Updated July 31, 2023

Difference Between Whole Life Insurance vs Term Life Insurance

In today’s world, where people are facing various health issues and illnesses due to environmental degradation and unhealthy lifestyles, obtaining medical insurance has become crucial. It is imperative to have life insurance or medical insurance of any amount and duration. When it comes to insurance, two prominent policies in the market are whole life insurance and term life insurance. This article aims to explore the significant distinctions between these two insurance products and shed light on their characteristics and provisions.

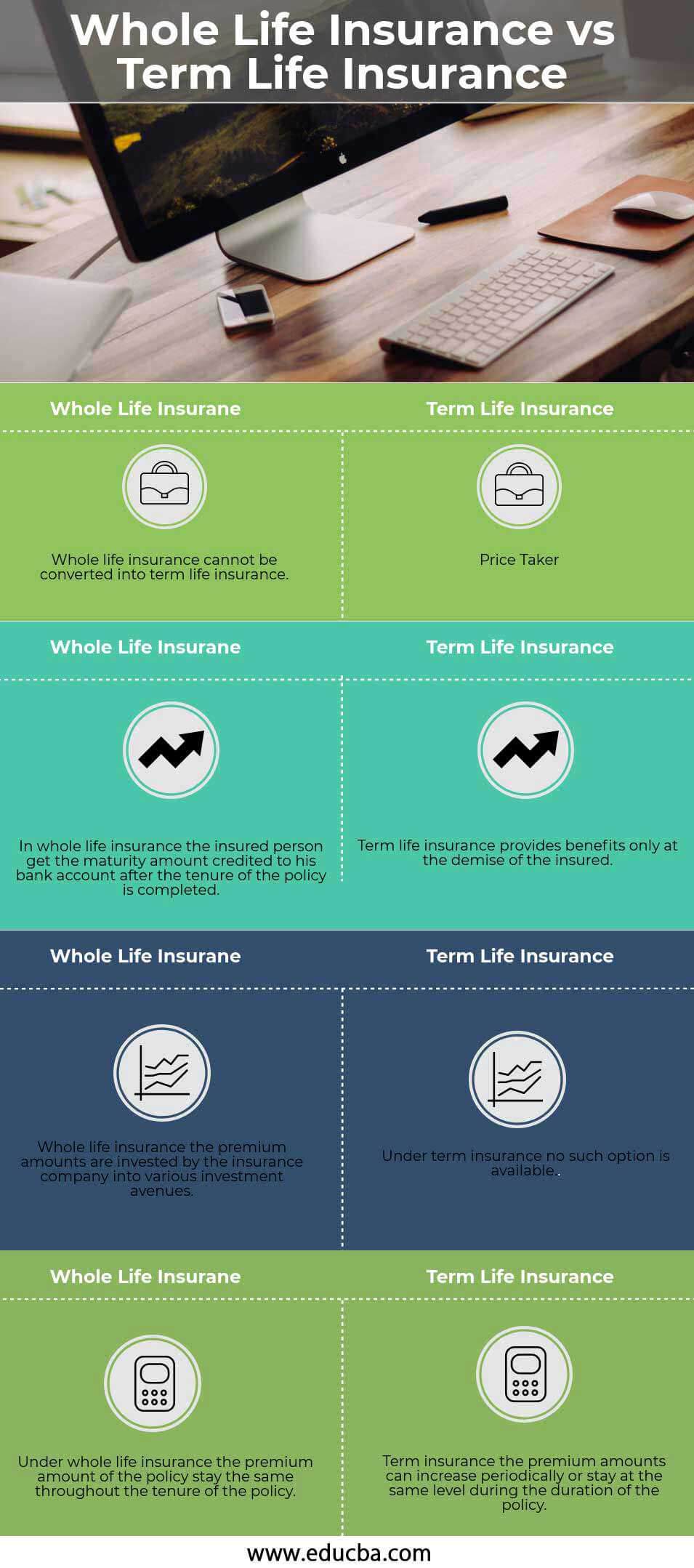

Whole Life Insurance vs Term Life Insurance (Infographics)

Below are the top 4 differences between Whole Life Insurance vs Term Life Insurance:

Key Differences Between Whole Life Insurance vs Term Life Insurance

Both life insurance are popular choices in the market:

- Term insurance is a form of insurance in which the policyholder pays premiums for a predetermined period and for a specified duration. Life insurance typically requires the insured to make payments throughout their lifetime, although there are instances where they pay premiums for a specific period of time.

- Term insurance typically does not provide any financial payouts from the insurance company unless the insured person passes away. Moreover, it offers limited options compared to whole life insurance since there is no provision for maturity or survival benefits. In contrast, whole life insurance policies allow the insured to borrow money from the insurance company at a lower interest rate, receive a lump sum amount as a survival benefit, or obtain maturity benefits.

- Term insurance plans typically have lower premiums compared to whole life insurance, which requires higher monthly payments. The insured’s age influences the premium amount for term insurance, with earlier subscriptions resulting in lower monthly premiums. On the other hand, whole life insurance entails higher premiums primarily due to the inclusion of ancillary benefits offered by the insurance company in addition to the insured amount and the policy selected.

- Whole life insurance involves the insured individual’s premiums being allocated to a protected fund and other investment options that are typically less risky. The fund declares and gives a bonus to the policyholder if it generates profits from these investments. However, term insurance lacks this aspect as it does not invest the premium amount.

Comparison Table of Whole Life Insurance vs Term Life Insurance

Below is the 4 topmost comparison between Whole Life Insurance and Term Life Insurance:

|

Whole Life Insurance |

Term Life Insurance |

| Whole life insurance cannot be converted into term life insurance. | Term life insurance can be converted into whole life insurance. |

| In whole life insurance, the insured person gets the maturity amount credited to his bank account after the tenure of the policy is completed. | Term life insurance provides benefits only at the demise of the insured. |

| Whole life insurance, the premium amounts are invested by the insurance company into various investment avenues. | Under term insurance, no such option is available. |

| Under whole life insurance, the premium amount of the policy stays the same throughout the tenure of the policy. | Term insurance, the premium amounts can increase periodically or stay at the same level during the duration of the policy. |

Conclusion

Choosing a life insurance policy depends on various factors, such as the insurer’s age, family size, and financial stability. For individuals aged 40 and above, a whole-life policy is often the most appropriate option. On the other hand, those in their younger years may find a term insurance policy more beneficial, as it can offer advantages in their later stages of life. It’s crucial not to postpone getting insured and not to wait until a tragic event occurs. Remember, obtaining insurance coverage and protecting your loved ones is never too late.

Recommended Articles

This is a guide to Whole Life Insurance vs Term Life Insurance. Here we discuss the key differences with infographics and a comparison table. You may also have a look at the following articles to learn more –