Updated July 25, 2023

Definition of Working Capital Turnover Ratio

The working capital turnover ratio (WCTR) shows how often the working capital is turned over in a year. The number indicates effectiveness in the utilization of working capital such that a higher ratio indicates efficient utilization of working capital and vice versa. The ratio shows how the company’s finances and sales are related.

Use the Working Capital Turnover Ratio Formula

where,

Examples (With Excel Template)

Let’s take an example to understand the Working Capital Turnover Ratio calculation in a better manner.

Example #1

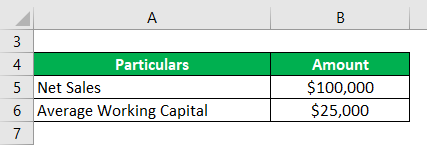

Calculate the working capital turnover ratio of the Company ABC Inc., which has net sales of $ 100,000 over the past twelve months, and the average working capital of the Company is $ 25,000.

Solution:

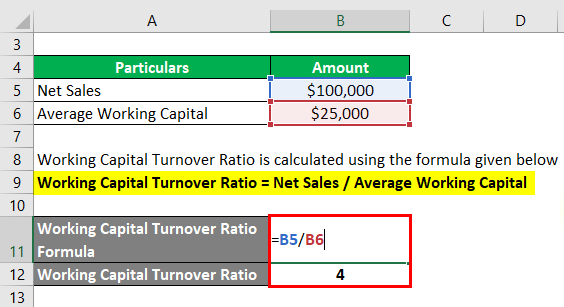

The formula to calculate Working Capital Turnover Ratio is as below:

Working Capital Turnover Ratio = Net Sales / Average Working Capital

- WCTR = $100,000 / $25,000

- WCTR = 4

Example #2

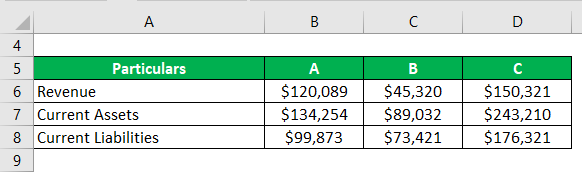

Calculate and analyze the working capital turnover ratios of the three companies A, B, and C, for 2019. The numbers are in $ Millions.

Solution:

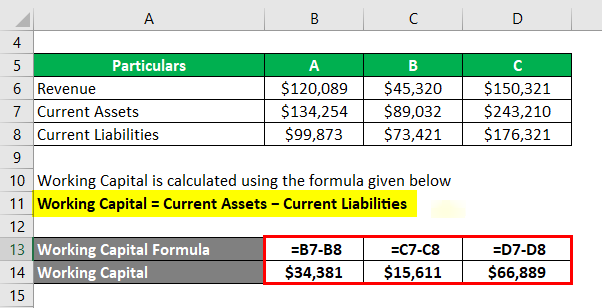

The following schedule contains the required calculations:

Working Capital = Current Assets − Current Liabilities

It is calculated using the formula given below

Working Capital Turnover Ratio = Net Sales / Average Working Capital.

Company A is using its working capital funds most efficiently, followed by Company B and then C.

