell 250 barrels of oil in the next year and earn $1 billion. Now, the company can convert this future income into marketable security and sell it for quick cash to buy the machinery.

Features of Securitization

1. Marketability: The entire purpose of securitization is marketability. It converts financial assets into marketable securities. Because of this, the shares are easily sold in the market, creating liquidity in the books of accounts.

2. Quality of Security: Securitization adds extra protection to the securities by dividing them into the level of risks (high, medium, low) and grading them as per their creditworthiness. It makes them more appealing to investors because they have additional safety.

3. Wide Distribution: Every investor has a different risk tolerance and thus requires different kinds of securities to invest in. Thus, the securitization process helps create special packages with different risk levels so that every investor can purchase as per their capacity.

4. Cash Flow Generation: Marketable securities are basically a group of assets like loans and mortgages. These assets generate monthly revenue for the banks, for example, receiving a monthly interest payment on a loan. Banks give investors a part of this revenue as a return on their investments. Therefore, this generates cash inflow for the originator (banks or financial institutions) and the investors.

5. Commoditization: Commoditization is one of the key features of securitization. It means converting difficult-to-sell, different products into similar groups of products. It makes these assets more similar and uniform so people can buy, sell, and compare them in a market. A significant example of this is loans. A bank cannot sell a loan without securitization. Loans need to be commoditized before it makes its way to the market.

Securitization Vs. Factoring

| Particulars | Securitization | Factoring |

| Definition | It is where banks create SPV to convert a group of assets into marketable securities. | It is where banks convert accounts receivables into marketable securities. |

| Assets involved | It includes all loans, mortgages, and credit receivables. | It includes only one asset – accounts receivables. |

| Funding | The cash comes from selling securities in the financial market. | The cash comes from the investors who buy the accounts receivables. |

| Control | The bank or institution still has control over the securities along with the investors. | The total goes to the investors. The initial owner company has no control left. |

| Usage | Widely used in mortgage-backed securities, auto loans, etc. | Commonly utilized by businesses to manage cash flow. |

| Example | A bank called “Moneytime” has a few home and auto loans, which they decided to securitize. They create special securities packages and sell them to investors in the financial market. This process will help the bank get cash from the investors and reduce risk because they turned their loans into securities. | ABC Manufacturing sells products to customers and allows them to pay later. Sometimes, when it needs quick cash for emergencies, they use factoring. They sell their accounts receivables (the money customers owe them) to a bank, and the bank gives them the cash right away. The bank then collects the money later from the customers. |

Benefits and Drawbacks of Securitization

| Advantages | Disadvantages |

| Diversification: Securitization allows the grouping of various kinds of assets. It decreases the overall risk and bifurcates it amongst the investors. |

Complexity: Without detailed knowledge, securitization is difficult for the common public to understand. |

| Liquidity: As a securitized asset is tradeable in the secondary market, the liquidity of marketable securities increases. |

Intermediaries: There are a lot of parties between the bank and the investors, like the SPV and grading agency. It increases the cost and decreases the profit. |

| Increase of Capital: Selling securitized assets increases the banks’ capital flow and facilitates development. |

Lack of Transparency: Due to its nature, only a few people know all the details of the securitized assets. It decreases the credibility of the investment. |

| Risk Management: When the originator sells the marketable securities in the market, the risk of their underlying asset bifurcates among the investors. |

Adverse Selection and Moral Hazard Due to human selection, some assets pooled together are deliberately or accidentally unsuitable for securitization. It is considered malpractice. |

| Lower Borrowing Cost: Generating revenue via securitization is cheaper than most other methods for the bank. |

Regulatory and Legal Risk: Regulatory bodies like SEC and SEBI set certain rules that banks should follow in securitization. Banks may have to pay penalties if they fail to follow these rules. |

Final Thoughts

The securitization process is complex and difficult to understand, but it is a very effective way for banks, financial institutions, and companies to generate funds. It also helps in reducing risk quantity in the books of accounts. Because of its nature, it is a win-win situation for both the banks and the investor. It has drawbacks, but the securitization process is a good way to pick up funds from the market at a low-interest rate.

Frequently Asked Questions (FAQs)

Q1. What is the difference between securitization and bond?

Answer: There is no major difference between securitization and bonds. The only difference is that in securitization, the investors who buy the security split the risk of the assets (loans) with the bank. Whereas in bonds, even after an investor purchases the security, the entire risk falls on the originator (bank or company) only. Bonds use a fixed rate system to calculate interest, whereas securitized assets use a floating rate system. Bonds are generally long-term, while securitized assets like mortgage bonds are for a shorter period.

Q2. What is the origin of securitization?

Answer: The origin of securitization dates back to the early part of the 1970s. The Government National Mortgage Association (Ginnie Mae) started pooling mortgage loans and issuing securities. This way, investors would invest in diverse mortgage pools instead of individual loans. Over time, securitization expanded to include other types of assets like credit card receivables, auto loans, and student loans.

Q3. What is the securitization of NPA?

Answer: A Non-performing asset or NPA is an asset that is no longer beneficial for the holder. For example, these are loans where the borrower cannot repay the loan amount within 90 days. Basically, a loan that has been overdue for more than ninety days is a Non-performing asset.

Securitization of an NPA is an old concept, as many banks have been doing it for years. However, if an NPA is in the books for more than 36 months (3 years), it doesn’t make sense to securitize them. Instead, banks can use the insolvency and bankruptcy codes to remove them from the account.

Recommended Articles

We have created a guide on what securitization is and how it works, along with its types and examples. Here are some of EDUCBA’s finance-based articles that you might find useful.