What is Workday Financial Management?

Workday Financial Management includes using Workday, an online software, to manage finances by using features like financial planning, analysis, and reporting.

Effective financial management is crucial for modern enterprises. It helps them ensure sustainable growth, regulatory compliance, and informed decision-making. Businesses can streamline operations, optimize resources, and enhance financial performance.

Key Features

1. Handling Quotations

Workday’s quotation handling feature allows firms to generate accurate quotes, automate processes to close deals faster and gain insights for better planning, forecasting, and staffing.

2. Managing Projects

It includes comprehensive tools for resource management, project costing, budgeting, and billing. It supports capital projects and provides detailed project analytics. These capabilities enable efficient planning, execution, and financial oversight, ensuring projects stay on budget.

3. Expense & Revenue Management

Workday’s expense and revenue management feature simplifies the entire process, making it intelligent and user-friendly. Employees can scan expense receipts in any currency from anywhere in the world, with Workday AI automatically populating details.

You can also submit expenses via email, phone, Slack, or Microsoft Teams. It also offers flexible billing models, detailed customer and contract tracking, and automated intercompany invoice processing, enhancing accuracy and reducing revenue leakage.

4. Automating General Ledger

Workday’s automation general ledger feature offers continuous accounting for real-time insights, allowing you to see the impact of transactions as they happen.

It transforms operational transactions into detailed accounting, consolidating data in real time for a faster closing. With multidimensional analysis, you can compare budgets versus actuals and blend financial and operational data.

5. Financial Analysis & Reporting

Workday’s financial reporting and analysis feature offers real-time insights and customizable dashboards to support informed decision-making. It integrates data from various sources to provide a comprehensive view of financial performance.

Users can create detailed reports, perform ad-hoc analysis, and access predictive analytics to forecast trends, enhancing strategic planning and operational efficiency.

6. Auditing

Workday’s audit feature ensures robust internal controls by providing real-time visibility and continuous monitoring of financial transactions. With automated workflows, detailed audit trails, and advanced analytics, it enhances compliance and reduces risk.

This powerful tool simplifies audits, supports regulatory requirements, and ensures the integrity of your financial data, making audit processes efficient and effective.

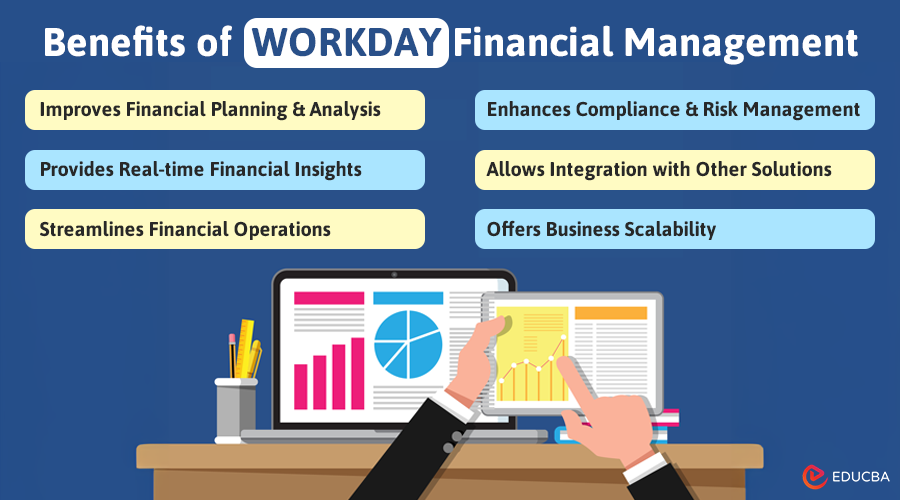

Benefits

1. Improves Financial Planning and Analysis

Workday enhances financial planning and analysis by providing accurate data and predictive analytics. It helps organizations develop effective budgets, forecasts, and strategic plans.

2. Provides Real-time Financial Insights

Workday delivers real-time visibility into financial data, allowing organizations to make informed decisions quickly. This capability helps in identifying trends, managing risks, and capitalizing on opportunities.

3. Streamlines Financial Operations

Workday streamlines financial processes through automation and integration, reducing manual efforts and errors. It leads to increased efficiency and productivity across financial operations.

4. Enhances Compliance and Risk Management

Workday ensures compliance with regulatory requirements and financial standards. Its risk management tools help identify and mitigate potential risks, safeguarding the organization’s financial health.

5. Allows Integration with Other Solutions

Workday supports integrations with third-party systems, enabling organizations to connect their financial management system with external applications like ERP, CRM, and banking systems. It also seamlessly integrates with other Workday solutions like Human Capital Management (HCM) and Payroll, providing a unified platform for managing business operations.

6. Offers Business Scalability

Workday helps businesses scale, accommodating increasing transaction volumes, expanding operations, and evolving financial needs. Its flexible architecture ensures long-term adaptability.

Implementation

Before implementing Workday financial management, organizations should assess their current financial processes, define their requirements, and set clear objectives.

Steps to Implement:

- Prepare pre-implementation checklists and requirements, which include setting realistic expectations, timelines, and budgets.

- Hold SOP meetings to analyze business processes, define Workday requirements, and build the foundational framework.

- Configure Workday modules, identify integration needs, review technology requirements, and outline customizations.

- Conduct Parallel Testing, Unit Testing, and End-to-End Testing to ensure functionality, accuracy, and system integration.

- Deploy the Workday system.

Best Practices:

- Engage stakeholders early and often.

- Use a phase-by-phase approach to manage complexity.

- Leverage Workday’s implementation tools and resources.

- Provide comprehensive training and support to users.

- Continuously monitor and optimize the system post-implementation.

Final Thoughts

Workday financial management represents the future of financial management with its innovative features, real-time insights, and scalability. As organizations continue to embrace digital transformation, Workday is well-positioned to support their evolving financial needs, ensuring sustainable growth and competitiveness.

Frequently Asked Questions (FAQs)

Q1. What are the modules of Workday financial management?

Answer: Workday core financials include modules such as:

- Accounting and Finance

- Close and Consolidate

- Revenue Management

- Accounting Center

- Expenses

- Grants Management

- Projects

- Services CPQ

Q2. What are Workday financial management certifications and training?

Answer: Workday provides financial management certifications and training through several programs.

- Workday Pro offers in-house expertise with a focus on competency and efficiency.

- Workday Success Plans give access to exclusive resources for deeper insights.

- Learn with Workday provides essential training for all skill levels, with flexible formats like virtual courses and workshops, allowing you to choose the level of support you need.

Q3. What is the cost of implementing Workday financial management?

Answer: The cost of implementing Workday financial management varies depending on factors like the organization’s size, number of users, required modules, and implementation complexity. For a precise quote, you should contact Workday or a certified partner directly.

Recommended Articles

If you found this article on Workday financial management helpful, check out these other finance blogs.