Example #3

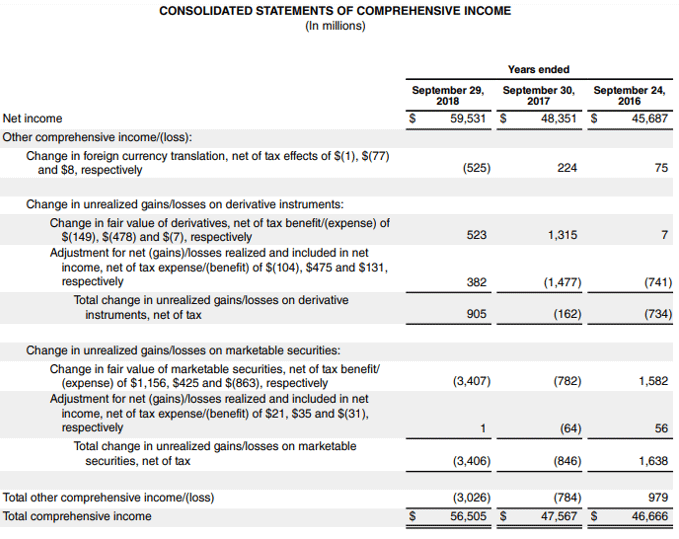

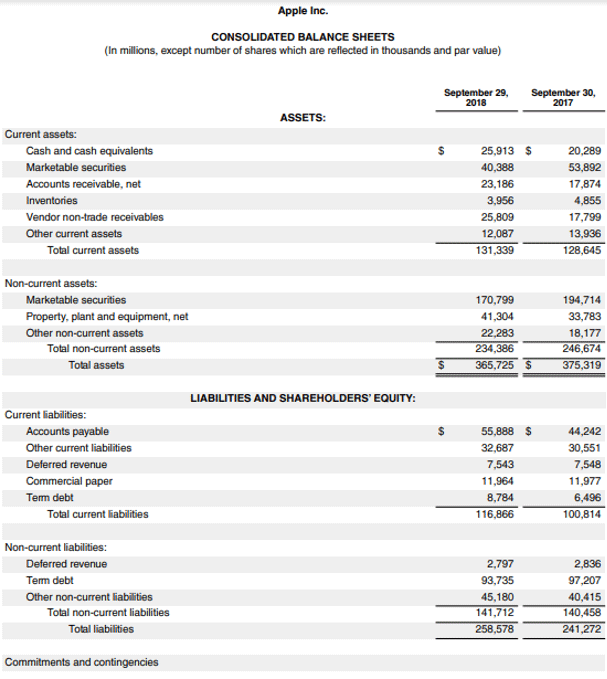

Consider the balance sheet and Income statement for Apple Inc.

Source Link: Apple Inc. Balance Sheet

How to Solution in Working Capital Turnover Ratio (Step-by-Step)

The formula to calculate Beginning Working Capital (2018) is as below:

- Beginning Working Capital = $131,339 – $116,866

- Beginning Working Capital = $14,473

Ending Working Capital (2017) is calculated as

- Ending Working Capital = $128,645 – $100,814

- Ending Working Capital = $27,831

The formula to calculate the average Working Capital of Apple Inc. is as below:

Average Working Capital = (Beginning Working Capital + Ending Working Capital) / 2

- Average Working Capital = ($14,473 + $27,831) / 2

- Average Working Capital = $21,152

The formula to calculate WCTR is as below:

- WCTR = $59,531/ $21,152

- WCTR = 2.81

Advantages

- The ratio gives an indication of the operations of the Company

- The ratio helps the management to make an informed decision on raising funds and utilization of the Company’s resources

- The management can decide on business expansion if it feels they have enough funds to continue its operations and build new resources.

Important Points

- WCTR measures the revenue of the Company from the working capital funds available with it.

- It helps the company to understand the relationship between working capital investment and revenue generation.

- The ratio provides a gauge for the efficiency with which the business is run and its financial management is carried out.

- A higher ratio demonstrates the company’s efficiency and gives it a competitive edge over rivals.

- However, a very high ratio of ~80% may indicate that the Company does not have enough funds to support the growth in its sales, further indicating the prospects of the Company being insolvent in the near future due to higher account payables.

- A lower ratio may indicate Company has higher account receivables or inventory assets. High account receivables have credit risk, and higher inventory has a risk of going stale, which is not good for sales.

Conclusion

The (WCTR) is a significant indicator of the efficiency of the Company and how well it is doing compared to its competitors. The (WCTR) gives an indication of efficiency in the utilization of the working capital. The analysts and the Company’s management often look at this ratio while doing business analysis. If the ratio is too high or too low than the industry’s average ratio, they should look for outliers in the company’s financials to make informed decisions.

Recommended Articles

This is a guide to Working Capital Turnover Ratio. Here we discuss how to calculate WCTR along with practical examples. We also provide a downloadable Excel template. You may also look at the following articles to learn more-