Updated July 29, 2023

Definition of Working Capital Ratio

The working capital ratio is also called a current ratio that focuses only on any company’s current assets and liabilities. It helps to analyze the financial health of any firm and if it could pay off current liabilities with current assets.

The current assets are the ones that can be quickly converted into cash which in turn can efficiently pay the debts in the shortest period. That is why current assets like cash, cash equivalents, and accounts receivables shall be pushed ahead efficiently to keep the cash flow healthy to achieve better WCR (Working Capital Ratio).

As the focus is mainly on current assets and current liabilities, firms shall importantly keep track of how the cash flow is moving on with time every month or quarterly, so they can take appropriate action to improve upon red-flagged areas of their finances.

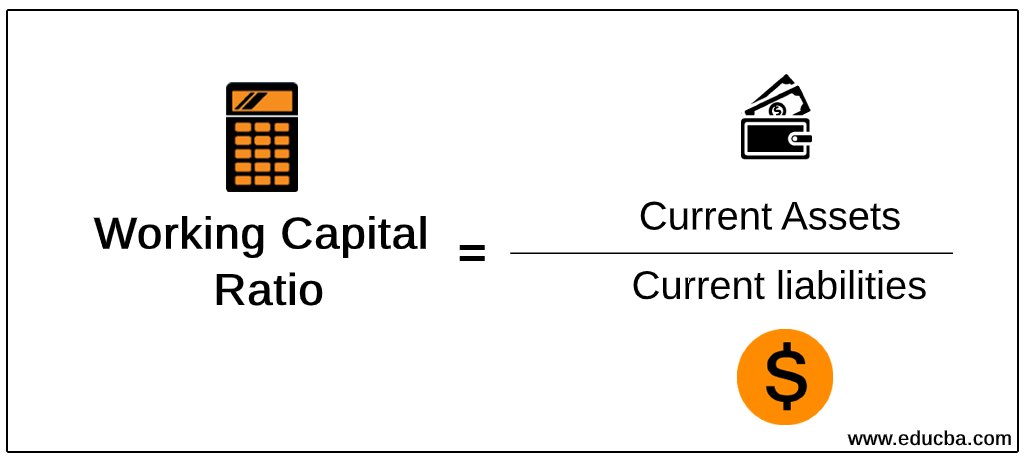

The Working capital ratio can be defined by comparing current assets and current liabilities, and the formula for the same is as below:

Current assets and liabilities take priority over long-term assets and liabilities. This way, investors and creditors get a hold of the financial status of any company.

Generally, if the Working Capital Ratio is 1, the company is not at risk and can survive once the liabilities are paid. Though it doesn’t conclude the company is doing great, it is just a neutral state. For a firm to maintain Working Capital Ratio higher than 1, they need to analyze the current assets and liabilities efficiently. A healthy ratio for WCR is between 1.2 – 2.0. Below this range, the company could go through a critical situation that might indicate to the firm that they need to work intensely on their short-term assets and grow them as soon as possible.

Example of Working Capital Ratio

Let’s take the example of an acquirer who is interested in the financials of ABC Sports and analyze the obtained information for the last three years:

| Year 1 | Year 2 | Year 3 | |

| Current assets | $4,000,000 | $7,500,000 | $10,050,000 |

| Current liabilities | $2,100,000 | $4,500,000 | $8,000,000 |

| Working capital ratio | 1.90 | 1.67 | 1.26 |

As we can figure out through the table above, the assets have been going way up each year, with which the liabilities also increased. However, in year 3, a big spike in liabilities weakened the Working Capital Ratio more than it affected years 1 and year 2.

An acquirer or investor in such situations of analysis will take a step back and won’t go ahead with the offeror, which may reduce it to a bigger extent. If a situation were another way around and WCR would have increased each year, that would be a good sign of financial improvement, and the acquirer could have gone ahead with the offer.

There are some actions that financial analysts can take to improve the cash flow and repair the damage caused, which impacts WCR to go down. The Accounts receivables are one of the parameters that can be looked at and make a big difference if efficiently utilized by the team. Sometimes, the payment terms agreed upon with the client are huge, like 75 days or 90 days, slows down the cash receivables. In such scenarios, the Finance team shall try to follow up with clients and ensure money comes in as soon as possible. Also, in this case, they might request clients to reduce the payment terms for future contracts, which will surely improve the cash flow and eventually WCR on the company.

Situations & Scenarios of Working Captial Ratio

- If the current assets increase, there will uprise in WCR.

- If the current assets decrease, there will be a downfall in WCR.

- If current liabilities increase, there will be a downfall in WCR.

- If current liabilities decrease, there will uprise in WCR.

Significance of the Working Capital Ratio

- It gives a holistic view of any company and indicates the financial health of future survival. The state of a negative Working Capital Ratio is enough for any company to bring back its focus on making improvements through every dimension possible.

- The state of positive WCR states that they can take care of short-term obligations and still hold current assets with them, which can keep them alert on maintaining a persistent scale of healthy Working Capital Ratio.

- As the current assets include Cash receivables, companies can set their contract terms as minimum as they can, so once the work is delivered, the payment will flow in within a short period of time and help grow current assets.

- The working capital ratio is indirectly related to how a company performs and makes big margins, eventually increasing the current income that can be liquidated quickly. A lower level of working capital in an organization makes stakeholders cautious and encourages them to monitor financial health consistently.

- Even if the Working Capital Ratio for any firm is above, it doesn’t mean they are doing a great job and achieving a big milestone. It also means the company is not utilizing its assets to maximize revenue.

- When implementing WCR, the timing of reporting must also be considered very seriously. Monthly expenditures like payroll and accounts payable would change the in-hand cash for any company before and after reporting.

Conclusion

Though the working capital ratio indicates the financial health of any company, a negative WCR doesn’t mean a company will go bankrupt or may not survive. There are large firms that report negative WCR but still survive. However, in such situations, they sell the purchased inventories with a short margin which helps them knock off the declined WCR and remove the red-flagged areas.

Recommended Articles

This has been a guide to the working capital ratio. Here we discussed the basics of the working capital ratio with the help of an example. You may also look at the following articles to learn more –