What is Technical Analysis

Technical Analysis is a method of analyzing securities such as stock, commodities, etc. in order to forecast the direction of pricing by studying past data such as the price and volume. It focuses on how stick prices are moving and how powerful these moves are. Technical analysis is based solely on the data generated by the market and by the actions of people in the market. Data are never revised later. Analysts do not make any guesses on the value of the data. It is based on the premise that people will act in similar ways when faced with similar conditions.

But to be more pragmatic, it is a tool used to make investment decisions. It helps assess risk and reward. And it can assist investors in allocating their resources among stocks, sectors, and asset classes.

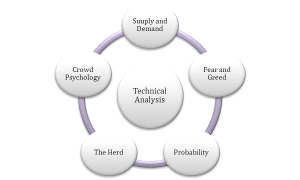

The above picture depicts the factors upon which Technical Analysis is dependent upon.

What Technical Analysis is not?

Technical analysis is not predicting the future of an endorsement or criticism of any company. There is an element of prediction and judgment as it attempts to find the probability of future action of a company’s stock but not the company itself that is under scrutiny.

Also, this analysis does not give an absolute prediction about the price movement but helps the investors and traders anticipate what could likely happen and accordingly take an investment decision.

What is a chart?

Technical analysis has been a bit of a mistake as it’s not that technical. Though there are complex mathematical tied to it but at its core, it is the method of determining if a stock or market as a whole is going up or going down. What we need to do in order to identify these trends is simply looking at a chart. Now let’s understand charts and how they help in Technical Analysis.

A chart is a tool both investors and traders use to help them determine whether to buy or sell the stock-bond commodity or currency. As mentioned bar charts summarize all the trading for any given time period such as a day or a week when all those summaries are plotted together trends emerge and patterns form – all revealing where a stock is right now and how it got there. After all, knowing a stock is trading at a price of 50 is not of much help but knowing it was at 45 last month and 40 the month before gives us a good idea that it has been a bullish trend.

Charts are where perception meets reality. For instance, a stock may look cheap according to an analyst’s calculations based on projected future earnings, but if there were no demand for the stock it is simply not going to go up.

Some analysts look at a chart and simply draw an arrow on the actual data plot if the arrow is pointing up they know the trend is up and vice versa.

On the charts, we look at what is happening right now and how it came to be. From there we make an educated guess about the future, but the goal is not to predict where prices will be in a year. The real goal is to determine what we do about it right now. If we decide to buy based on a chart, we will already know what has to happen to prove us wrong and that helps us limit losses.

Understanding Each Part Of Chart

- Price

Price action tells us what the supply and demand equilibrium is at any given point in time..

- Volume

Volume is very useful In determining whether a stock is cooling back in correction or changing direction. And another important use is is in the identification of both the final panic and initial surges as investor moods change from one extreme to another.

- Momentum

Momentum indicators quantify what the naked eye can tell us about the price action. Momentum In the market causes trends to stay in effect until halted by outside factors.

- Structure

The way price action is used on charts in twofold; either the stock in question is moving or is not. The former creates a trend either higher or lower the latter creates resting zones and further shapes of these resting zones give us clues as to when the next trend will be up or down. It is the structure of these ups downs and flats that is analyzed.

- Sentiment

The sentiment is the summation of all market expectations. It ranges from fear and hopelessness to indifference to greed and complacency. At the bottom of a bear market, the expectations of the participants are almost unanimous for a lower prices and more financial losses.

What are the support and resistance?

Support

At some price level, a falling stock price will stabilize. Enough investors will perceive it to be good value and demand shares; while others will perceive the price to be too low for them to want to sell any more of their holdings.

Resistance

If a stock is trending higher it will eventually encounter price levels at which it finds resistance to its advance. Resistance is also another name for support because at those levels investors collectively decide that value has been reached and they sell their shares.

Why use Technical Analysis?

The next logical question that comes to one’s mind is what does technical analysis do? The answer to this is that it has the ability to recognize when a stock has reached support or resistance level or a shift in perception takes place can help investors take investment decisions i.e. to use:

- Buy low, sell high approach or

- Buy high, sell higher approach, or

- Whether to buy the stock or not

The ability to apply these aspects of the chart will reveal the market to investors when it is safe to buy a stock or not. Technical analysis is the only investment decision discipline that tells you when you are wrong to minimize losses.

Practice effective risk analysis and management. Practice effective risk analysis and management. Design and deliver creative solutions to your clients’ investment needs.

Goals of Technical Analysis

- Seeing where the stock is currently trading and figuring out how it got there

This can be done by using charting tools such as the

- Stock trends

- Support levels

- Resistance levels

We also try to find out a pattern or a trend to help.

- Determining the power of a trend

This can be determined by looking at important technical concepts such as trading volume and momentum.

- Making comparisons of the stock to the market, peer companies, and itself

For this we look at the relative performances and moving averages (average prices over a defined period of time, usually 50-200 days)

Criteria for Investment using technical analysis tools

In looking for a stock, the following are the key technical analysis tools that should be met, not necessarily all bot most.

- Trends and trendlines

Trends can be classified in three ways: Up, Down or Range bound. In an uptrend, a stock rallies often with intermediate periods of consolidation or movement against the trend. In a downtrend, a stock declines often with intermediate periods of consolidation or movement against the trend. In range-bound, there is no apparent direction to the price movement on the stock chart and there will be little or no rate of price change.

These trends can be measured using trendlines. All we want is stocks that are in rising trends.

- Support and Resistance

This basically tells us what price levels are likely to bring put buyers or the sellers. Here we want to see that if the current price has either just moved through resistance or one that is far from the next resistance level.

- Moving Averages

They help in determining if the trend is turning, also it shows if the existing trend is progressing in an orderly manner or no. here we are looking at prices to be above-selected averages but not too far above them.

- Relative Performance

This divides the price of a stock by a relative market index or industry group. Here the theory is to find out if the ratio is going up the stock is outperforming the market and is thus a strong candidate for further gains and vice versa. Here we are looking for stocks whose relative performances are increasing.

- Volume

The number of shares traded and when (either when prices rise or when they fall). We basically analyze if buying is spreading to other investors and for urgency for all to buy when prices start to rise.

- Momentum

We want to know if the days when the stock rises outnumber those when it falls. If losing days are more and frequent then we can say the trend is weakening.

- Sentiment

It is to find out if everybody is thinking the same thing? Is it time to go the other way? Here we want to know what everyone is thinking about the same thing.

A career in Technical Analysis

Any person who enjoys working with numbers and is keen about statistics and capital markets may enjoy being a technical analyst.

Technical Analyst Job Description

Technical analysts study the trends and patterns of the stocks to make predictions about its future performance. They find out this sophisticated information to find out the best time and price at which to sell stocks. These professionals are often employed by finance and investment agencies, financial institutions, and brokerage houses.

Technical Analyst Pre-requisites

A bachelor’s degree in commerce major, like economics or finance, is required for a career in technical analysis. Some firms may require employees to have Master of Business Administration or master’s degrees in finance.

Skills

- Critical-thinking

- Analytical skills

- Communication skills

- Good in maths and statistics

- Experience working with computer spreadsheets

- Knowledge of computer software programs